- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

Astrana Health (ASTH): Exploring Current Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Astrana Health (ASTH) shares have been relatively subdued this week, with recent performance showing little reaction from investors. This is occurring even as broader healthcare sector movements take place. The current price offers a potential window to examine how its valuation stacks up.

See our latest analysis for Astrana Health.

While Astrana Health’s share price has rebounded 4.63% in the past week, the bigger picture reveals momentum is still fading. The 30-day share price return is -30.26% and the one-year total shareholder return is down 46.22%. This reflects ongoing shifts in market sentiment, despite some encouraging short-term movement.

If you’re interested in uncovering what else is happening across the healthcare sector, it's a great opportunity to browse the See the full list for free.

With shares down sharply over the past year and recent discounts to analyst price targets, investors face a key question: is Astrana Health now undervalued, or is the market already accounting for any future gains?

Most Popular Narrative: 45.6% Undervalued

Astrana Health’s most widely followed narrative estimates the company’s fair value far above its last close, suggesting there is sizable upside potential if ambitious growth scenarios play out. With the consensus narrative forecasting continued sector leadership, much relies on the successful execution of new strategies and operational integration.

Sustained investment and rapid integration of proprietary technology platforms and data infrastructure (including AI-driven capabilities) are enabling better cost control, real-time utilization management, and operational leverage. These factors could contribute to further EBITDA margin expansion as scale increases and as new geographies ramp.

Want a peek behind the valuation curtain? There is a bold call embedded here: aggressive margin expansion and technological edge drive the story. Ready to see what else powers this optimistic price target? Dive into the full narrative for all the details.

Result: Fair Value of $42.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, since changes to government reimbursement rates or challenges in integrating acquisitions could limit Astrana Health’s ability to deliver on growth expectations.

Find out about the key risks to this Astrana Health narrative.

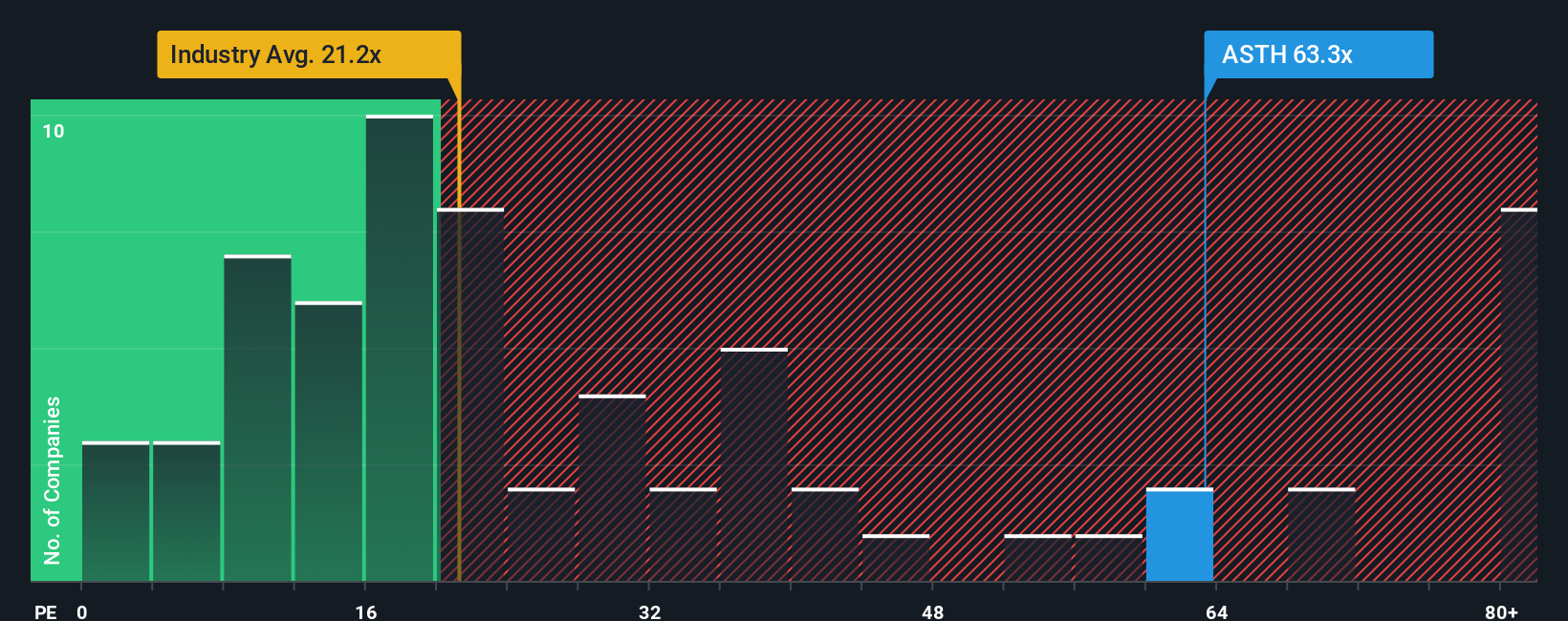

Another View: Multiples Suggest a Cautious Stance

Looking at standard market ratios, Astrana Health currently trades on a price-to-earnings ratio of 121.2x, which is much higher than the healthcare industry average of 22.7x, its peers at 60.3x, and our estimated fair ratio of 34.3x. This wide gap signals significant valuation risk if market sentiment turns. Could the multiples be pointing to a reality check ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astrana Health Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft a unique view of Astrana Health in just a few minutes, and Do it your way.

A great starting point for your Astrana Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one opportunity. If you're serious about capturing the next wave of winners, put these powerful, handpicked lists to work for your portfolio.

- Capitalize on the future of artificial intelligence by reviewing these 25 AI penny stocks, which highlights real breakthroughs in automation, data science, and machine learning.

- Boost your search for stable income by checking out these 15 dividend stocks with yields > 3%, featuring companies that offer robust yields above 3%.

- Uncover hidden value plays with these 932 undervalued stocks based on cash flows, which is packed with stocks trading below their intrinsic cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.