- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

iRhythm Technologies (IRTC): Exploring Valuation After Recent Share Price Dip and Long-Term Gains

Reviewed by Simply Wall St

iRhythm Technologies (IRTC) shares have moved a bit over the past week, with investors taking note of recent price shifts. The stock saw a mild dip, which has prompted some to revisit its valuation story and long-term prospects.

See our latest analysis for iRhythm Technologies.

Over the past year, iRhythm Technologies has firmly captured investors' attention, with a year-to-date share price return of 95.21% and a stellar 1-year total shareholder return of 96.33%. This reflects growing optimism about its prospects. Recent short-term dips stand in contrast to this strong upward momentum, hinting at both opportunity and ongoing market debate over its valuation and future growth potential.

If you're watching medtech leaders like iRhythm, it's worth taking the next step to discover other innovative healthcare stocks with potential. See the full list for free.

With shares pulling back despite strong longer-term gains, the question now is whether iRhythm Technologies is trading below its true value, or if the recent rally has already factored in all of its future growth.

Most Popular Narrative: 9.6% Undervalued

With iRhythm Technologies closing at $174.60, the most popular narrative places its fair value at $193.07. This suggests investors may be overlooking catalysts that underpin current analyst optimism. The difference reflects a market that has not fully priced in anticipated growth and improvements included in the consensus.

Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership), is improving product differentiation, diagnostic yield, and workflow efficiency. This is likely to result in higher gross margins and operating leverage as software and data become a larger component of the business.

Want to know the quantitative leap behind this upgraded outlook? There is a bold blend of growth acceleration, expanding margins, and surprising future profit multiples that justify this target. Which financial assumptions actually power these projections? Discover the narrative’s hidden drivers and see if the headlines match the true story.

Result: Fair Value of $193.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressure from new wearable technologies and regulatory hurdles could disrupt iRhythm’s growth story and put pressure on its margins.

Find out about the key risks to this iRhythm Technologies narrative.

Another View: High Sales Ratio Raises Questions

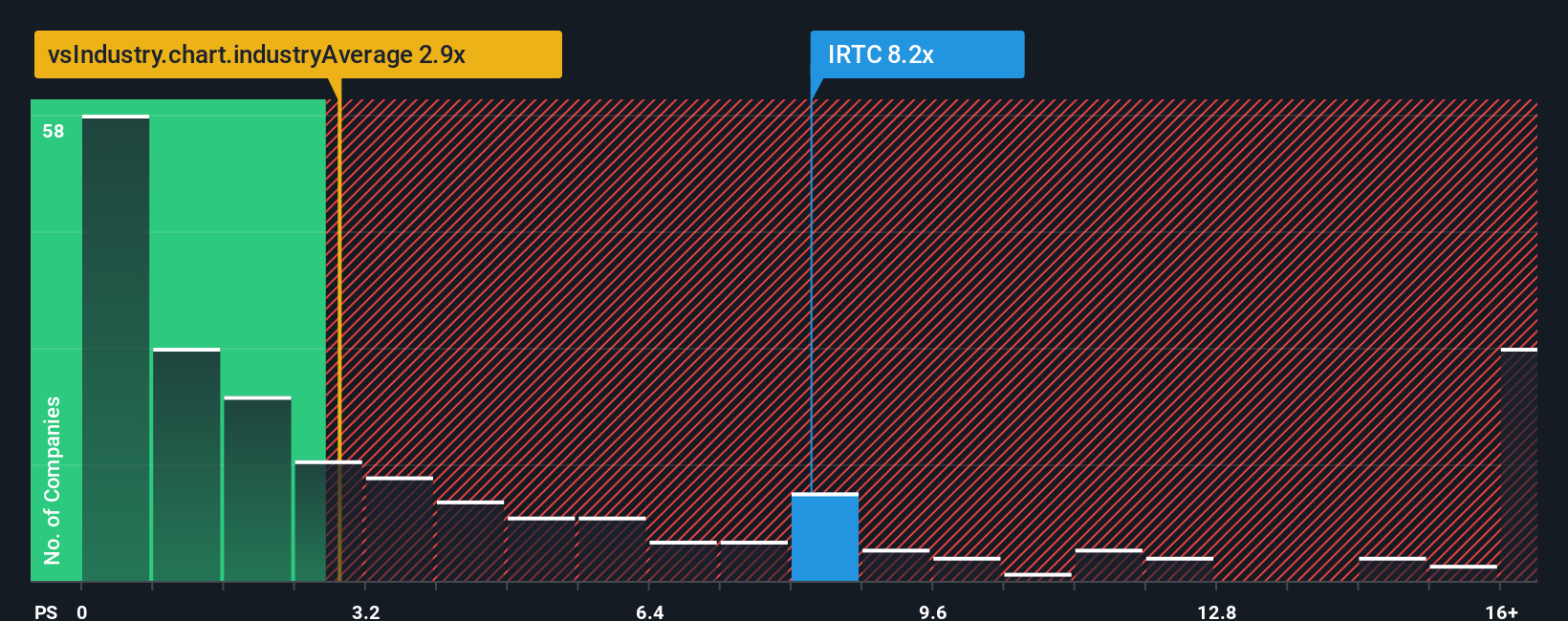

Looking at the market through a sales-based lens, iRhythm Technologies is priced at 8 times sales, while the US Medical Equipment industry average is only 3.1 times and the fair ratio sits at 4.8 times. This wide gap suggests investors are expecting a lot from future growth, but this premium could signal heightened valuation risk just as easily as potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

Feel free to dive into the numbers yourself and shape your own perspective on iRhythm Technologies. It's quick and you can build your own in under three minutes. Do it your way

A great starting point for your iRhythm Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Miss your chance to get in early and you might regret it later. Take control of your strategy by acting now with these high-impact ideas:

- Boost your portfolio’s yield and cash flow by checking out these 16 dividend stocks with yields > 3%, which offers reliable dividends and attractive payouts above 3%.

- Seize opportunities in next-level healthcare leaders by tracking these 32 healthcare AI stocks, as they develop powerful AI solutions for medicine and diagnostics.

- Capitalize on breakthroughs in computing by following these 28 quantum computing stocks, which is at the forefront of quantum technology and its rapid development.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives