- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

How Recent Product Correction and Legal Inquiry May Impact Tandem Diabetes Care’s (TNDM) Investment Outlook

Reviewed by Sasha Jovanovic

- Earlier this month, Tandem Diabetes Care issued a voluntary medical device correction addressing a potential risk that certain t:slim X2 insulin pumps may stop delivering insulin, and The Rosen Law Firm launched an investigation into possible securities claims regarding related disclosures.

- This combination of product safety action and legal investigation has brought significant attention to the company’s transparency practices and risk oversight.

- We’ll assess how the voluntary medical device correction and associated legal scrutiny may affect Tandem Diabetes Care’s current investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Tandem Diabetes Care Investment Narrative Recap

For shareholders in Tandem Diabetes Care, the core investment case often centers on the company’s ability to drive widespread adoption of its insulin pump technology, expand recurring revenue from supplies, and keep pace with rapid changes in diabetes care. The recent voluntary device correction and legal investigation have put renewed focus on product reliability and transparency, but these events do not appear to materially shift the most important near-term catalyst, which remains the upcoming launches in the automated insulin delivery pipeline; however, they could amplify the biggest risk, which is executional and reputational pressure as competition intensifies.

Of recent company developments, the FDA clearance for Tandem’s new Mobi Mobile App stands out, as it aims to boost patient engagement and usage rates, a key growth driver. While this innovation supports the ongoing shift toward more user-friendly, integrated solutions, it arrives as the business is under increased scrutiny for risk controls and quality assurance, showing that future adoption may hinge as much on stakeholder trust as technical progress.

Yet, against ongoing product updates and expanding international reach, investors should also be aware that potential interruptions to insulin delivery, no matter how quickly addressed, can...

Read the full narrative on Tandem Diabetes Care (it's free!)

Tandem Diabetes Care's outlook anticipates $1.2 billion in revenue and $14.4 million in earnings by 2028. This reflects a 7.5% annual revenue growth rate and a $219.9 million increase in earnings from the current level of -$205.5 million.

Uncover how Tandem Diabetes Care's forecasts yield a $20.64 fair value, in line with its current price.

Exploring Other Perspectives

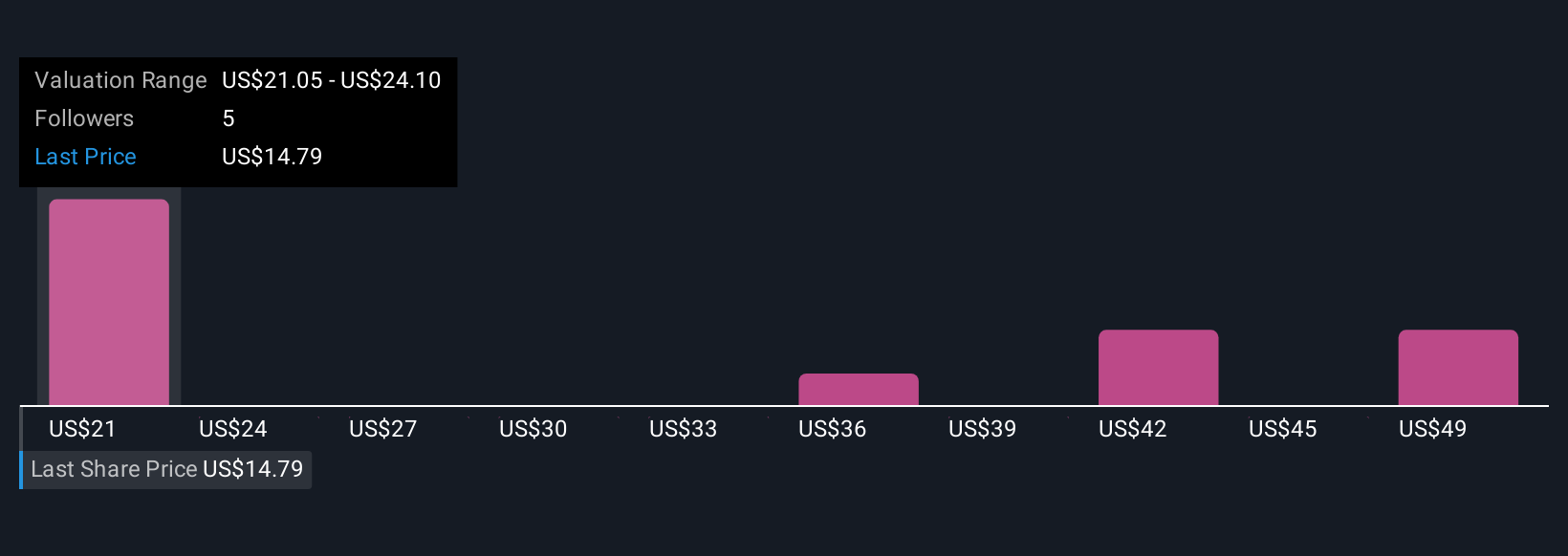

Estimates from five Simply Wall St Community members put Tandem Diabetes Care’s fair value between US$20.64 and US$54.01 per share. As competition and operational risks amplify pressure on new product launches, these wide-ranging views show just how differently market participants assess potential outcomes.

Explore 5 other fair value estimates on Tandem Diabetes Care - why the stock might be worth over 2x more than the current price!

Build Your Own Tandem Diabetes Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tandem Diabetes Care research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Tandem Diabetes Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tandem Diabetes Care's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026