- United States

- /

- Healthtech

- /

- NasdaqGS:SDGR

Could Copernic Catalyst Progress Shift Schrödinger’s (SDGR) Long-Term Growth Thinking?

Reviewed by Sasha Jovanovic

- Recently, Schrödinger reported third quarter results showcasing robust year-over-year revenue growth driven by both software and drug discovery segments, alongside revised 2025 guidance and a narrowed quarterly net loss.

- Copernic Catalysts, in collaboration with Schrödinger, announced surpassing a major technical milestone for the Neptune ammonia catalyst, highlighting significant potential industrial and environmental benefits.

- We'll explore how this advancement in ammonia catalyst development with Copernic could influence Schrödinger's growth outlook and investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Schrödinger Investment Narrative Recap

To believe in Schrödinger, I think an investor needs confidence in the company's ability to convert its scientific and AI-driven innovation, mainly in drug discovery and software, into sustainable, recurring revenue while managing ongoing operating losses. The recent strong Q3 results and technical milestone with Copernic Catalysts do provide a positive signal for future pipeline advances, but they do not fundamentally change the key near-term catalyst of ongoing drug discovery progress, or the biggest risk: persistent pressures on software revenue growth and profitability.

Among the company’s recent announcements, the collaboration with Copernic Catalysts is especially relevant as it shows Schrödinger’s practical impact on industrial chemistry, with the Neptune ammonia catalyst potentially increasing plant profits and reducing emissions. This underscores how partnerships and tangible deliverables from Schrödinger’s technology could serve as a valuable driver as investors focus on revenue diversification and visibility.

But despite this promising catalyst, investors should not overlook the risk that continued margin pressure and weak new software client growth could...

Read the full narrative on Schrödinger (it's free!)

Schrödinger's narrative projects $396.6 million in revenue and $34.8 million in earnings by 2028. This requires 18.6% yearly revenue growth and a $216.1 million increase in earnings from -$181.3 million today.

Uncover how Schrödinger's forecasts yield a $27.30 fair value, a 49% upside to its current price.

Exploring Other Perspectives

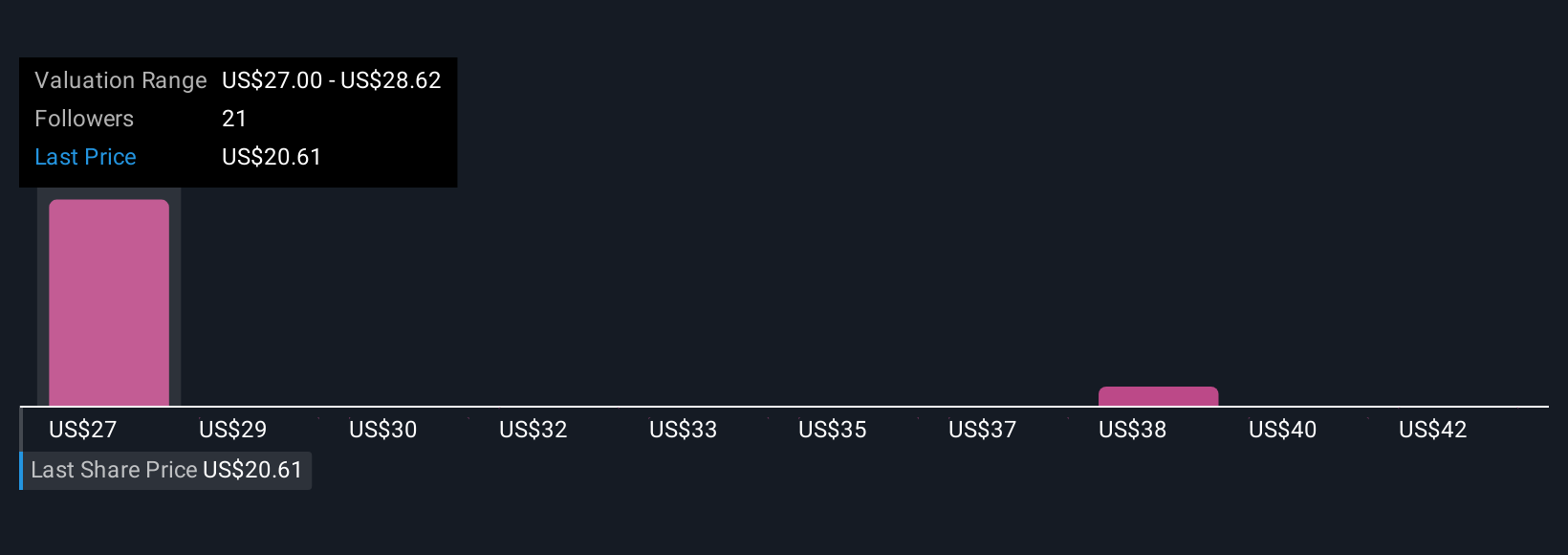

Six different perspectives from the Simply Wall St Community put Schrödinger’s fair value between US$27.30 and US$43.20. While views are wide ranging, the ongoing pressure on software gross margins remains top of mind for many following the company's outlook.

Explore 6 other fair value estimates on Schrödinger - why the stock might be worth just $27.30!

Build Your Own Schrödinger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schrödinger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schrödinger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schrödinger's overall financial health at a glance.

No Opportunity In Schrödinger?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SDGR

Schrödinger

Develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives