- United States

- /

- Healthcare Services

- /

- NasdaqGM:NAKA

A Fresh Look at Kindly MD (NAKA) Valuation Following Major Shelf Registration Filing

Reviewed by Kshitija Bhandaru

Kindly MD (NAKA) just wrapped up a shelf registration worth over $410 million, which could allow for potential capital raises. This move signals the company is setting the stage for future growth or strategic actions.

See our latest analysis for Kindly MD.

Kindly MD’s recent shelf registration comes at a time when sentiment has clearly shifted. Over the last month, the share price return was a sharp -78.95%, and the one-year total shareholder return is -29.92%. Momentum has faded quickly, and investors seem cautious about the company’s next steps even as management lines up potential growth moves.

If this sort of market shakeup has you curious about other opportunities, consider broadening your horizons and discovering fast growing stocks with high insider ownership

With shares down significantly and a shelf registration in place, is Kindly MD trading at a steep discount, or has the market already factored in any potential rebound and growth? Is there a genuine buying opportunity here, or is everything already reflected in the current price?

Price-to-Book Ratio of 44.3x: Is it justified?

Kindly MD is currently valued at a price-to-book (P/B) ratio of 44.3x, placing it well above both its peers and its industry. At a last close of $0.96, the stock commands a significant premium relative to what investors normally pay for healthcare companies.

The price-to-book multiple compares a company’s market price to its net asset value. For healthcare businesses, particularly those at early stages or with inconsistent profitability, this ratio is often used to weigh the price of future potential against current business fundamentals. A high ratio implies strong market optimism, but may also reflect risk or limited underlying assets.

Kindly MD’s P/B ratio is a massive outlier; its multiple dwarfs the peer group average of 1.9x and the broader US healthcare industry average of 2.2x. Such a steep premium suggests market expectations are disconnected from current fundamentals, and could rapidly adjust if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 44.3x (OVERVALUED)

However, rapid revenue growth may not offset persistent net losses. Further declines in investor sentiment could also weigh on the company’s future valuation.

Find out about the key risks to this Kindly MD narrative.

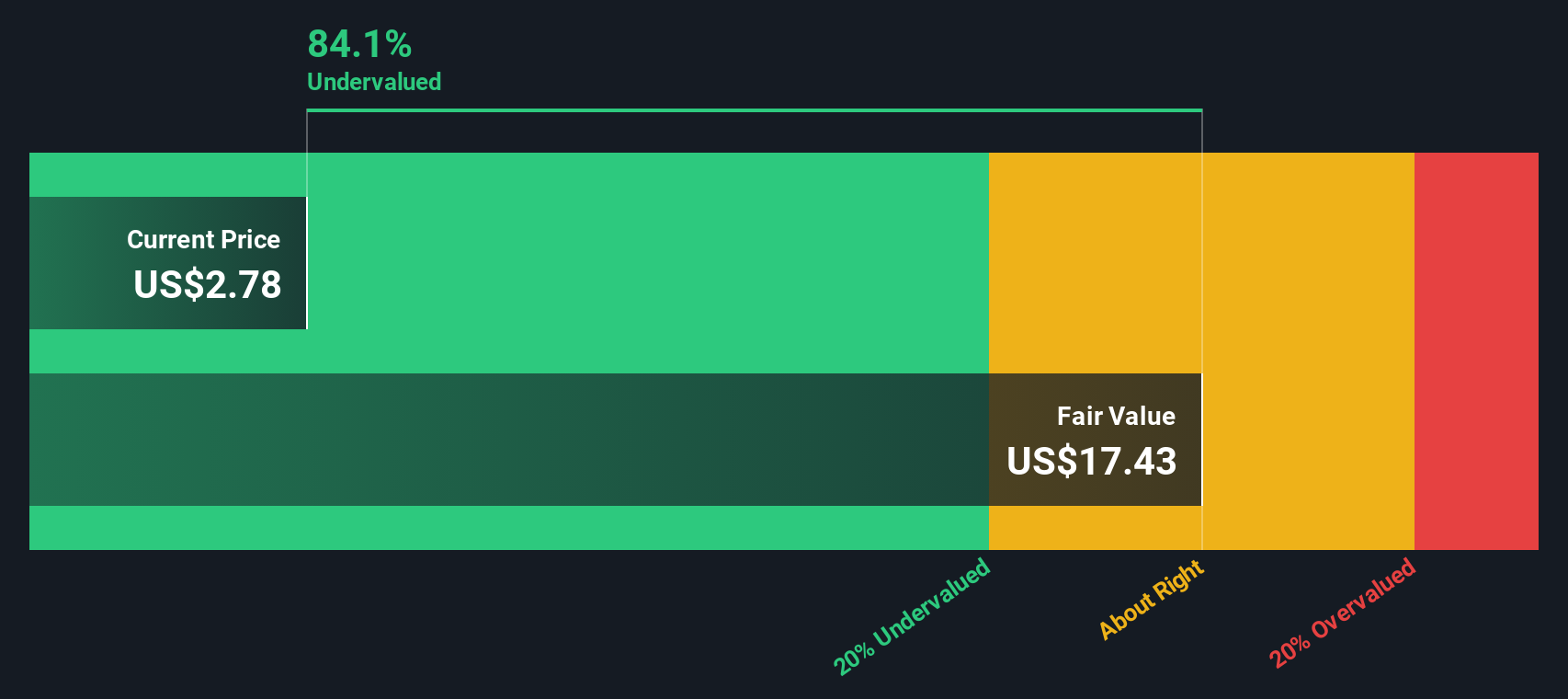

Another View: The SWS DCF Model Says Shares Are Deeply Undervalued

Looking at Kindly MD through the lens of our SWS discounted cash flow (DCF) model paints a very different picture. In this view, the stock is trading about 93.9% below our estimate of fair value, which suggests it could be massively undervalued despite every current challenge. Is the market overlooking recovery potential, or is the discount precisely what the risks deserve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kindly MD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kindly MD Narrative

If our analysis doesn't quite fit your perspective, or you'd rather dive deeper and form your own view, you can quickly craft your own outlook in just a few minutes with Do it your way.

A great starting point for your Kindly MD research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit yourself to just one stock when the market is full of exciting opportunities. The Simply Wall Street Screener makes it easy to find your next smart move.

- Capitalize on fresh momentum by checking out these 888 undervalued stocks based on cash flows, which are currently trading for less than their true worth and positioned for potential upside.

- Boost your portfolio’s income stream and stability with these 19 dividend stocks with yields > 3%, offering yields above 3% and reliable fundamentals.

- Seize the future of medicine and technology by uncovering these 32 healthcare AI stocks, pioneering breakthroughs in AI-driven healthcare solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindly MD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAKA

Kindly MD

A healthcare and healthcare data company, provides direct health care services to patients integrating prescription medicine and behavioral health services.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives