- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

Reviewed by Simply Wall St

As December 2025 begins, the U.S. stock market faces a pullback with major indices like the Dow Jones, S&P 500, and Nasdaq closing lower amid a risk-off sentiment affecting big tech and crypto-tied shares. In such an environment, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on mispricings in the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.20 | $17.95 | 48.8% |

| Warrior Met Coal (HCC) | $77.48 | $154.17 | 49.7% |

| Super Group (SGHC) (SGHC) | $10.94 | $21.64 | 49.4% |

| Sotera Health (SHC) | $17.35 | $33.65 | 48.4% |

| Nicolet Bankshares (NIC) | $126.48 | $242.17 | 47.8% |

| MoneyHero (MNY) | $1.25 | $2.42 | 48.4% |

| Flutter Entertainment (FLUT) | $204.12 | $391.77 | 47.9% |

| First Busey (BUSE) | $23.52 | $45.34 | 48.1% |

| DexCom (DXCM) | $63.52 | $126.54 | 49.8% |

| BioLife Solutions (BLFS) | $25.41 | $49.69 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies.

DexCom (DXCM)

Overview: DexCom, Inc. is a medical device company that designs, develops, and commercializes continuous glucose monitoring systems globally, with a market cap of approximately $24.77 billion.

Operations: DexCom generates revenue primarily from its patient monitoring equipment segment, which accounts for approximately $4.52 billion.

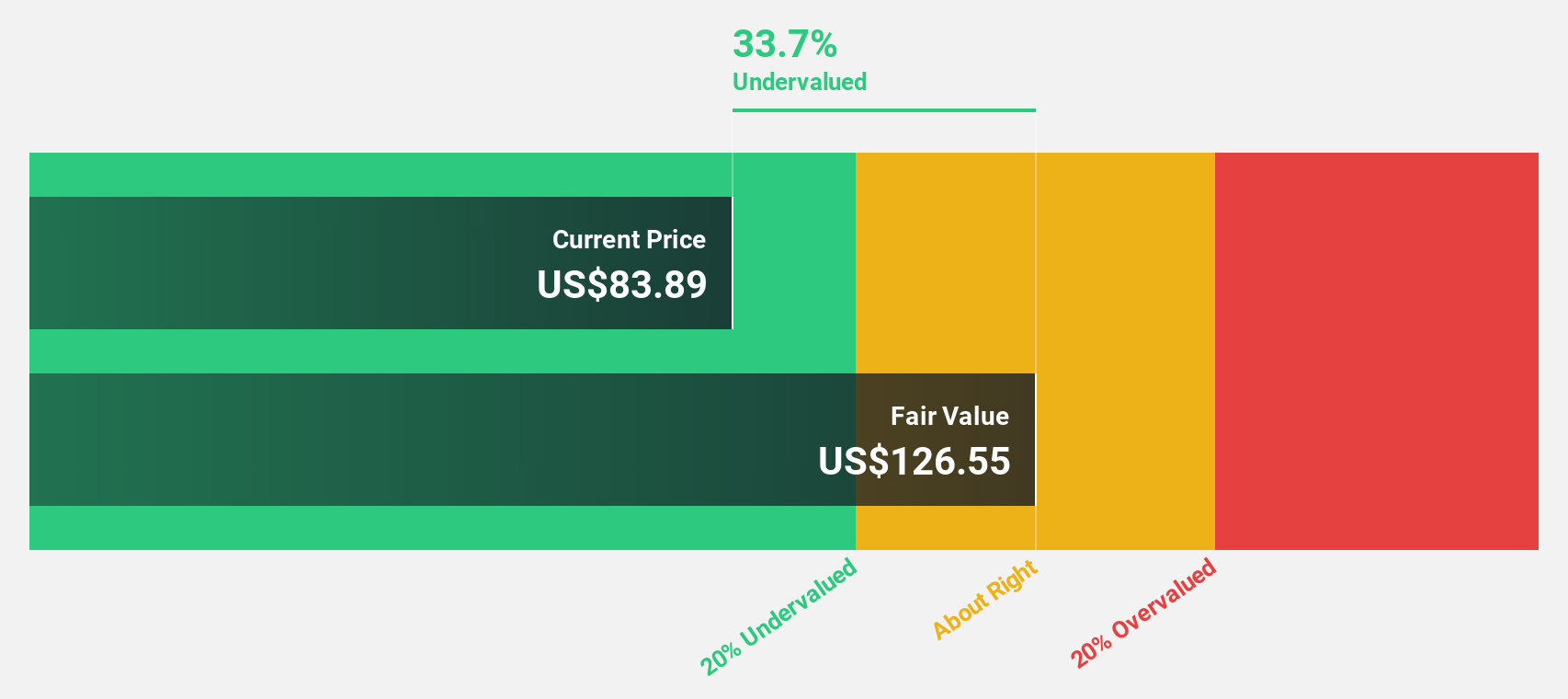

Estimated Discount To Fair Value: 49.8%

DexCom is trading at US$63.52, significantly below its estimated fair value of US$126.54, suggesting it may be undervalued based on discounted cash flow analysis. The company's earnings are projected to grow over 20% annually, outpacing the broader U.S. market's growth expectations. However, recent legal challenges related to unauthorized design changes in its glucose monitoring systems could pose financial and reputational risks despite the positive cash flow outlook.

- Our comprehensive growth report raises the possibility that DexCom is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of DexCom stock in this financial health report.

Super Micro Computer (SMCI)

Overview: Super Micro Computer, Inc. develops and sells modular and open-standard server and storage solutions globally, with a market cap of approximately $19.94 billion.

Operations: The company's revenue segment primarily consists of high-performance server solutions, generating approximately $21.05 billion.

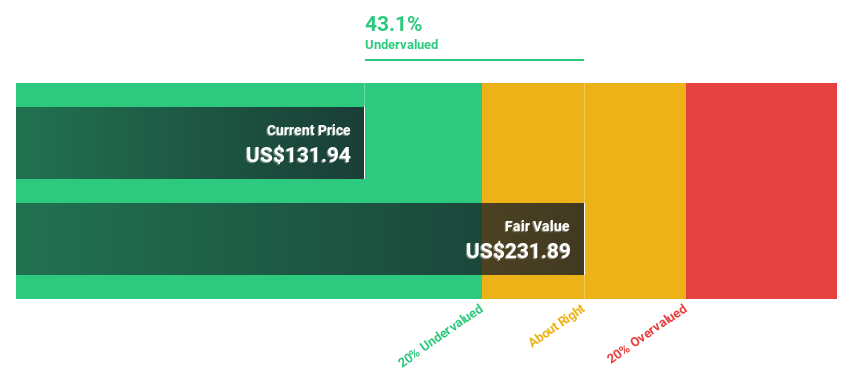

Estimated Discount To Fair Value: 34.3%

Super Micro Computer's stock is trading at US$33.41, well below its estimated fair value of US$50.84, highlighting potential undervaluation based on cash flow analysis. The company's earnings are expected to grow significantly, outpacing the U.S. market average. Despite a decrease in profit margins from 7.6% to 3.8%, Super Micro has raised its fiscal 2026 revenue guidance to at least $36 billion and continues expanding into the federal market with new AI-focused product offerings.

- Our growth report here indicates Super Micro Computer may be poised for an improving outlook.

- Dive into the specifics of Super Micro Computer here with our thorough financial health report.

Jabil (JBL)

Overview: Jabil Inc. offers engineering, manufacturing, and supply chain solutions globally, with a market cap of approximately $22.43 billion.

Operations: The company's revenue segments include Regulated Industries at $11.88 billion, Intelligent Infrastructure at $12.32 billion, and Connected Living and Digital Commerce at $5.61 billion.

Estimated Discount To Fair Value: 18.7%

Jabil's stock, priced at US$209.99, is trading below its fair value estimate of US$258.19, suggesting undervaluation based on cash flow analysis. Despite a decline in profit margins from 4.8% to 2.2%, earnings are projected to grow significantly over the next three years, surpassing U.S. market averages. Recent strategic alliances in AI-driven cybersecurity and energy storage systems highlight Jabil's diversification efforts and potential for future growth amidst high debt levels and insider selling activities.

- According our earnings growth report, there's an indication that Jabil might be ready to expand.

- Navigate through the intricacies of Jabil with our comprehensive financial health report here.

Taking Advantage

- Dive into all 212 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026