- United States

- /

- Healthcare Services

- /

- NasdaqGS:PINC

Premier (PINC): A Fresh Look at Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

Premier (PINC) has been quietly trending higher over the past 3 months, with shares climbing nearly 15%. While there has not been a specific news event to move the needle, the stock’s steady performance is capturing investors’ attention.

See our latest analysis for Premier.

Premier’s momentum has clearly accelerated over the past quarter, with a nearly 15% share price return in the last 90 days and a standout year-to-date gain of just under 32%. While the longer-term total shareholder return remains slightly negative over three and five years, this recent strength suggests improving sentiment and a possible shift in growth outlook.

If Premier’s surge has you rethinking your approach, now could be the ideal time to discover See the full list for free.

With Premier’s shares approaching analysts’ targets and recent returns outpacing longer-term averages, investors must now consider whether the company’s upside remains undervalued or if the market has already priced in the next wave of growth.

Most Popular Narrative: 2.4% Overvalued

Premier’s fair value is estimated at $27.50, just below the recent close of $28.17. This reflects tightly balanced expectations for where its fundamentals meet market sentiment.

Expectations that ongoing consolidation among hospital systems will heighten Premier's client concentration risk, reducing the company's pricing power during GPO contract renewals and placing ongoing pressure on top-line growth and net margins in future years.

Curious what bold projections power this valuation? The full narrative reveals the profit assumptions and future financial milestones analysts expect Premier to reach. Find out which number could surprise you most.

Result: Fair Value of $27.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong long-term demand for Premier’s analytics and advisory services, combined with rapid contract wins, could offset downside risks and reshape future expectations.

Find out about the key risks to this Premier narrative.

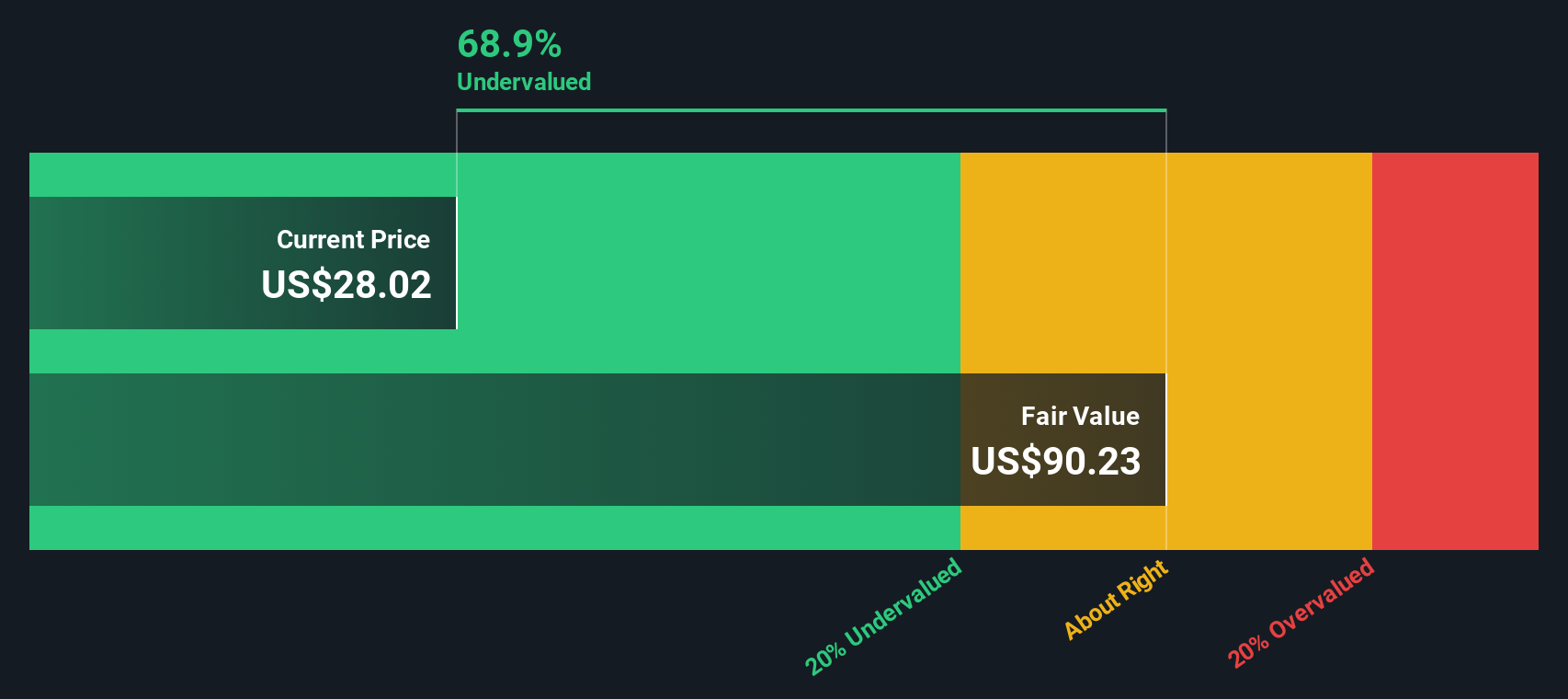

Another View: SWS DCF Model Suggests Potential Upside

Switching perspectives, our SWS DCF model places Premier’s fair value much higher at $64.12 per share. That suggests the market could be undervaluing Premier’s true long-term cash flow potential, in stark contrast to the more cautious analyst consensus. Which view will prove correct as the business evolves?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Premier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Premier Narrative

If you see things differently or enjoy drawing your own conclusions from the numbers, you can put together a personalized narrative in just a few minutes, starting with Do it your way.

A great starting point for your Premier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others spot opportunities. Give yourself an edge by checking out new stocks with breakthrough growth, solid fundamentals, or rising trends using the Simply Wall Street Screener.

- Capture high yields and consistent income with leading companies by checking out these 15 dividend stocks with yields > 3% offering powerful dividend growth potential.

- Seize the future by targeting innovators at the forefront of artificial intelligence when you review these 26 AI penny stocks built for next-level performance.

- Ride emerging digital trends and uncover the next wave of blockchain leaders by exploring these 82 cryptocurrency and blockchain stocks that are transforming finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PINC

Premier

Operates as a healthcare improvement company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives