- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (ATRC) Losses Worsen 12.8% Annually, Challenging Bullish Profitability Narratives

Reviewed by Simply Wall St

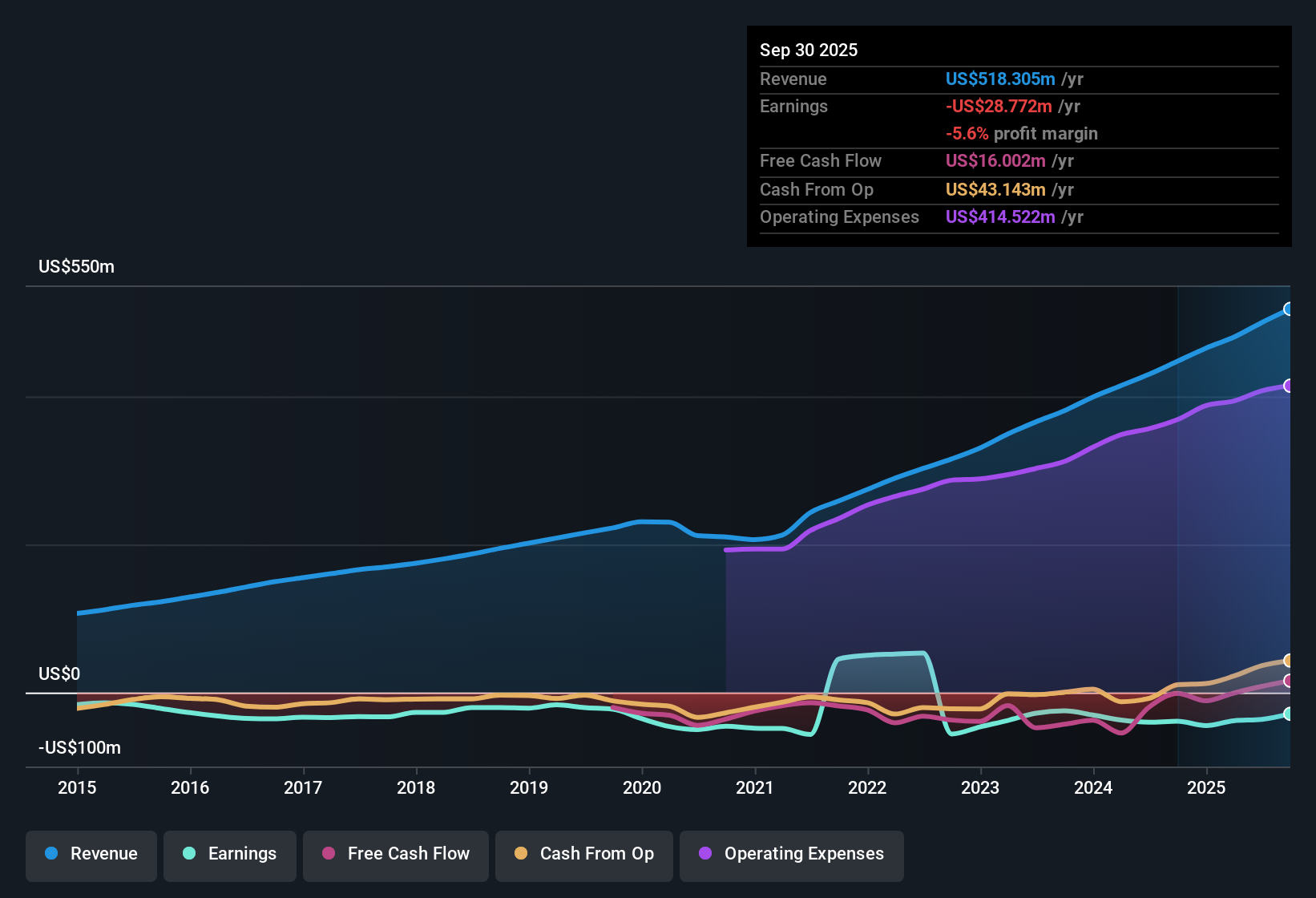

AtriCure (ATRC) remains unprofitable, with losses having increased at an average rate of 12.8% per year over the past five years. While the company is currently posting negative EPS, forecasts are calling for earnings growth of 76.64% per year and a potential return to profitability within the next three years. With revenue expected to expand 11.6% per year, outpacing the broader US market, investors are weighing up the company’s growth outlook against its ongoing losses and premium pricing.

See our full analysis for AtriCure.The next section takes these latest figures and puts them head-to-head with the key narratives that investors follow. This highlights where expectations are confirmed and where surprises emerge.

See what the community is saying about AtriCure

Margins Projected to Turn Positive

- Analysts forecast that AtriCure's profit margins will rise from -7.3% today to 1.8% within the next three years, marking a key shift from losses to positive profitability.

- According to the analysts' consensus view, anticipated margin improvement is heavily supported by operational efficiencies and slower growth in SG&A and R&D expenses, both increasing at rates below revenue growth.

- Top-line expansion is being driven by strong adoption of minimally invasive devices and successful product launches, both noted as core drivers of this expected margin turnaround.

- The consensus also points to the scaling operating leverage as a reason to expect that as revenues grow 12.8% annually, net margins should improve in tandem.

- The breadth of clinical trials (like LeAAPS and BoxX-NoAF) and international sales growth form the backbone of bullish claims that this margin inflection is sustainable. However, hitting the forecasted 1.8% positive margin relies on recurring revenue from new products and geographies materializing as planned.

- Consensus narrative notes that new clinical data and global expansion efforts will be pivotal in not just hitting but maintaining positive margins, reinforcing the long-term optimism if AtriCure executes well.

- Get the full rundown on where analysts align and diverge over AtriCure's shift to margin positivity. See the major talking points in their full consensus argument. 📊 Read the full AtriCure Consensus Narrative.

Premium Price Without Profits

- AtriCure currently trades at a price-to-sales ratio of 3.3x, which places it above the industry average of 2.8x but below the peer group average of 3.9x.

- The analysts' consensus narrative emphasizes that investors are paying a premium for AtriCure because they expect a strong revenue growth story and a path to profitability.

- The company’s DCF fair value is estimated at just $0.79, far below the current share price of $34.09, highlighting a steep gap between modeled intrinsic value and market optimism.

- To justify today’s price and the consensus target of $51.22, AtriCure would need to hit $717.8 million in revenues and $13.2 million in earnings by 2028 while maintaining rapid top-line expansion.

Strong Revenue Outlook Faces Competitive Pressures

- Future annual revenue growth is projected at 12.8% for the next three years, outpacing the US Medical Equipment industry growth rate of 10.3% per year.

- Analysts’ consensus view acknowledges the robust outlook but also highlights risks, such as intensifying competition from pulsed field ablation (PFA) catheter technologies and global pricing pressures, which could moderate gains.

- These emerging competitors and international pricing headwinds may limit the premium that AtriCure can command for its products, impacting both revenue growth and gross margin expansion.

- Meanwhile, the requirement for significant ongoing investment in R&D and commercialization means that hitting the forecasted growth will not automatically translate to large bottom-line gains unless costs remain controlled.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AtriCure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data another way? Share your perspective and craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your AtriCure research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

AtriCure’s premium price, ongoing losses, and uncertain path to positive margins raise concerns about its current valuation and sustainability.

Want to skip overvalued companies with a similar risk profile? Discover better opportunities by checking out these 831 undervalued stocks based on cash flows that may offer stronger value and upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives