- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Can Surgery Partners' (SGRY) Updated Guidance Change the Conversation on Profitability?

Reviewed by Sasha Jovanovic

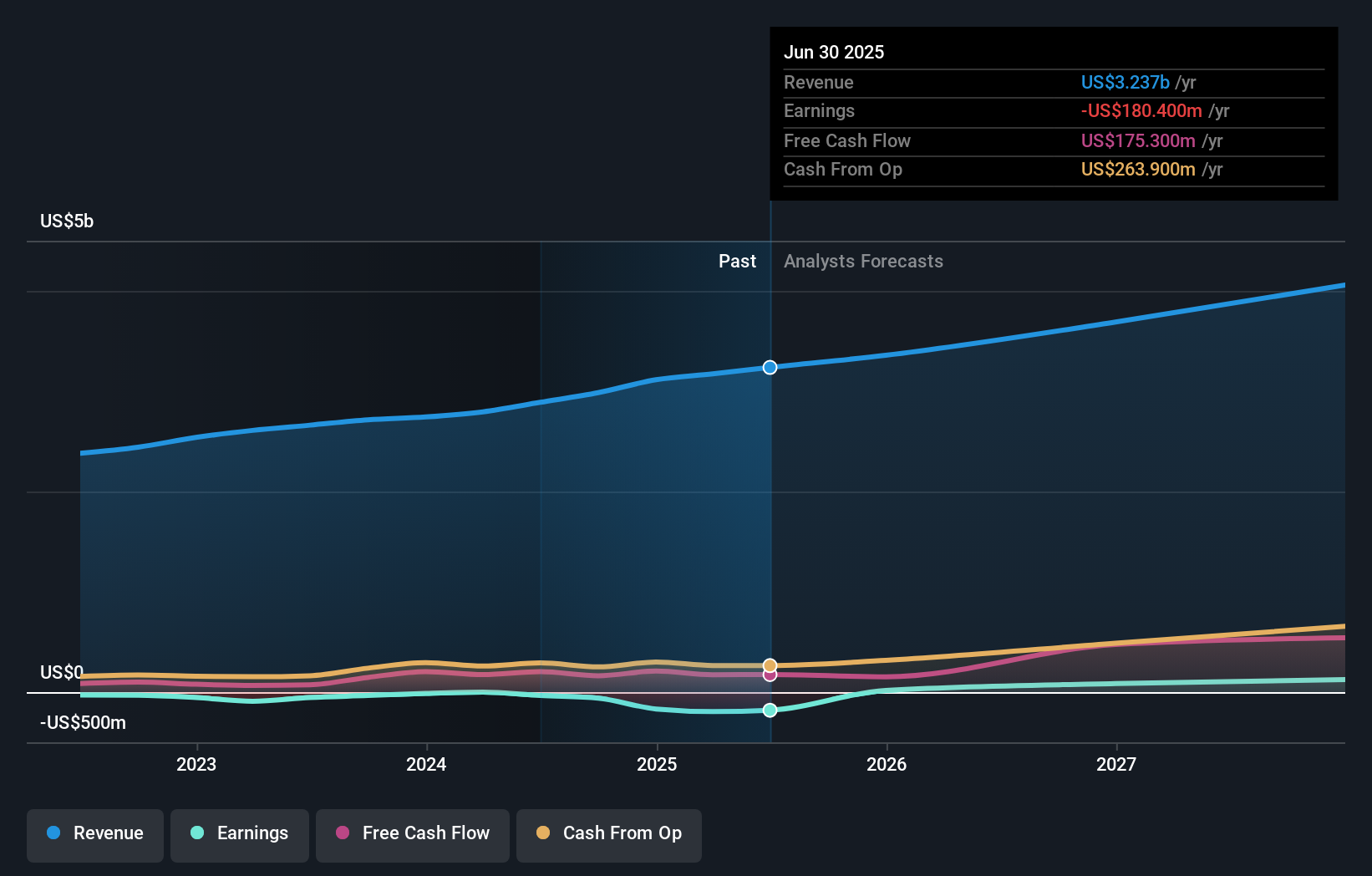

- On November 10, 2025, Surgery Partners reported third-quarter results with sales of US$821.5 million and a reduced net loss of US$22.7 million, and issued updated full-year revenue guidance of US$3.28–3.30 billion.

- Notably, the company recorded year-over-year revenue growth while also narrowing its quarterly net loss compared to the same period last year.

- We'll explore how the updated full-year guidance signals management's confidence in operational performance and influences Surgery Partners' investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Surgery Partners Investment Narrative Recap

Owning shares in Surgery Partners often hinges on believing in the sustained migration of high-acuity surgical procedures to outpatient settings, combined with managed execution on operational initiatives. The recent update to full-year sales guidance and a narrower loss signal ongoing improvement, but the impact is not material enough to overshadow the key near-term catalyst: maintaining above-market organic growth in surgical volumes. However, rising interest expenses from debt service remain the biggest risk, continuing to put pressure on earnings.

The most relevant recent development is the revised 2025 revenue guidance, now set at US$3.28–3.30 billion. While this shows management's conviction about their current trajectory, it also reinforces how guidance realism can anchor expectations around ongoing revenue growth, keeping attention on execution rather than speculative upside from portfolio shifts.

Yet, as improving sales momentum contrasts with the company's exposure to higher interest expenses, investors should be aware that...

Read the full narrative on Surgery Partners (it's free!)

Surgery Partners' outlook anticipates $4.3 billion in revenue and $164.3 million in earnings by 2028. This requires annual revenue growth of 9.9% and an earnings increase of $344.7 million from the current level of -$180.4 million.

Uncover how Surgery Partners' forecasts yield a $31.00 fair value, a 93% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors submitted two fair value estimates for Surgery Partners, ranging from US$31 to US$80.92 per share. While some focus on the earnings growth potential, many remain alert to execution and debt service as crucial variables shaping the company's future performance.

Explore 2 other fair value estimates on Surgery Partners - why the stock might be worth just $31.00!

Build Your Own Surgery Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surgery Partners research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Surgery Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surgery Partners' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives