- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

TransMedics Group (NASDAQ:TMDX) shareholders are still up 265% over 5 years despite pulling back 3.4% in the past week

The last three months have been tough on TransMedics Group, Inc. (NASDAQ:TMDX) shareholders, who have seen the share price decline a rather worrying 52%. But that doesn't change the fact that shareholders have received really good returns over the last five years. It's fair to say most would be happy with 265% the gain in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for TransMedics Group

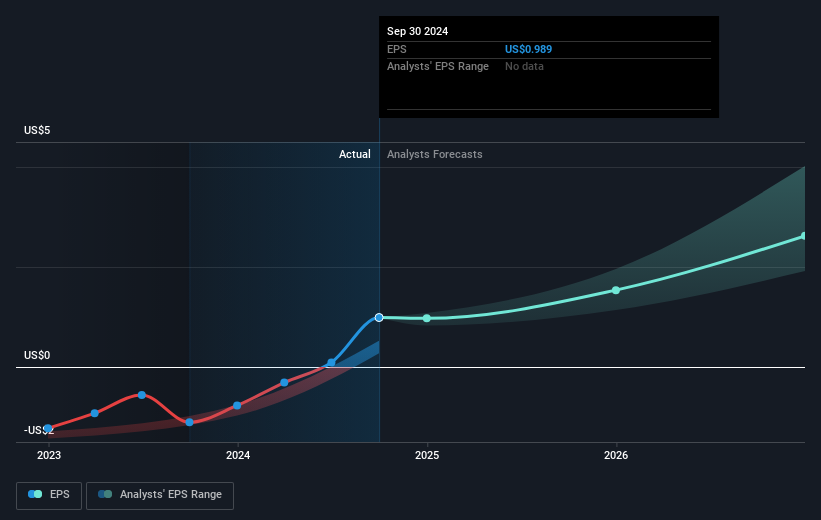

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, TransMedics Group moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how TransMedics Group has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling TransMedics Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in TransMedics Group had a tough year, with a total loss of 5.7%, against a market gain of about 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 30% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with TransMedics Group (including 2 which are concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

High growth potential slight.