- United States

- /

- Medical Equipment

- /

- NasdaqGS:OFIX

Orthofix Medical (OFIX): Losses Deepen, Shares Trade 42% Below Fair Value Despite Discounted Valuation

Reviewed by Simply Wall St

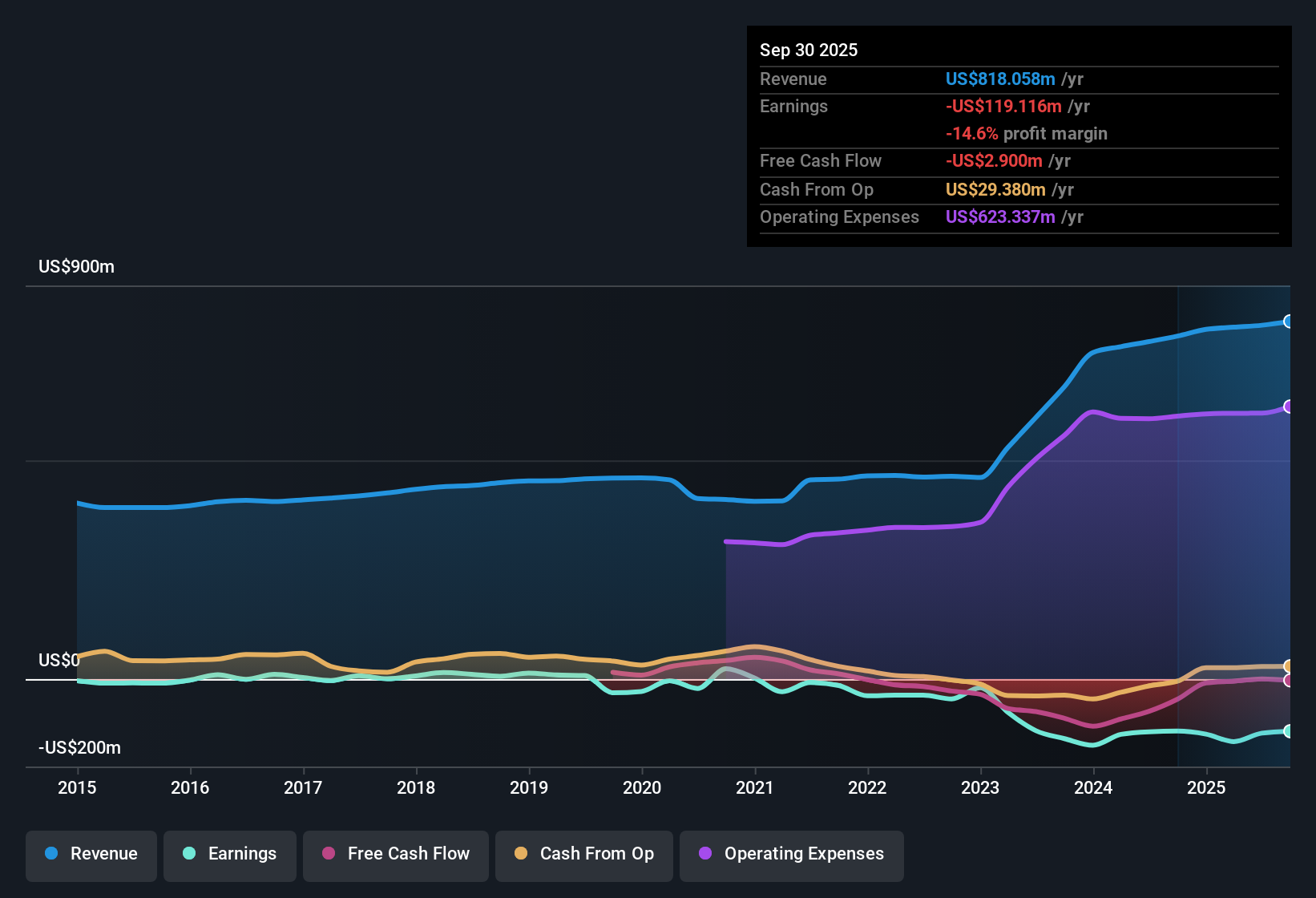

Orthofix Medical (OFIX) remains unprofitable, with losses expanding at a steep 42.7% annual rate over the last five years. Despite revenue being forecast to grow at 4.8% per year, lagging the broader US market’s 10.5% pace, the share price sits at $14.87, which is well below an estimated fair value of $25.85. For investors, the premium lies in the stock’s discounted valuation, as Orthofix trades with a notably low 0.7x price-to-sales ratio compared to much higher industry and peer multiples, while unprofitability continues to weigh on sentiment.

See our full analysis for Orthofix Medical.The question now is how these results compare with the broader stories shaping investor expectations. Some common narratives may find support in the latest numbers, while others could be up for debate.

See what the community is saying about Orthofix Medical

Losses Continue Despite Margin Expansion Targets

- Orthofix’s net losses have grown at an annual rate of 42.7% over the past five years, with analysts not expecting the company to achieve profitability within the next three years.

- Consensus narrative sees recent and anticipated product launches, such as TrueLok Elevate, FITBONE, and the 7D FLASH navigation system, driving higher adoption and, over time, improved margins.

- Despite the ambition to boost procedure volumes and efficiency, the persistent negative profit margin and lack of any forecasted shift to profit by 2027 underlines how operational gains may take years to reach the bottom line.

- Ongoing reliance on major new products introduces additional risk, as any delays in surgeon uptake or performance could stall the margin improvement story outlined by consensus.

- Analysts expect Orthofix’s revenue to grow at 4.7% per year for the next three years, a figure which falls short of the US medical equipment sector benchmark of 10.5% annual growth.

- Consensus narrative highlights that commercial investments and operational efficiencies should provide a foundation for improved scale and pricing leverage.

- Yet, with the forecast growth rate trailing the industry by a considerable margin, this reinforces the view that Orthofix will need either a meaningful acceleration in demand or significant gains in profitability to catch up with industry peers.

- Sustained lower growth may leave the company’s long-term earnings potential dependent on already known market drivers, without the benefit of emerging tailwinds.

Discounted Valuation Anchors Upside Potential

- Orthofix trades at a price-to-sales ratio of just 0.7x, dramatically below the US medical equipment average of 2.8x and the peer average of 7.4x. The share price remains well below both the $25.85 DCF fair value estimate and the $22.55 analyst price target, with shares currently at $14.87.

- According to the analysts' consensus view, the substantial valuation gap reflects market skepticism over near-term profitability, but also leaves room for gains if future product launches and operational changes succeed in closing the performance gap with the sector.

- If Orthofix can achieve industry-level profit margins by 2028 as consensus projects, earnings could reach $115.9 million, bringing the forward PE to 10.6x versus the industry’s 28.6x, offering notable re-rating potential for patient investors.

- The highly discounted current price compared to both analyst and DCF fair value implies the market is already pricing in many operational challenges, so even modest improvements could drive outsized returns.

- The single largest reward flagged for Orthofix is its deeply discounted trading level relative to both fair value estimates and peers; the stock price sits 34.6% below the average analyst price target.

- The consensus narrative notes that while execution risk and margin pressures remain key watchpoints, investors willing to look past short-term losses may find a compelling value thesis if Orthofix’s innovation pipeline delivers on growth ambitions.

- The importance of near-term catalysts, such as successful commercialization of new products and distribution reshaping, will remain high for sentiment going forward.

- Patient investors focused on value and turnaround stories may see the risk/reward balance as skewed toward upside from these levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Orthofix Medical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a different angle? You can shape your own view and build a personal narrative in just a few minutes. Do it your way

A great starting point for your Orthofix Medical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Orthofix’s slow revenue growth and persistent unprofitability highlight ongoing challenges in scaling up earnings and matching industry performance.

If steadier revenue and earnings are your priority, focus on stable growth stocks screener (2077 results) to screen for companies consistently delivering results across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OFIX

Orthofix Medical

Operates as a medical technology company in the United States, Italy, Germany, the United Kingdom, France, Brazil, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives