- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Reassessing Omnicell (OMCL) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Omnicell (OMCL) has quietly put together a stronger stretch of performance, with the stock up about 11% over the past week and roughly 25% in the past 3 months, despite a weak year.

See our latest analysis for Omnicell.

That recent 1 week and 3 month share price momentum looks more like a reset in sentiment than a random bounce. The share price is still down on a year to date basis and the 1 year total shareholder return remains negative, so investors are cautiously re-rating the story rather than chasing a full recovery.

If Omnicell has you rethinking the sector, this could be a good moment to scan other healthcare names and compare their trajectories using healthcare stocks.

With shares still well below their five year peak despite improving earnings and a modest discount to analyst targets, is Omnicell quietly trading at a bargain, or is the market already pricing in a healthier growth outlook?

Most Popular Narrative Narrative: 14.4% Undervalued

With Omnicell last closing at $40.50 against a narrative fair value near $47.33, the current setup frames a clear valuation gap to unpack.

The continued rollout and adoption of the cloud native OmniSphere platform across Omnicell's customer base will simplify enterprise wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher margin, recurring SaaS based revenues, supporting improved revenue predictability and net margins.

Curious how a steady top line, rising margins and a punchy future earnings multiple can still add up to upside from here? The narrative leans on a specific blend of growth pacing, profitability gains and valuation ambition that most investors would not guess from the headline numbers. Want to see exactly which financial levers are doing the heavy lifting in that $47 plus fair value?

Result: Fair Value of $47.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case depends on navigating tariff costs and potential hospital budget pressure, both of which could easily derail Omnicell's margin and growth trajectory.

Find out about the key risks to this Omnicell narrative.

Another Take on Valuation

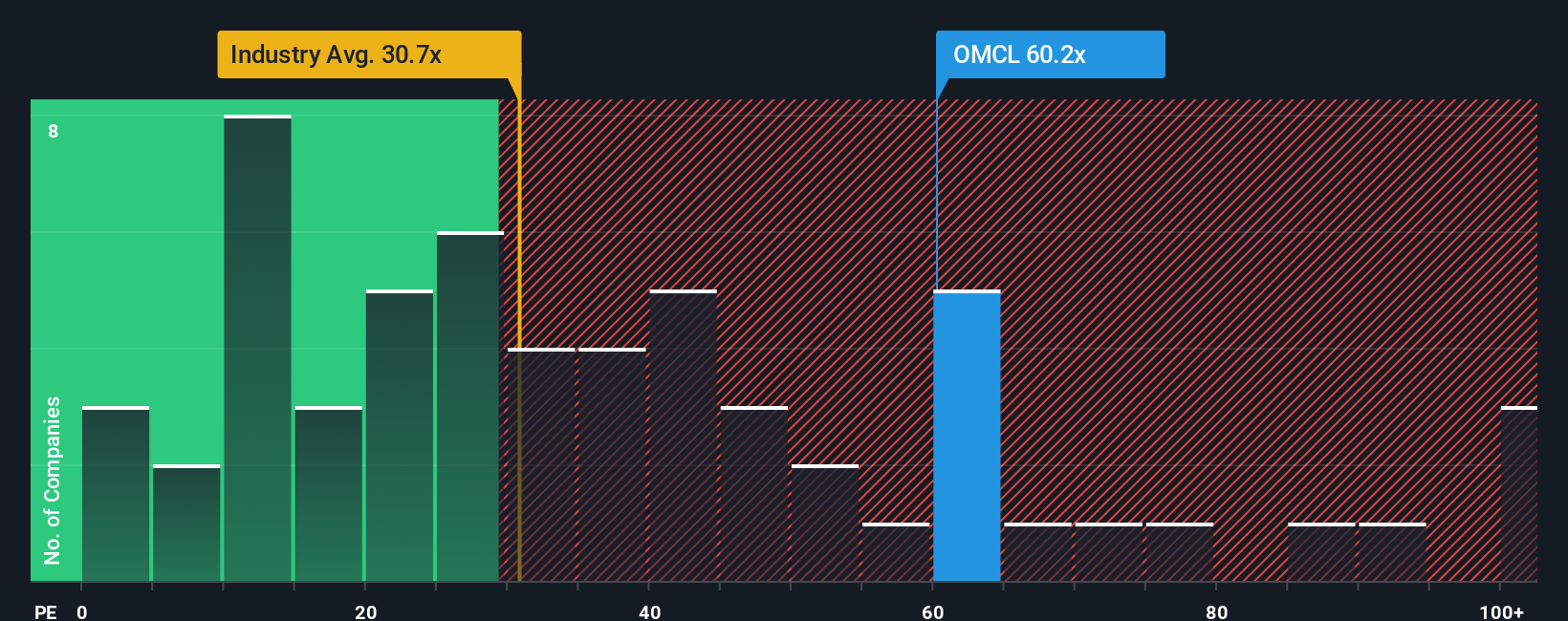

Step away from fair value models and Omnicell suddenly looks stretched. At roughly 91 times earnings versus about 29 times for the US Medical Equipment industry and 22 times for peers, and a fair ratio nearer 34 times, today’s price builds in a lot of optimism. Is that margin of safety thin or just evolving?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

If you see the numbers differently, or prefer to dig into the details yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Ready for more investment ideas?

Before you move on, take a moment to line up your next opportunity with focused stock ideas that other investors will only notice much later.

- Capture potential mispricings early by scanning these 907 undervalued stocks based on cash flows, which may be trading below what their cash flows suggest.

- Tap into powerful secular trends by targeting these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your passive income game by zeroing in on these 15 dividend stocks with yields > 3% to help support a more resilient, yield focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026