- United States

- /

- Healthtech

- /

- NasdaqGS:HTFL

Assessing HeartFlow (HTFL) Valuation After Recent Pullback and Strong Year-to-Date Performance

Reviewed by Simply Wall St

HeartFlow (HTFL) shares have pulled back about 6% over the past week, with a month-long slide leaving the stock just above $32. This recent dip has sparked renewed attention from investors who are considering whether current levels present an opportunity.

See our latest analysis for HeartFlow.

The latest downward move from HeartFlow comes after a solid run this year, with a year-to-date share price return of over 13% and a strong 90-day gain that hints at underlying momentum. While the recent pullback has caught some investors’ attention, the longer-term trend suggests interest hasn’t faded entirely, especially as valuation and growth prospects remain in focus.

If HeartFlow’s recent volatility has you curious about what else is on the move, it could be a great moment to check out opportunities in healthcare stocks See the full list for free.

With recent results showing both rapid growth and ongoing volatility, the key question for investors looms large: Is HeartFlow now trading at an attractive discount, or is the market already factoring in all of its future upside?

Price-to-Sales Ratio of 18.3x: Is it justified?

At the last close price of $32.56, HeartFlow’s price-to-sales ratio stands at 18.3x, significantly higher than typical valuations in its sector. This premium valuation immediately stands out against both peers and industry averages.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of the company's revenue. For healthcare innovators like HeartFlow, high P/S figures can sometimes be justified by exceptional growth potential. However, they also indicate that investors have set very high expectations.

Compared to the US Healthcare Services industry average of just 2.8x and a peer average of 3x, HeartFlow trades at a substantial premium. Without profitability or a unique market position that could justify this level, it represents a notable divergence that investors should approach with care.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 18.3x (OVERVALUED)

However, rapid revenue growth may not offset sizable annual net losses or justify a premium unless HeartFlow delivers stronger profitability and meets high investor expectations.

Find out about the key risks to this HeartFlow narrative.

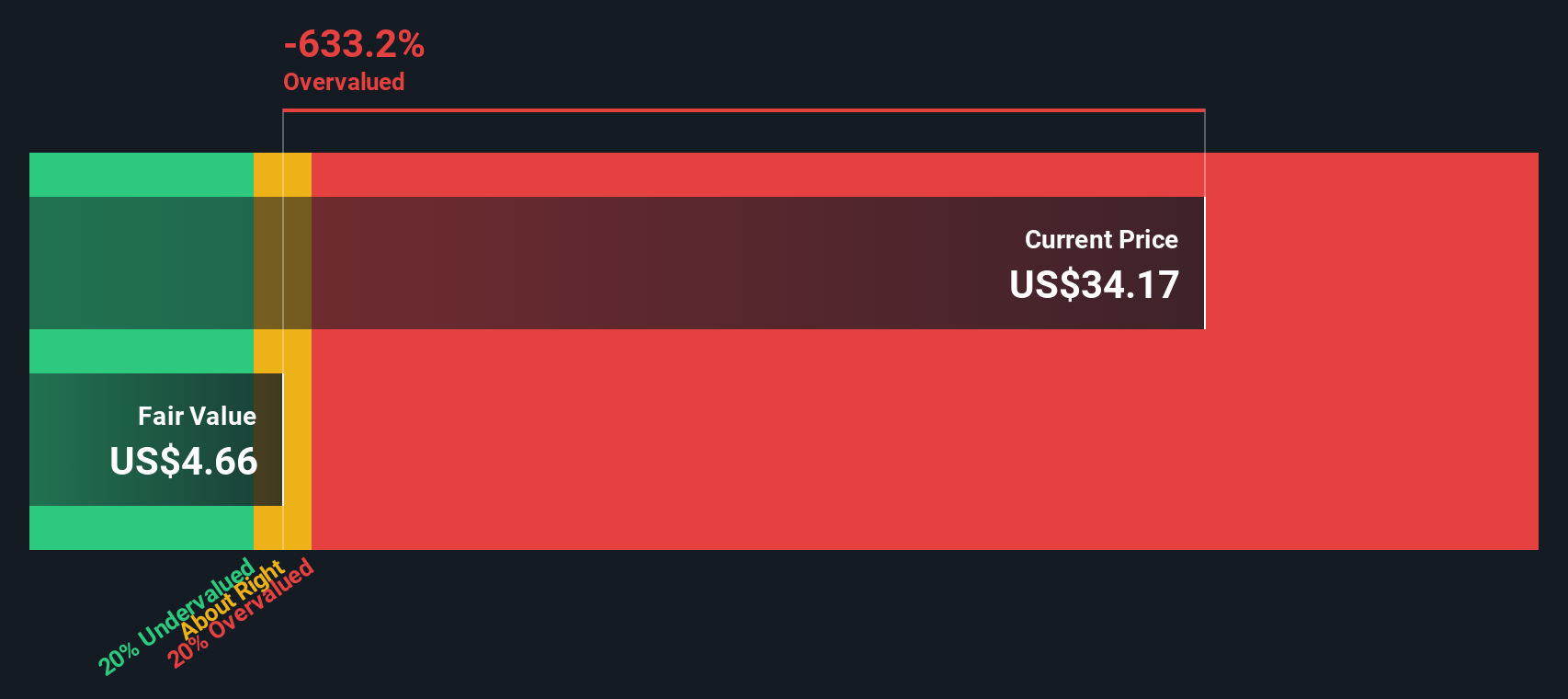

Another View: Discounted Cash Flow Suggests a Steep Premium

Taking a different approach, our SWS DCF model estimates HeartFlow’s fair value at just $4.64 per share. This is significantly lower than its current price of $32.56. The comparison indicates that the market may be pricing in much more optimism than the model supports, which raises questions about whether investors are overestimating future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HeartFlow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HeartFlow Narrative

If you’ve got a different take or want to dig into the data personally, you can pull together your own view in just a few minutes. Do it your way

A great starting point for your HeartFlow research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Skip the guesswork and use these handpicked ideas to spot stand-out stocks that might not be on your radar yet, but could shape your returns.

- Capitalize on the booming artificial intelligence trend by checking out these 25 AI penny stocks, which are transforming industries and redefining what is possible.

- Secure consistent income streams with these 16 dividend stocks with yields > 3%, offering yields above 3 percent. See which companies keep returns flowing regardless of market swings.

- Catch the next potential value surge with these 882 undervalued stocks based on cash flows, highlighting stocks the market may be underpricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HeartFlow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTFL

HeartFlow

A medical technology company, provides non-invasive solutions for diagnosing and managing coronary artery diseases worldwide.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives