- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Why Cooper Companies (COO) Is Up 5.2% After Strategic Review, Buyback Completion And 2026 Outlook

Reviewed by Sasha Jovanovic

- In early December 2025, CooperCompanies reported fourth-quarter and full-year results showing higher revenue of US$1,065.2 million and US$4,092.4 million respectively, but lower net income and diluted EPS from continuing operations versus the prior year, alongside updated 2026 revenue guidance and details on a completed US$1.03 billion share repurchase program.

- The company also launched a formal strategic review, signaled by a planned transition of the board chair role to long-time director and former Procter & Gamble executive Colleen Jay, highlighting an increased focus on portfolio optimization and capital allocation.

- Next, we’ll examine how CooperCompanies’ formal strategic review shapes its existing investment narrative around product innovation, efficiency, and capital returns.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cooper Companies Investment Narrative Recap

To own CooperCompanies, you need to believe its contact lens and women’s health franchises can convert product innovation and efficiency gains into steadily improving earnings, despite softer recent profit trends. The latest results show modest revenue growth but lower net income, so the near term catalyst remains execution on higher margin products and cost discipline, while the biggest risk is that slower contact lens market growth and pricing pressure keep revenue stuck in low single digits. The December update does not materially change that balance.

The most relevant recent announcement here is the formal strategic review, paired with a completed US$1,034.8 million buyback and a new US$2 billion repurchase focus. While the review could encompass partnerships, divestitures, or other transactions, near term it mainly reinforces capital returns as a key tool to offset cyclical weakness in fertility and Paragard and to support the existing narrative around improving profitability and free cash flow.

Yet investors should be aware that if global contact lens growth stays near 4% and pricing remains tight...

Read the full narrative on Cooper Companies (it's free!)

Cooper Companies' narrative projects $4.9 billion revenue and $786.2 million earnings by 2028. This requires 6.4% yearly revenue growth and about a $378 million earnings increase from $407.8 million today.

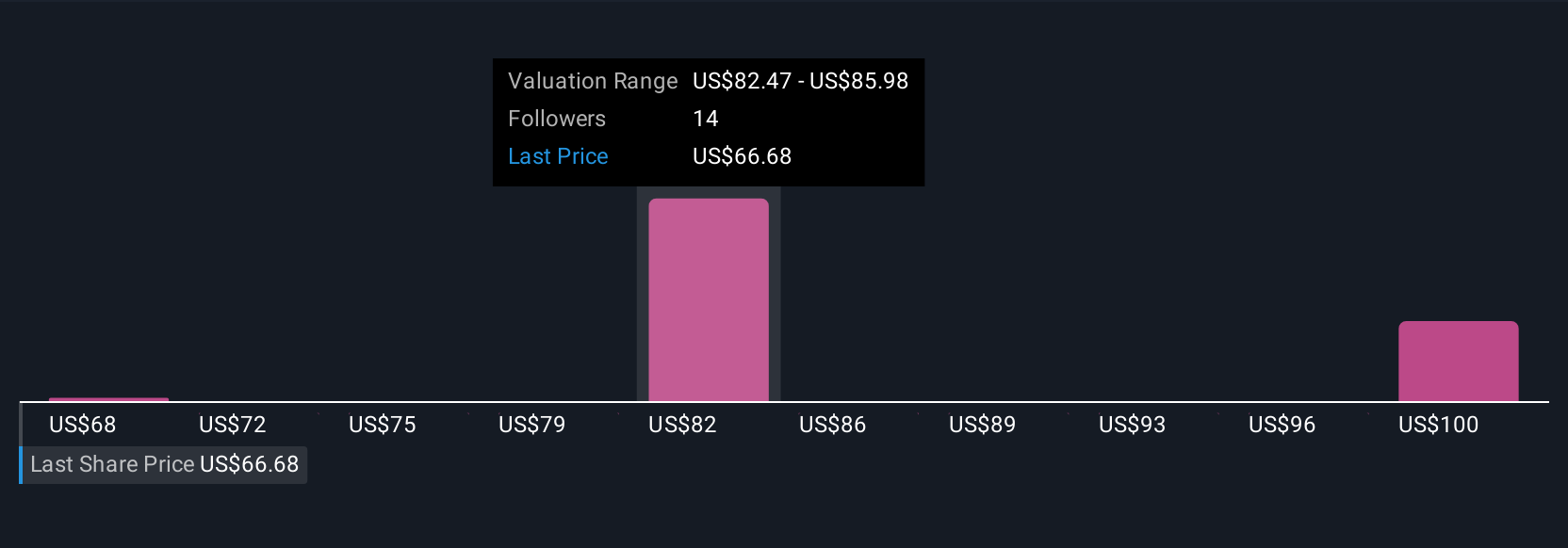

Uncover how Cooper Companies' forecasts yield a $83.00 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for CooperCompanies cluster between US$68.44 and US$92.78, underlining how differently individual investors view its prospects. You should weigh those views against the risk that a slower growing global contact lens market and softer pricing could cap CooperCompanies’ revenue trajectory and keep execution on premium products under close scrutiny.

Explore 3 other fair value estimates on Cooper Companies - why the stock might be worth 16% less than the current price!

Build Your Own Cooper Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cooper Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cooper Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cooper Companies' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026