- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPCH

A Look at Option Care Health's (OPCH) Valuation Following Strong Q3 Revenue Outperformance

Reviewed by Simply Wall St

Option Care Health (OPCH) shares have climbed following its Q3 earnings, where the company delivered revenue that topped analyst forecasts. This stronger performance comes as the broader home health and hospice industry continues to see steady demand.

See our latest analysis for Option Care Health.

Option Care Health’s shares have rebounded with momentum after Q3 results, now up 37% year-to-date and delivering a 1-year total shareholder return of over 30%. This steady climb has been driven by solid sector demand and positive investor sentiment following the company’s recent financial outperformance.

If this kind of resilience in healthcare catches your eye, discover more companies riding similar trends with our curated See the full list for free.

With the stock trading about 13% below analyst price targets and nearly 50% below some intrinsic value estimates, the big question for investors is whether OPCH still offers upside or if the market has already factored in the company’s future growth.

Most Popular Narrative: 11.9% Undervalued

Option Care Health's widely followed narrative points to a fair value noticeably above the last close. This suggests the stock's current price could be an attractive entry for investors ahead of potential growth. The narrative's valuation relies on several pivotal growth levers that may influence future performance.

Continued expansion of the company's national suite footprint and advanced practitioner model is improving nurse productivity and enabling the treatment of higher acuity, complex, and new therapeutic cohorts (including oncology and Alzheimer's). This is driving both margin improvements and new revenue streams.

Ever wonder what underpins Option Care Health's high valuation? Hint: aggressive topline expansion, powerful margin levers, and future profit multiples typically associated with fast growers. Curious which eye-catching forecasts drive the narrative’s bullish stance? Get the full story behind the numbers.

Result: Fair Value of $35.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as a shift toward lower-margin therapies or tightening reimbursement rates could challenge the upbeat narrative surrounding Option Care Health’s future growth.

Find out about the key risks to this Option Care Health narrative.

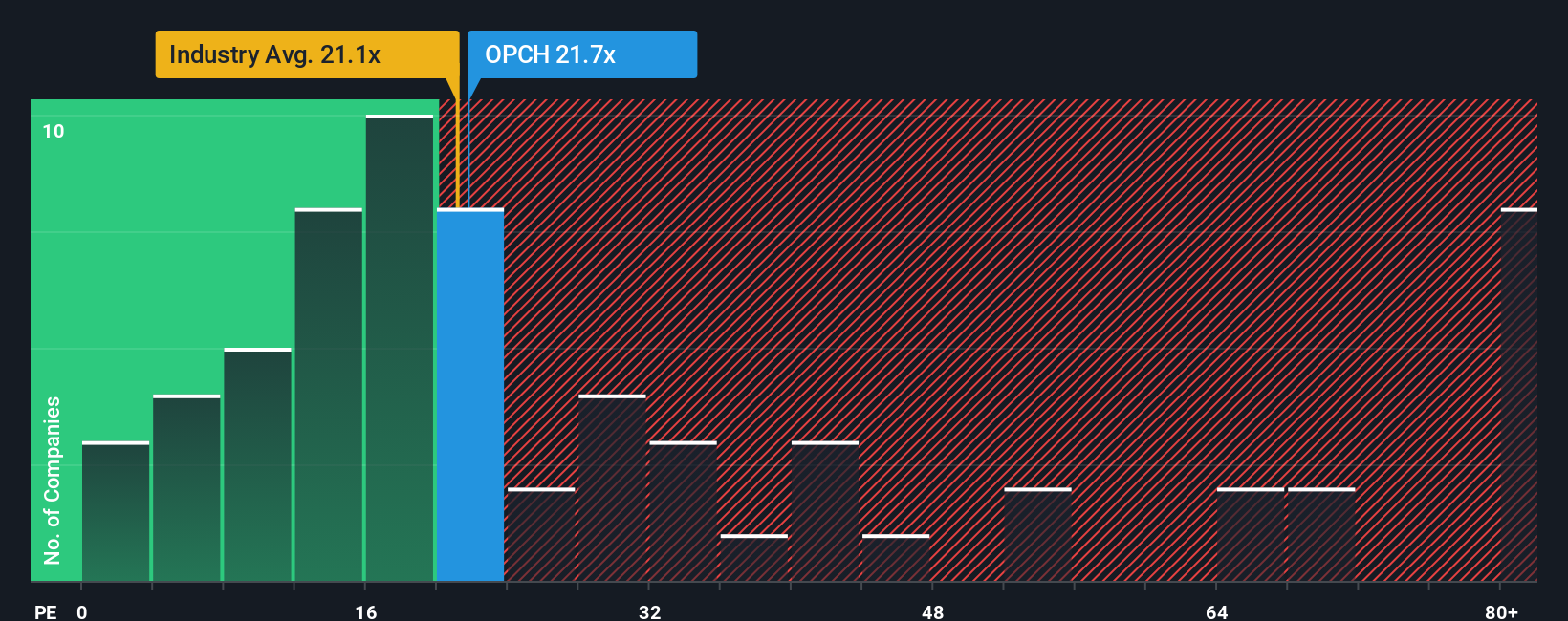

Another View: Market Multiples Tell a Different Story

Switching gears to look at traditional earnings multiples, Option Care Health trades at a ratio of 23.6x, which is noticeably higher than the US Healthcare industry average of 22.7x and also above the fair ratio of 21x. This raises questions about valuation risk, even if the stock appears attractive by peer comparison. Are investors potentially overpaying for recent growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Option Care Health Narrative

If you want to challenge these perspectives or prefer to dig into the details yourself, crafting your own narrative is quick and straightforward. Do it your way.

A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors seize every opportunity. Expand your search beyond the obvious and you could spot tomorrow's winners before the crowd catches on. Use these top screens to harness real market trends and strengthen your portfolio today:

- Find out which companies are harnessing AI to transform industries. Start with these 25 AI penny stocks and get ahead of the curve in this unstoppable megatrend.

- Lock in lasting returns by checking out these 15 dividend stocks with yields > 3%, featuring strong yields, steady payouts, and a history of shareholder rewards.

- Benefit from breakthrough advances in computing and future-proof your investments by running through these 28 quantum computing stocks, where disruptive innovation meets real market opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPCH

Option Care Health

Offers home and alternate site infusion services in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026