- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

FDA Biologic Approval For AVANCE Might Change The Case For Investing In Axogen (AXGN)

Reviewed by Sasha Jovanovic

- Axogen has reported that the FDA has approved the Biologics License Application for AVANCE, an acellular nerve allograft for treating peripheral nerve discontinuities in adults and children aged one month and older under a biologic regulatory framework.

- This shift from tissue to biologic classification, with certain indications approved under the FDA’s Accelerated Approval pathway pending confirmatory trials, enhances regulatory rigor and could influence how clinicians, payers, and patients view AVANCE’s safety and clinical value ahead of its licensed commercial release expected in early second-quarter 2026.

- We’ll now examine how full BLA approval for AVANCE as a biologic could reshape Axogen’s investment narrative and long-term risk profile.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Axogen Investment Narrative Recap

To own Axogen, you need to believe that nerve repair evolves into a durable, procedure-based franchise where AVANCE remains the reference graft across multiple indications. With full BLA approval now secured, the key near term catalyst shifts to successful execution of confirmatory trials and a smooth transition to biologic-grade manufacturing, while the biggest risk is that any clinical, operational, or reimbursement setbacks around AVANCE could have an outsized impact given Axogen’s portfolio concentration.

Among recent announcements, the FDA’s earlier extension of the Avance BLA PDUFA date in August 2025 now looks like a prelude to a more robust filing that ultimately gained approval. That episode underlines how incremental regulatory requirements can slow timelines, but also how meeting those expectations can strengthen the product’s evidentiary foundation, which matters as Axogen works to broaden adoption and support its growth catalysts.

Yet investors should be aware that Axogen’s reliance on a single biologic nerve repair platform means that if AVANCE’s confirmatory studies underperform or reimbursement expectations shift...

Read the full narrative on Axogen (it's free!)

Axogen’s narrative projects $323.0 million in revenue and $25.7 million in earnings by 2028.

Uncover how Axogen's forecasts yield a $29.12 fair value, a 3% upside to its current price.

Exploring Other Perspectives

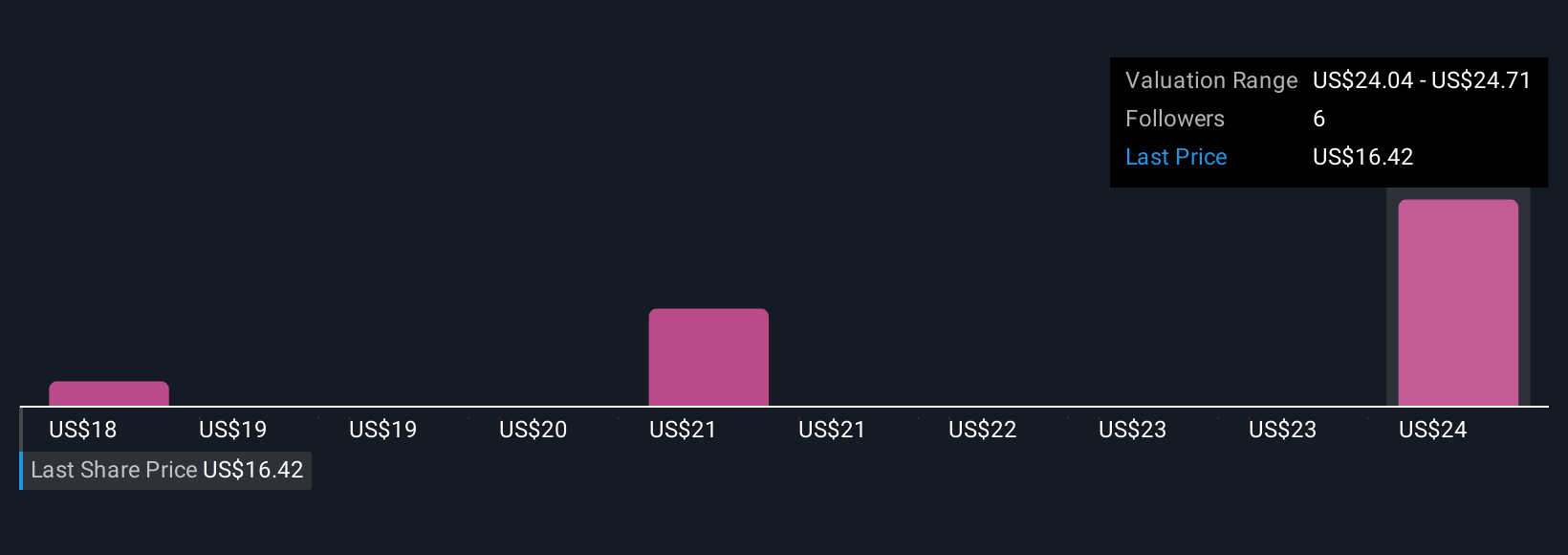

Simply Wall St Community members peg Axogen’s fair value between US$17.95 and US$45.78 across 4 independent views, highlighting how far opinions can spread. Set this against Axogen’s dependence on AVANCE’s BLA backed franchise and you can see why it helps to weigh several perspectives on how concentrated product risk might affect future performance.

Explore 4 other fair value estimates on Axogen - why the stock might be worth as much as 62% more than the current price!

Build Your Own Axogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axogen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Axogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axogen's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026