- United States

- /

- Medical Equipment

- /

- NasdaqGM:CERS

Promising Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Federal Reserve's meeting unfolds, investors are closely monitoring potential interest rate cuts that could influence market dynamics. Amid these developments, penny stocks continue to capture attention as a viable investment area, despite their seemingly outdated label. These smaller or newer companies can offer unique opportunities for growth and value, especially when they demonstrate strong financial resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.09 | $462.9M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.71 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8606 | $147.23M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.285 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.38B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.57 | $598.45M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $370.12M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.85 | $6.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.51 | $101.73M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CuriosityStream (CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content through various channels, with a market cap of approximately $263.51 million.

Operations: The company generates revenue primarily from its factual content offerings, amounting to $66.60 million.

Market Cap: $263.51M

CuriosityStream Inc. is navigating the penny stock landscape with a focus on expanding its factual content offerings, evidenced by recent licensing agreements with major broadcasters and streaming platforms globally. Despite being unprofitable, the company has reduced losses over five years and forecasts significant revenue growth for Q4 2025. CuriosityStream maintains a robust cash runway exceeding three years, bolstered by positive free cash flow and no debt burden. However, its dividend sustainability is questionable due to insufficient earnings coverage. Recent insider selling may warrant caution but does not overshadow strategic content distribution advancements and infrastructure upgrades supporting AI training markets.

- Click to explore a detailed breakdown of our findings in CuriosityStream's financial health report.

- Understand CuriosityStream's earnings outlook by examining our growth report.

Cerus (CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $397.62 million.

Operations: The company's revenue is derived entirely from its Blood Safety segment, amounting to $199.19 million.

Market Cap: $397.62M

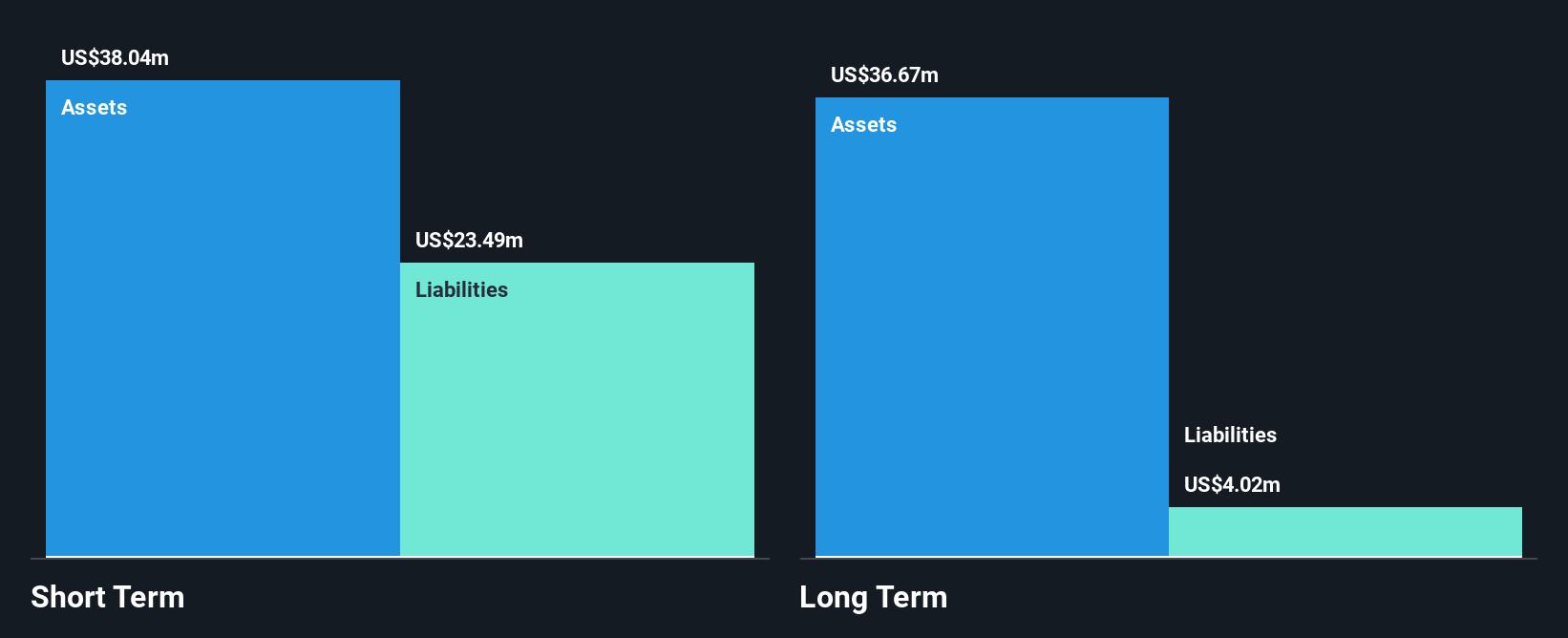

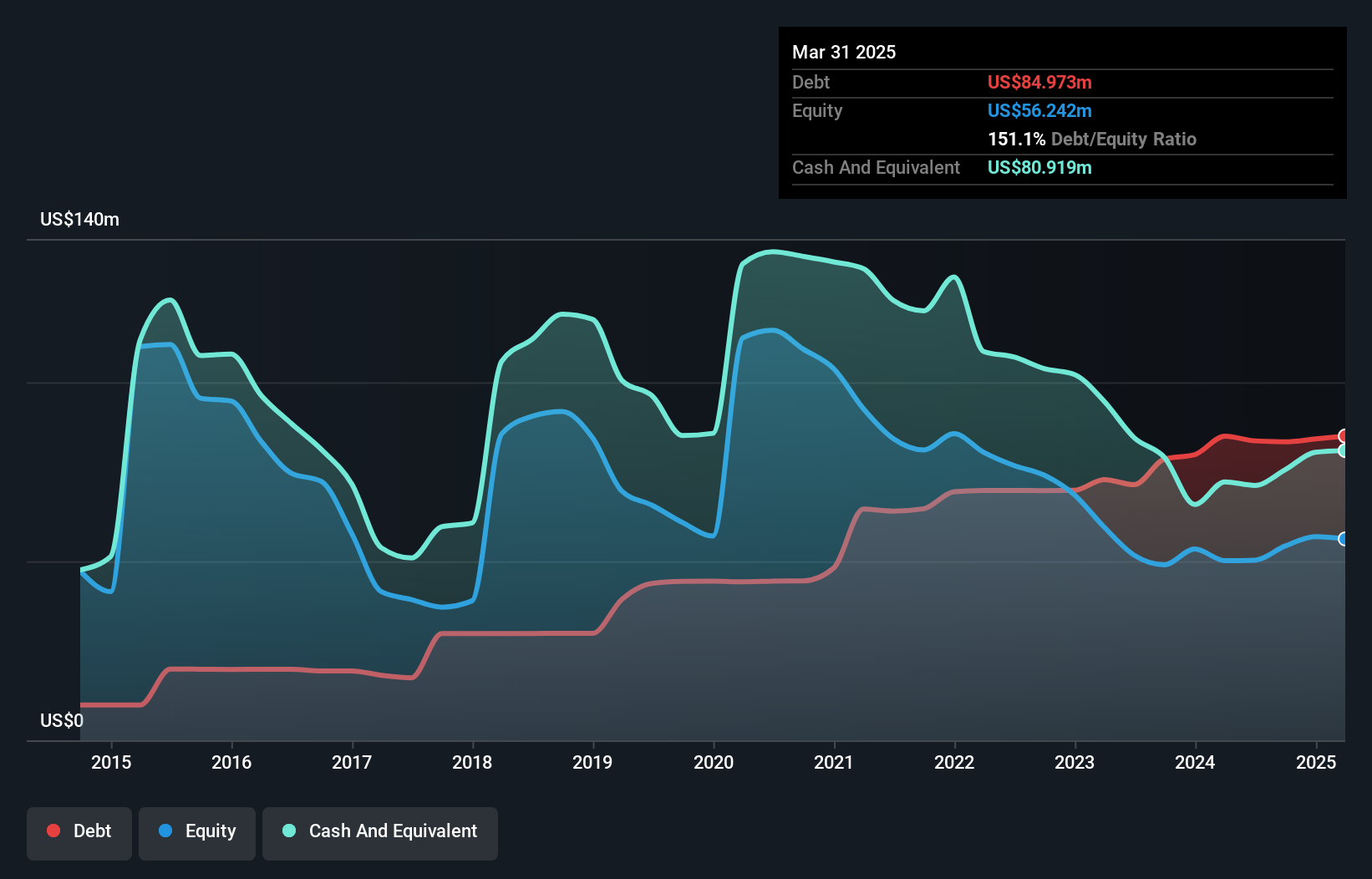

Cerus Corporation, while navigating the penny stock domain, demonstrates potential through its robust revenue growth in the Blood Safety segment, expected to reach US$202-204 million for 2025. Despite being unprofitable with a negative return on equity and high share price volatility, Cerus has reduced losses significantly over five years. The company benefits from a strong cash position with short-term assets surpassing liabilities and a positive free cash flow ensuring over three years of runway. However, significant insider selling raises concerns amidst stable weekly volatility and an experienced management team guiding operations.

- Take a closer look at Cerus' potential here in our financial health report.

- Assess Cerus' future earnings estimates with our detailed growth reports.

Make It Happen

- Dive into all 345 of the US Penny Stocks we have identified here.

- Ready For A Different Approach? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CERS

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026