- United States

- /

- Medical Equipment

- /

- NasdaqCM:PLSE

Will FDA Green Light for NANOCLAMP AF Trial Change Pulse Biosciences' (PLSE) Cardiac Surgery Narrative?

Reviewed by Simply Wall St

- Earlier this month, Pulse Biosciences announced that the U.S. FDA approved its Investigational Device Exemption, allowing the company to begin a pivotal clinical study of its nanosecond Pulsed Field Ablation Cardiac Surgery System for atrial fibrillation.

- This FDA milestone highlights growing interest in nonthermal ablation technologies, which may reduce risks of collateral tissue damage compared to traditional methods.

- We’ll explore how FDA approval for the NANOCLAMP AF study could reshape Pulse Biosciences’ investment narrative in the cardiac surgery field.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Pulse Biosciences' Investment Narrative?

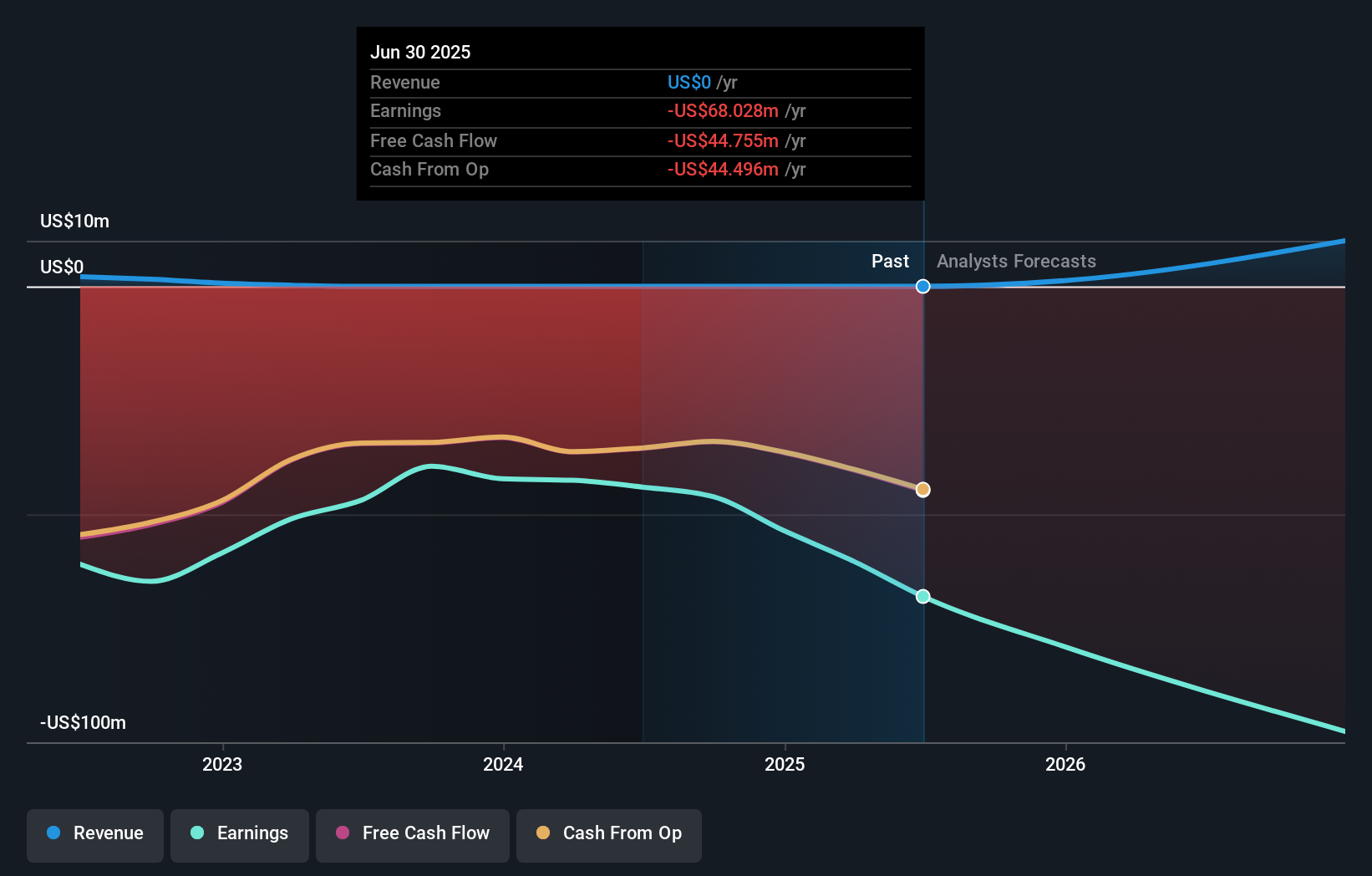

For shareholders of Pulse Biosciences, the big picture centers on the promise that its proprietary nanosecond Pulsed Field Ablation (nsPFA) technology can carve out a place in high-need medical markets. The recent FDA Investigational Device Exemption approval for the NANOCLAMP AF study is a real milestone: it ushers Pulse Biosciences into pivotal trials in cardiac surgery and validates its technology for atrial fibrillation, sharpening a key catalyst in the near term. This development could help shift the focus away from ongoing losses and limited revenue, at least temporarily, by signaling regulatory traction, a common hurdle for early-stage medical device companies. However, a successful clinical and commercialization path is far from certain. Risks tied to cash burn and lack of profitability remain front and center, especially as the market response to the FDA news has yet to fundamentally change the company’s financial outlook or reverse its prolonged share price weakness. On the other hand, regulatory advances don’t erase capital or execution risk, investors should be aware.

Upon reviewing our latest valuation report, Pulse Biosciences' share price might be too optimistic.Exploring Other Perspectives

Build Your Own Pulse Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pulse Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Pulse Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pulse Biosciences' overall financial health at a glance.

No Opportunity In Pulse Biosciences?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLSE

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026