- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Examining Intuitive Surgical’s Valuation After Recent Robotic Surgery Advancements and Market Rally

Reviewed by Bailey Pemberton

- If you have ever wondered whether Intuitive Surgical’s share price actually aligns with its long-term potential, you are in the right place.

- The stock has shown healthy momentum recently, rising 6.2% over the last month and up 8.3% year-to-date. However, it has only posted a modest 4.7% gain over the past year.

- Market sentiment has shifted following news about advancements in robotic surgical technology and new regulatory approvals, which are opening up opportunities globally. This has deepened the conversation around what the future holds for the business. Many are considering whether these developments signal the beginning of a new growth phase or introduce new risks that investors need to consider.

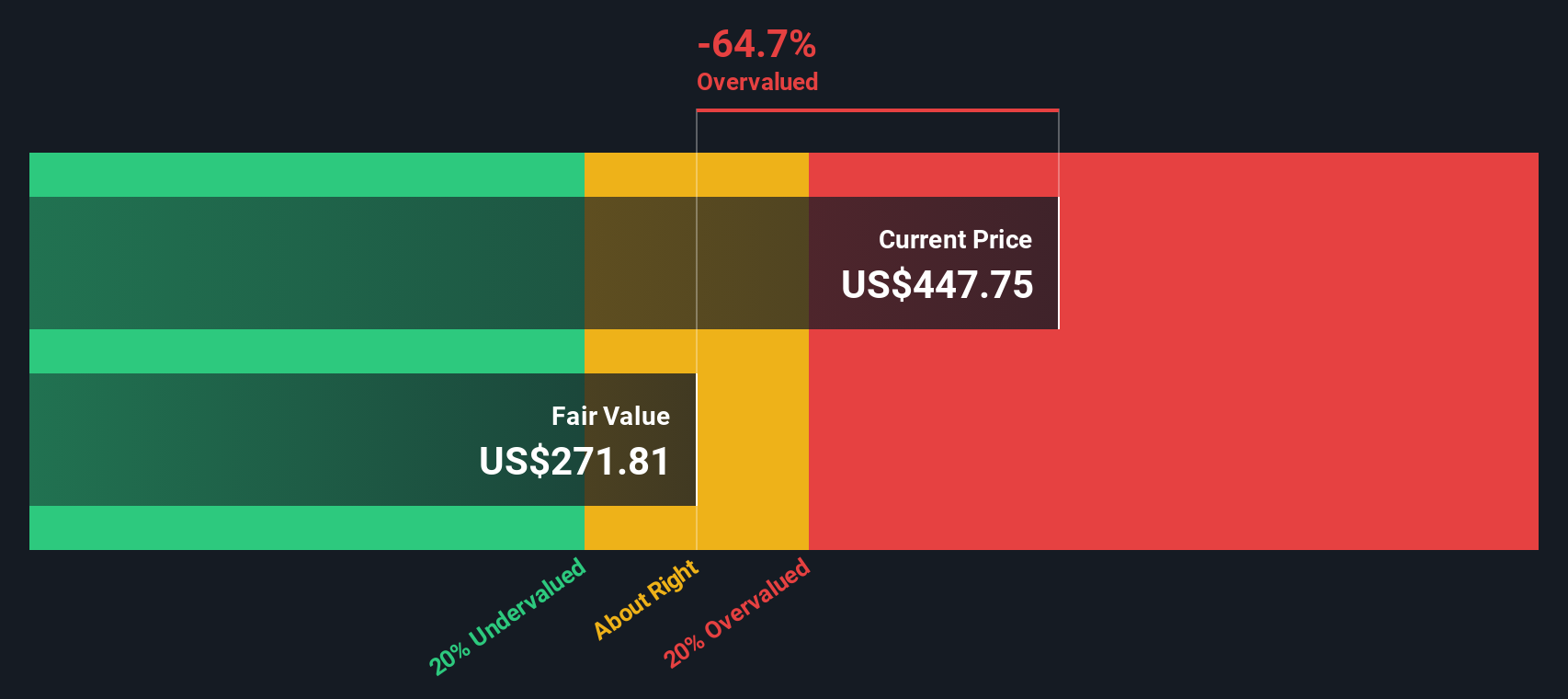

- Intuitive Surgical currently holds a valuation score of 0 out of 6, meaning it does not screen as undervalued on any of our six key checks. Let’s break down what this means using different valuation approaches, and be sure to read on to discover a smarter way to weigh value at the end of this article.

Intuitive Surgical scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting those cash flows back to the present using an expected rate of return. This method aims to capture what those future cash flows are worth in today's dollars, offering a clearer picture of the company's value based on its ability to generate profit over time.

For Intuitive Surgical, the latest reported Free Cash Flow was $1.90 Billion. Analyst projections suggest steady growth, with estimates reaching $3.70 Billion by 2026 and $5.31 Billion by the end of 2029. Beyond these years, further increases are extrapolated by Simply Wall St, indicating expectations for ongoing expansion, though analyst certainty decreases further out.

After applying this 2 Stage Free Cash Flow to Equity DCF approach, the estimated intrinsic value for Intuitive Surgical’s shares is $328.86. Comparing this to the current share price, the DCF model indicates the stock is trading at a 72.5% premium to its calculated fair value. This suggests the market price is substantially higher than what the company’s future cash flows would justify today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 72.5%. Discover 923 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intuitive Surgical Price vs Earnings (PE)

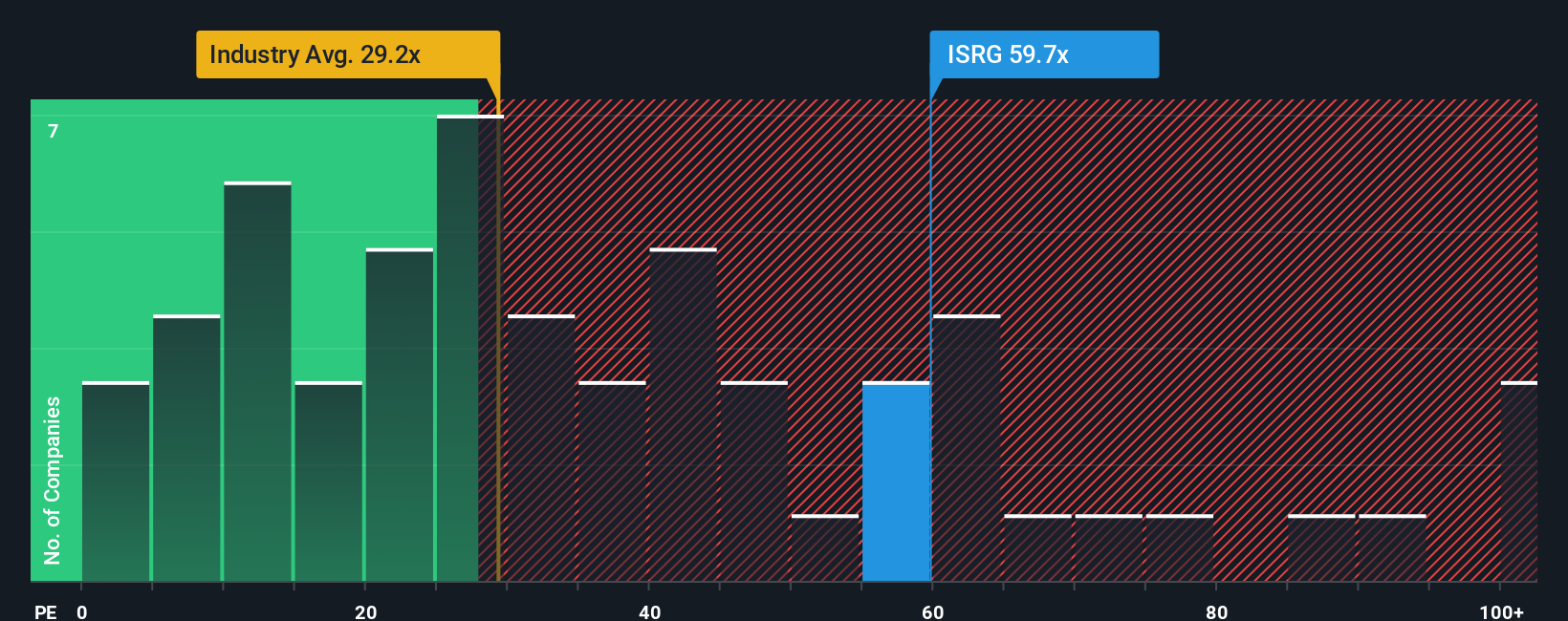

The Price-to-Earnings (PE) ratio is one of the most commonly used valuation metrics for profitable companies, as it relates a company’s market value to its current earnings. It is especially meaningful for established businesses with steady profits because it allows investors to quickly gauge whether a stock is expensive or cheap relative to its peers and the broader market.

Of course, what counts as a "normal" or "fair" PE ratio depends on a variety of factors. Companies with higher growth expectations and lower risk profiles typically command higher PE ratios, while those with uncertain prospects or more risk often trade at a discount. These differences make it essential to compare Intuitive Surgical’s PE ratio to multiple benchmarks for context.

Currently, Intuitive Surgical trades on a PE of 73.2x. This is notably higher than the peer average of 36.5x and the broader Medical Equipment industry average of 28.6x. However, Simply Wall St’s proprietary “Fair Ratio” for Intuitive Surgical is calculated at 38.7x. The Fair Ratio is a more rigorous standard than simply comparing with peers or the industry because it factors in the company’s projected earnings growth, profit margins, business risks, industry classification, and market cap.

Because the company's actual PE is significantly higher than its Fair Ratio, even after accounting for its advantages, the stock appears to be priced above what would be considered justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

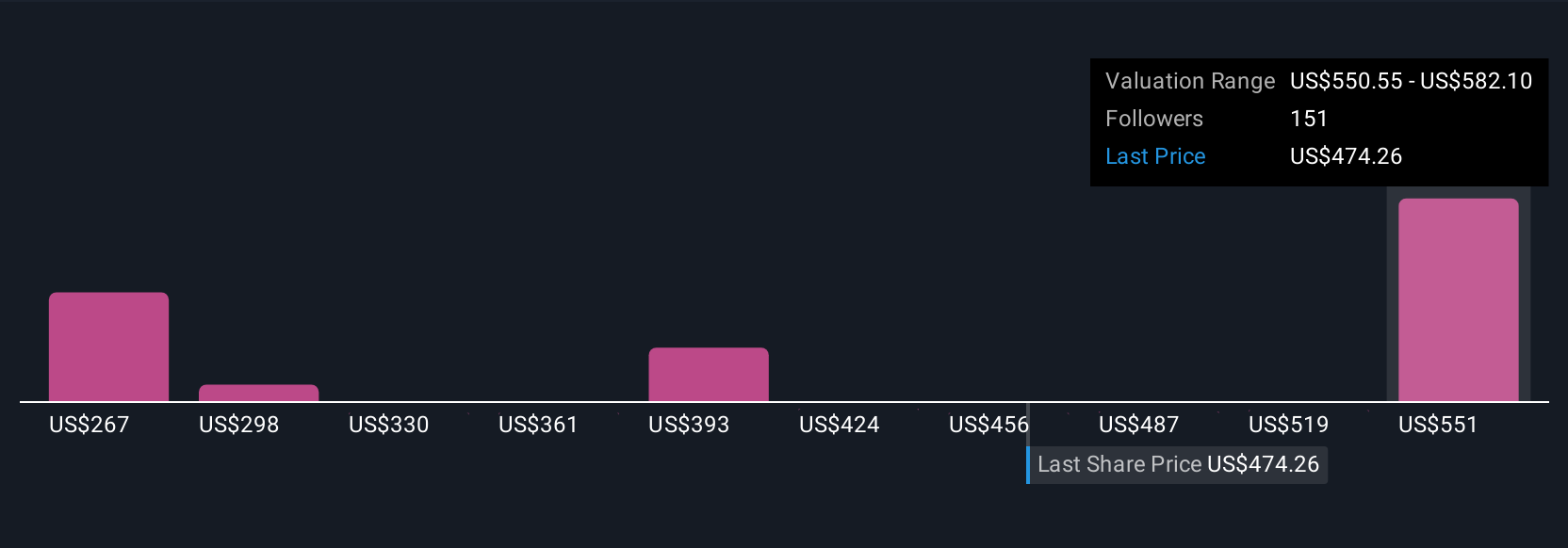

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is an investor’s personal story or perspective about a company, connecting why they think Intuitive Surgical will succeed (or not) with their own forecasts for future revenue, profit margins, and ultimately what they believe is a fair value for the stock.

This approach goes beyond just the numbers by linking a company’s prospects and risks directly to a financial forecast and a share price that makes sense for those assumptions. Narratives are easy to create and share right on Simply Wall St’s Community page, a feature used by millions of investors to compare views and ideas.

With Narratives, you can see at a glance how each investor’s view measures up by comparing their fair value estimate with the current market price, making it easier to decide when to buy, hold, or sell. Plus, Narratives are updated automatically with the latest news, earnings results, and new data so your investment story evolves as new information emerges.

For Intuitive Surgical, for example, some Narratives estimate a fair value as high as $592.96 per share based on bullish revenue growth and margins, while more cautious investors set their fair value as low as $325.55, showing how different perspectives lead to different investment decisions.

For Intuitive Surgical, here are previews of two leading Intuitive Surgical Narratives:

- 🐂 Intuitive Surgical Bull Case

Fair Value: $592.96

Current Price is 4.3% below fair value

Revenue growth assumption: 13.48%

- Continued global expansion and product innovation are fueling recurring revenue, margin stability, and long-term competitive advantages for Intuitive Surgical.

- Broader regulatory support and strong clinical outcomes are lowering barriers to adoption, supporting durable growth in key healthcare markets.

- Analysts see the company reaching $3.7 billion in profits by 2028, with a consensus price target nearly 20% above today’s share price. Risks include government budget constraints, trade uncertainty, and competition.

- 🐻 Intuitive Surgical Bear Case

Fair Value: $400.91

Current Price is 41.6% above fair value

Revenue growth assumption: 12.02%

- Intuitive Surgical has built a resilient, high-margin business with a growing installed base, but the share price rarely offers attractive long-term returns from current levels.

- The current valuation suggests just 1% annual return even with solid free cash flow growth, leaving little margin of safety for new investors.

- The author praises the company and plans to wait for a lower price, noting the stock almost never falls to a compelling valuation despite recent declines.

Do you think there's more to the story for Intuitive Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026