- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

How Analyst Upgrades and Fresh Capital at Guardant Health (GH) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, several Wall Street firms reiterated positive ratings on Guardant Health while boosting their outlooks, highlighting the company’s leadership in liquid biopsy and precision oncology testing following stronger-than-expected third-quarter results and fresh capital raises through convertible notes and equity offerings.

- At the same time, Chief People Officer Terilyn J. Monroe’s sizeable stock sale alongside option exercises has drawn attention to insider activity against the backdrop of Guardant’s expanding testing volumes and growing Reveal product traction.

- Building on this growing analyst optimism, we’ll examine how the strengthened outlook for Guardant’s liquid biopsy leadership shapes its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Guardant Health Investment Narrative Recap

To own Guardant Health, you need to believe liquid biopsy and precision oncology can justify today’s rich valuation despite ongoing losses and heavy R&D spend. The latest analyst target hikes and capital raises support the near term catalyst of scaling test adoption, while also highlighting the key risk that continued cash burn and potential future dilution could still weigh on shareholder outcomes. Monroe’s insider sale is attention grabbing but does not appear to change that core equation.

The recent upsized US$350 million 0% convertible notes and roughly US$284.4 million equity offering are especially relevant here, because they add financial flexibility to fund growth while reinforcing concerns about dilution and the path to profitability. Together with stronger than expected third quarter revenue, driven by higher testing volumes and Reveal traction, these moves frame the central trade off between Guardant’s growth ambitions and its continued lack of profits.

However, investors should also be aware that ongoing high cash burn and the risk of further equity dilution could...

Read the full narrative on Guardant Health (it's free!)

Guardant Health's narrative projects $1.5 billion revenue and $82.1 million earnings by 2028. This requires 22.5% yearly revenue growth and an earnings increase of about $496 million from -$413.8 million today.

Uncover how Guardant Health's forecasts yield a $99.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

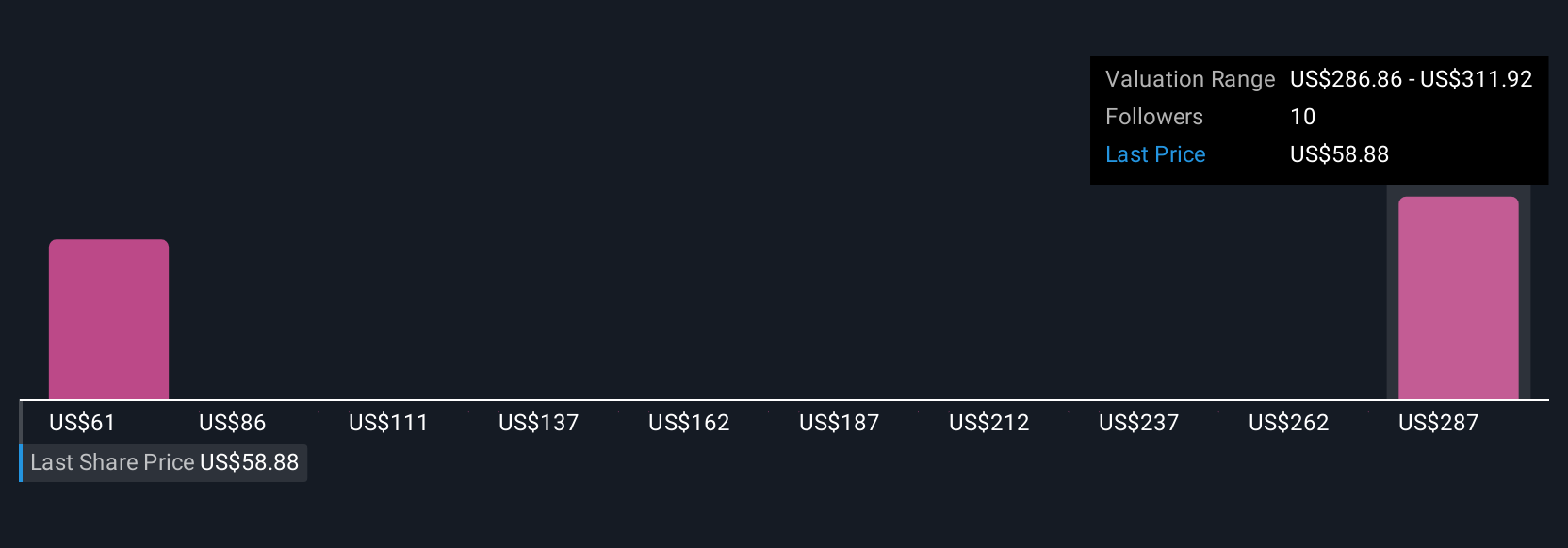

Four fair value estimates from the Simply Wall St Community span roughly US$68 to US$242 per share, showing how far apart individual views can be. Against that backdrop, Guardant’s continued net losses and substantial cash burn raise important questions about how long the company can pursue growth before profitability expectations need to adjust, so it is worth exploring several alternative viewpoints.

Explore 4 other fair value estimates on Guardant Health - why the stock might be worth 37% less than the current price!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026