- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

The Bull Case For Henry Schein (HSIC) Could Change Following Launch of AI-Powered Impact Panel Integration

Reviewed by Sasha Jovanovic

- In the past week, VideaHealth and Henry Schein One jointly announced the launch of the Impact Panel, a new AI-powered enhancement for Dentrix and Dentrix Ascend users that directly integrates real-time diagnostics and patient education tools into dental imaging workflows.

- The Impact Panel's patient education features, which have shown a 19% increase in case acceptance for practices using its QR function, highlight the growing importance of transparency and patient engagement in dental care delivery.

- We'll explore how the recent AI-driven workflow integration is expected to influence Henry Schein's ongoing digital transformation narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Henry Schein Investment Narrative Recap

Owning shares of Henry Schein often means believing in the company’s ability to drive recurring growth through digital transformation and value-added services. The recent launch of the Impact Panel, an AI-powered upgrade for dental imaging workflows, aligns well with this narrative by reinforcing technology-led differentiation, a critical short-term catalyst, though it does not materially resolve ongoing risks tied to pricing pressures or soft patient traffic in the core dental segment.

The company's raised earnings guidance for 2025, now expecting total sales growth of 3% to 4% over 2024, stands out as the most directly relevant recent announcement. This uptick in guidance is supportive of the technology and integration initiatives that underpin Henry Schein’s optimism around sustainable growth, even as competitive and operational risks remain top-of-mind for many investors.

Yet, against this progress, the threat of persistent margin pressure from competitive pricing and customer price sensitivity is an important factor for investors to consider...

Read the full narrative on Henry Schein (it's free!)

Henry Schein's outlook anticipates $14.4 billion in revenue and $614.4 million in earnings by 2028. This scenario implies a 4.0% annual revenue growth rate and a $225.4 million earnings increase from current earnings of $389.0 million.

Uncover how Henry Schein's forecasts yield a $75.15 fair value, a 3% upside to its current price.

Exploring Other Perspectives

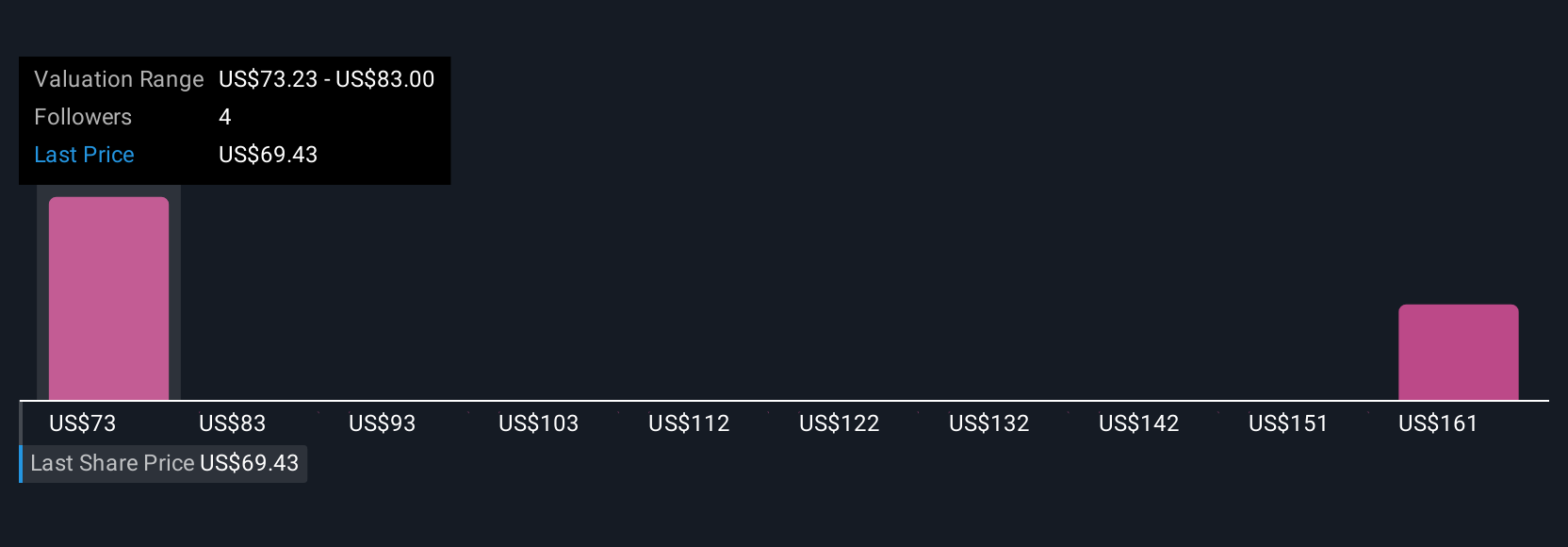

Individual fair value estimates from two members of the Simply Wall St Community range from US$75.15 to US$174.11 per share. Against this broad spectrum, ongoing efforts to boost high-margin business amid tight pricing could be pivotal, consider these varied viewpoints as you weigh your own.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth over 2x more than the current price!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives