- United States

- /

- Healthcare Services

- /

- NasdaqCM:NUTX

Is Nutex Health’s (NUTX) Extended Buyback Plan Clarifying Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On December 4, 2025, Nutex Health’s board extended its previously authorized US$25,000,000 common stock repurchase program through March 31, 2026, to be executed under Rule 10b-18 and a Rule 10b5-1 trading plan.

- The extension underscores management’s focus on offsetting dilution from stock compensation tied to new and ramping hospitals while signaling confidence in the company’s capital allocation approach.

- Next, we’ll assess how extending the US$25,000,000 buyback program may influence Nutex Health’s investment narrative around growth, risk, and capital allocation.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Nutex Health Investment Narrative Recap

To own Nutex Health, you need to believe its micro-hospital and arbitration-heavy model can keep converting strong visit growth into sustainable earnings while managing regulatory and cash collection risks tied to the No Surprises Act. Extending the US$25,000,000 buyback program looks incremental rather than a major near term catalyst, but it does touch on the current dilution and capital allocation debate without materially changing the core risk profile around IDR collections.

The reopening of Red River ER & Hospital in Sherman, Texas, is closely linked to the buyback story, since new and ramping facilities are part of the stock compensation that the repurchase program is designed to offset. For investors focused on near term catalysts, each additional hospital brought online reinforces Nutex’s growth-through-expansion approach, but it also increases exposure to collection risk on arbitration-driven revenue and the long term question of how mature-site performance will evolve.

Yet beneath the extended buyback and new hospital opening, investors should be aware of how dependent Nutex remains on the No Surprises Act’s arbitration process and...

Read the full narrative on Nutex Health (it's free!)

Nutex Health's narrative projects $1.2 billion in revenue and $98.9 million in earnings by 2028.

Uncover how Nutex Health's forecasts yield a $241.67 fair value, a 50% upside to its current price.

Exploring Other Perspectives

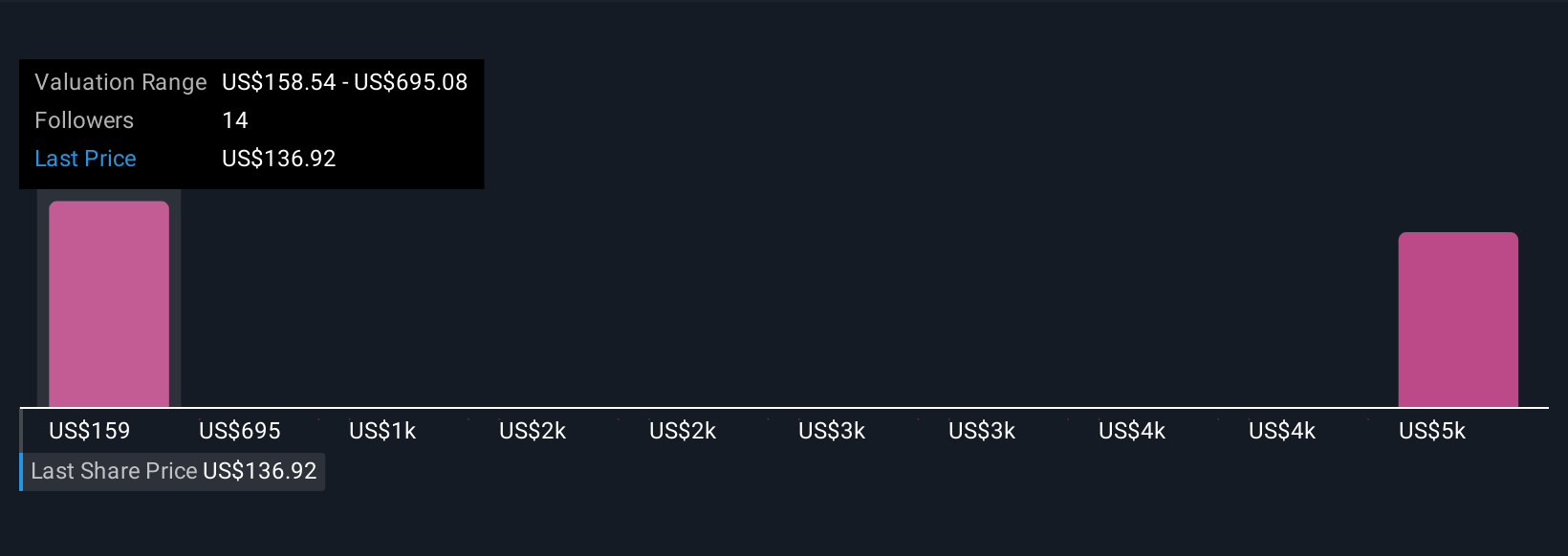

Seven fair value estimates from the Simply Wall St Community span roughly US$159 to over US$5,500 per share, highlighting sharply different return expectations. Against that wide spread, Nutex’s dependence on the No Surprises Act’s arbitration framework raises important questions about how regulatory shifts could affect the company’s ability to sustain its recent profitability and capital return plans, so it is worth comparing several of these viewpoints before deciding what the stock is really worth.

Explore 7 other fair value estimates on Nutex Health - why the stock might be a potential multi-bagger!

Build Your Own Nutex Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutex Health research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutex Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutex Health's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutex Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NUTX

Nutex Health

Operates as a healthcare services and operations company in the United States.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026