- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Cooper Companies (COO): Evaluating Valuation After Wells Fargo Downgrade on Slowing Core Market Trends

Reviewed by Simply Wall St

Cooper Companies (COO) was downgraded by Wells Fargo, as analysts pointed to slowing trends in its core markets, especially the contact lens business. This move reflects a more cautious stance on Cooper's future performance.

See our latest analysis for Cooper Companies.

Shares of Cooper Companies have struggled to regain momentum, with a 1-year total shareholder return of -28.2% highlighting the challenges the company faces despite occasional short-term rallies. Ongoing concerns about slower growth in its key segments have weighed on investor sentiment and contributed to recent price volatility.

If shifts in healthcare demand have you rethinking your strategy, you might want to explore other opportunities and see the full list of innovators in our healthcare screener. See the full list for free.

Given the recent downgrade and challenging returns, the question now is whether Cooper Companies is trading at a discount that signals untapped value, or if the market has already adjusted for its slowing growth outlook.

Most Popular Narrative: 13.6% Undervalued

According to the most widely followed narrative, Cooper Companies' fair value sits well above its recent close. With the stock trading at $71.75 and the narrative placing fair value at $83, the stage is set for a debate on whether future improvements will justify the optimism built in.

Investments in automation, digital solutions, and integration of recent acquisitions (notably in CooperSurgical and the fertility segment) are coming to fruition, leading to expected operating efficiencies, working capital improvements, and operating margin expansion. These developments support higher future earnings and free cash flow conversion.

How aggressive are the assumptions behind that bullish price target? The narrative hints at margin improvements, automation successes, and a turning point in free cash flow, but what blend of revenue growth and profit improvement is actually factored in? Uncover the projections behind this optimistic fair value and see what most investors might be missing.

Result: Fair Value of $83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable order patterns from product transitions and ongoing price competition in Asia could still cloud the outlook for Cooper Companies’ recovery.

Find out about the key risks to this Cooper Companies narrative.

Another View: A Look at Market Multiples

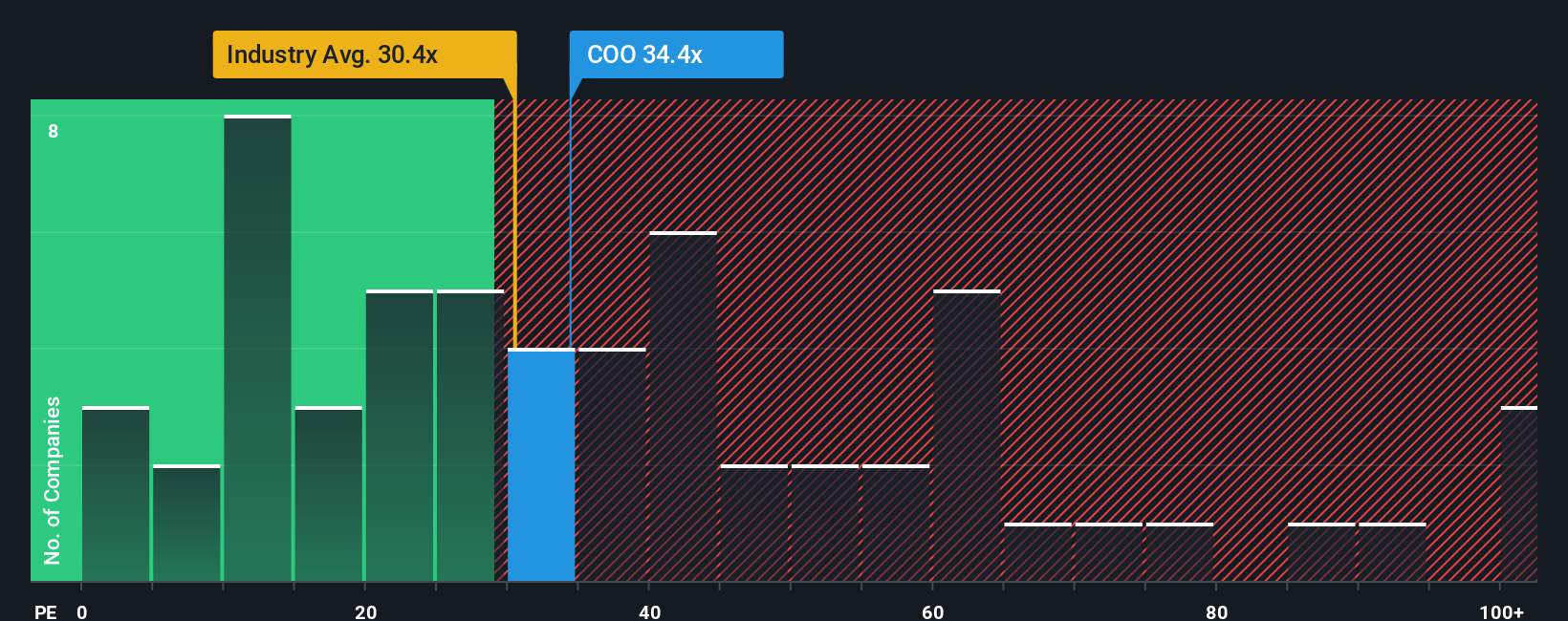

While the earlier valuation points to Cooper Companies' shares being undervalued, comparing its price-to-earnings ratio to industry benchmarks offers a more cautious take. The company trades at 35x earnings, which is much steeper than both its peers’ average of 24.8x and the industry average of 28.1x. Even compared to a fair ratio of 29.3x, shares still look expensive. Does this higher multiple signal conviction in Cooper's growth, or add risk if future results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If you have a different perspective or prefer hands-on analysis, you can quickly dive into the details and form your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Simply Wall St’s screeners uncover investment angles that others miss. Take action and give yourself a powerful edge.

- Spot high-yield potential by checking out these 15 dividend stocks with yields > 3%, which deliver impressive yields above 3% and reliable cash flow to your portfolio.

- Capitalize on innovation surges by targeting these 27 AI penny stocks, offering you access to the hottest breakthroughs in artificial intelligence.

- Amplify your returns with these 3590 penny stocks with strong financials, combining strong financials and outsized growth possibilities for those seeking the next hidden gem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives