- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

How Investors May Respond To BrightSpring Health Services (BTSG) After Upgraded Analyst Earnings Forecasts

Reviewed by Sasha Jovanovic

- In recent days, analysts have revised their earnings estimates upward for BrightSpring Health Services, Inc., reflecting strengthened optimism about the company's upcoming quarter and full-year performance. This broad-based upward revision by analysts has resulted in BrightSpring achieving a top analyst rating, highlighting heightened confidence in its future outlook.

- This surge in analyst sentiment reveals how consensus expectations can swiftly shift due to changes in underlying business prospects.

- We'll now examine how improved analyst confidence and upgraded earnings forecasts may impact BrightSpring's investment narrative and long-term potential.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BrightSpring Health Services Investment Narrative Recap

To be a shareholder in BrightSpring Health Services, you need to believe in the continued expansion of specialty pharmacy and home health services, both of which are positioned to benefit from demographic trends and ongoing investments in technology and integration. While recent upward earnings revisions have supported optimism for short-term performance, the main catalyst remains execution against robust revenue guidance, while the persistence of elevated labor costs stands out as the most immediate risk; the recent news on upgraded analyst sentiment does not meaningfully shift either factor's materiality at present. Among recent company developments, the October 2025 follow-on equity offering, which raised US$431.73 million through 15 million new shares, is especially relevant in this context. This influx of capital is expected to strengthen BrightSpring’s balance sheet as it prepares to sustain investments in pharmacy growth and broader care integration, which are fundamental to both current analyst confidence and the company's ability to deliver on its guidance. In contrast, investors should also be aware that continued labor shortages and wage pressures in healthcare could...

Read the full narrative on BrightSpring Health Services (it's free!)

BrightSpring Health Services is projected to reach $16.8 billion in revenue and $361.8 million in earnings by 2028. This outlook assumes a 10.1% annual revenue growth rate and a $314.5 million increase in earnings from the current $47.3 million.

Uncover how BrightSpring Health Services' forecasts yield a $39.77 fair value, a 10% upside to its current price.

Exploring Other Perspectives

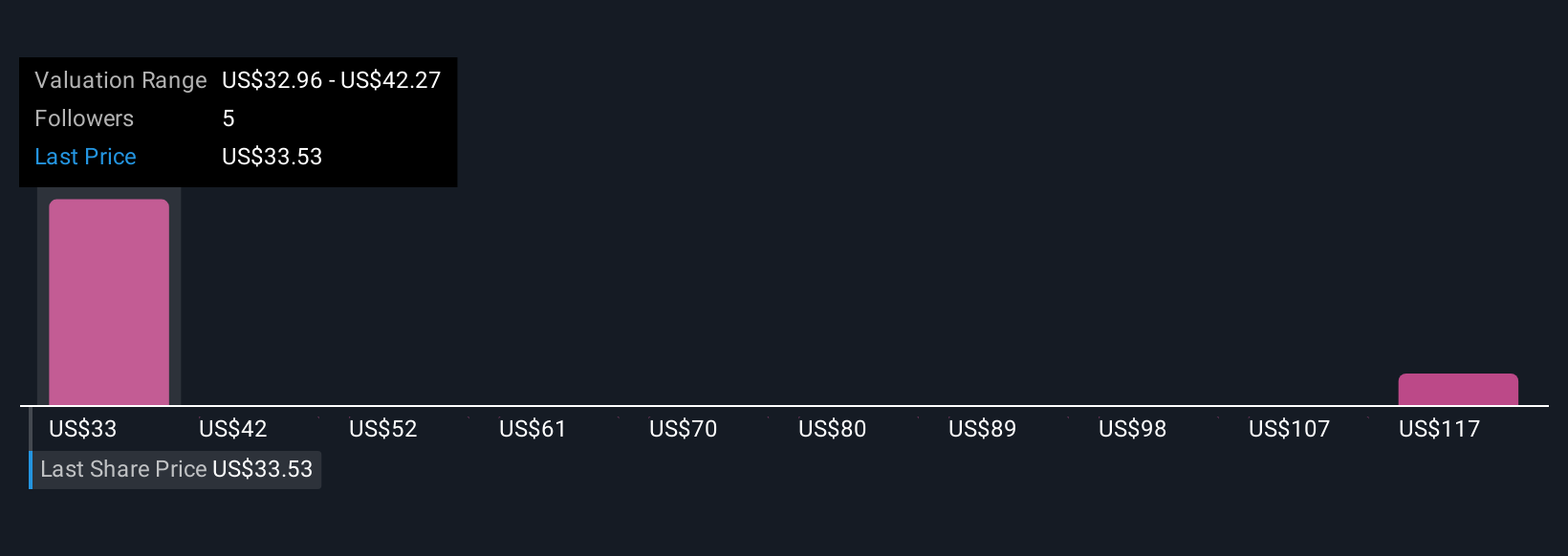

Simply Wall St Community members provided two fair value estimates for BrightSpring, with projections spanning from US$39.77 to US$128.19 per share. These sharply varied opinions exist alongside analyst concerns about rising staffing costs, reminding you that investor outlooks can diverge widely and are influenced by critical industry risks.

Explore 2 other fair value estimates on BrightSpring Health Services - why the stock might be worth over 3x more than the current price!

Build Your Own BrightSpring Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BrightSpring Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrightSpring Health Services' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026