- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Did AtriCure’s (ATRC) Earnings Beat and Insider Selling Just Reframe Its Growth Story?

Reviewed by Sasha Jovanovic

- AtriCure recently reported quarterly results that surpassed analyst earnings expectations, while disclosures showed some directors reducing their holdings through insider stock sales.

- A consensus “Moderate Buy” rating from eleven brokerages highlights how Wall Street’s generally positive stance is balancing those insider transactions in shaping sentiment.

- Now, we’ll explore how the stronger-than-expected earnings report influences AtriCure’s existing investment narrative built around growth, profitability, and competition.

Find companies with promising cash flow potential yet trading below their fair value.

AtriCure Investment Narrative Recap

To own AtriCure, you need to believe its atrial fibrillation and stroke prevention technologies can grow into a larger, profitable cardiac surgery franchise despite ongoing losses and rising competition. The latest earnings beat supports that long term thesis but does not materially change the near term catalyst around clinical trial readouts, nor the key risk that pulsed field ablation and pricing pressure could weigh on growth and margins.

The recent progress on the BoxX NoAF clinical trial stands out alongside the earnings surprise, because it directly connects to AtriCure’s potential to expand its addressable market in Afib and stroke prevention. As this trial advances, it could become an increasingly important counterweight to pressures on the minimally invasive ablation business and international pricing, especially if it ultimately supports broader use of the EnCompass clamp and AtriClip systems.

Yet despite the improving numbers, investors should be aware that growing PFA catheter adoption could still...

Read the full narrative on AtriCure (it's free!)

AtriCure's narrative projects $717.8 million revenue and $13.2 million earnings by 2028.

Uncover how AtriCure's forecasts yield a $50.00 fair value, a 38% upside to its current price.

Exploring Other Perspectives

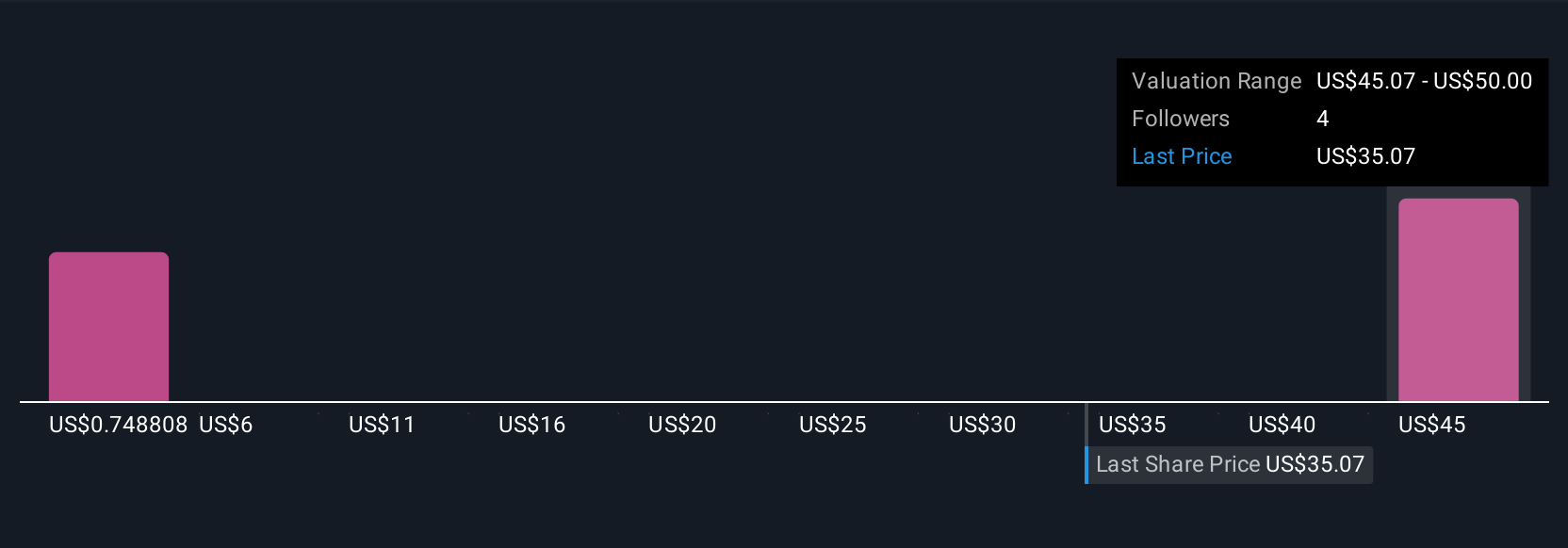

Two fair value estimates from the Simply Wall St Community range widely, from about US$0.78 to US$50 per share, underscoring how far apart individual views can be. Against that backdrop, the recent earnings beat and progress in trials like BoxX NoAF highlight why some investors focus on long term growth catalysts while others remain cautious about competitive and profitability risks, so it is worth weighing several perspectives before deciding where you stand.

Explore 2 other fair value estimates on AtriCure - why the stock might be worth less than half the current price!

Build Your Own AtriCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtriCure research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free AtriCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtriCure's overall financial health at a glance.

No Opportunity In AtriCure?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026