- United States

- /

- Medical Equipment

- /

- NasdaqGS:MASI

Is Masimo's Refocus on Core Monitoring and New CEO Reshaping the Investment Case for MASI?

Reviewed by Sasha Jovanovic

- Masimo recently announced the divestiture of its Non-Healthcare business and the appointment of Katie Szyman as CEO, signaling a renewed emphasis on its core monitoring operations.

- This move reflects the company’s commitment to sharpen its focus on core competencies, with further details on long-term goals expected at the upcoming investor day.

- We'll explore how the leadership transition could reshape Masimo's approach to core monitoring and affect expectations for long-term growth.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Masimo Investment Narrative Recap

To be a Masimo shareholder today, you need to believe in the company’s ability to regain momentum by doubling down on its core monitoring segment, especially following the divestment of its Non-Healthcare division and the appointment of Katie Szyman as CEO. The shift in leadership is not expected to meaningfully change the most important short-term catalyst: accelerating adoption of next-generation hospital monitoring solutions, though it remains to be seen if this renewed strategic focus will address the biggest risk, ongoing pressure from hospital purchasing cycles and OEM competition. Among recent company news, the expanded partnership with Royal Philips stands out. By integrating Masimo’s monitoring technology into Philips’ multi-parameter monitors, this move strengthens Masimo’s commercial presence and directly supports its core monitoring catalyst, potentially enhancing revenue visibility and deepening relationships with top health system customers. However, with the risk of slower contract renewals and tougher hospital budgets still looming, investors should be aware that…

Read the full narrative on Masimo (it's free!)

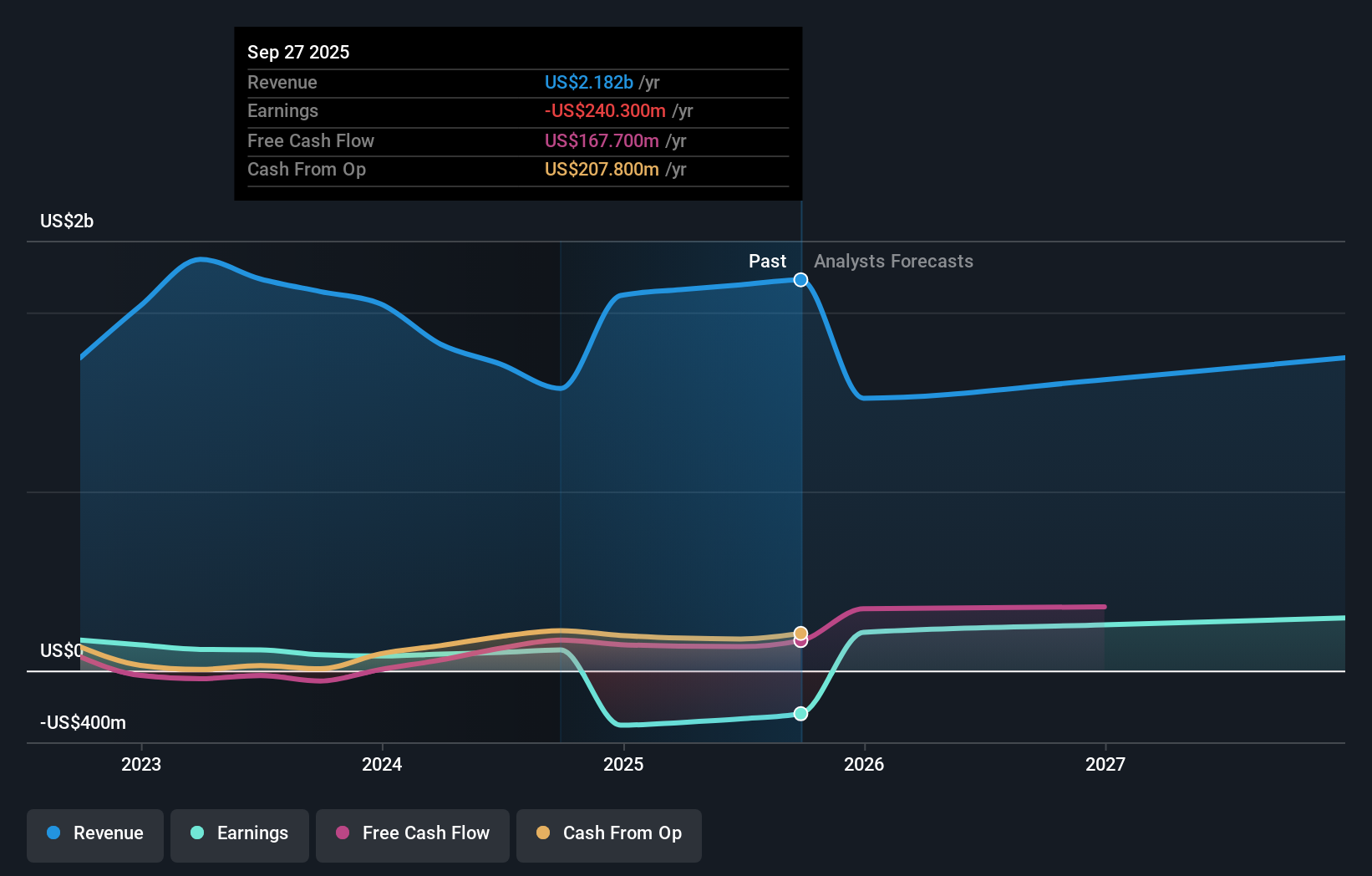

Masimo's narrative projects $1.8 billion revenue and $293.5 million earnings by 2028. This requires a 5.1% yearly revenue decline and a $563.2 million earnings increase from current earnings of -$269.7 million.

Uncover how Masimo's forecasts yield a $183.12 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Masimo span from US$137.02 to US$261.87 based on three distinct analyses. While many see opportunity, several warn that delays or losses in major hospital contracts may create earnings volatility and affect longer-term financial predictability.

Explore 3 other fair value estimates on Masimo - why the stock might be worth just $137.02!

Build Your Own Masimo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Masimo research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Masimo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Masimo's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MASI

Masimo

Develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026