- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

Why Alignment Healthcare (ALHC) Is Up 9.0% After Beating Q3 Earnings and Securing Analyst Upgrades

Reviewed by Sasha Jovanovic

- Earlier this week, Alignment Healthcare reported third-quarter 2025 results that exceeded expectations for both earnings and revenue, while also receiving upgraded ratings from major financial firms including JP Morgan and Goldman Sachs due to optimism around its growth prospects in the Medicare Advantage market.

- An important detail was that analysts emphasized Alignment’s unique technology-driven approach to senior care as a differentiator in an expanding competitive sector.

- We’ll now explore how Alignment’s robust earnings report and recognition of its care model could shape the company’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Alignment Healthcare Investment Narrative Recap

To consider Alignment Healthcare as a potential investment, investors need to believe in the company’s ability to sustainably expand in the fast-growing Medicare Advantage market while leveraging its technology-driven care model to set itself apart from both established rivals and newer players. While the latest earnings surprise and analyst upgrades highlight near-term strength, they do not materially diminish the most important risk right now: possible changes to Medicare Advantage reimbursement rates and increased regulatory scrutiny could pressure future revenue and margins. The most relevant company development related to these catalysts is Alignment’s achievement of industry-leading Star Ratings for all member plans for the 2026 payment year. By securing this recognition, the company positions itself to benefit from higher reimbursement rates and better member retention, factors that can strengthen revenue per member even as the market becomes more competitive and reimbursement rules tighten. Yet, in contrast, investors should be aware that even top-tier Star Ratings may not fully shield Alignment from the impact of...

Read the full narrative on Alignment Healthcare (it's free!)

Alignment Healthcare's outlook forecasts $6.8 billion in revenue and $118.7 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 26.7% and a $169.7 million increase in earnings from the current level of -$51.0 million.

Uncover how Alignment Healthcare's forecasts yield a $21.04 fair value, a 10% upside to its current price.

Exploring Other Perspectives

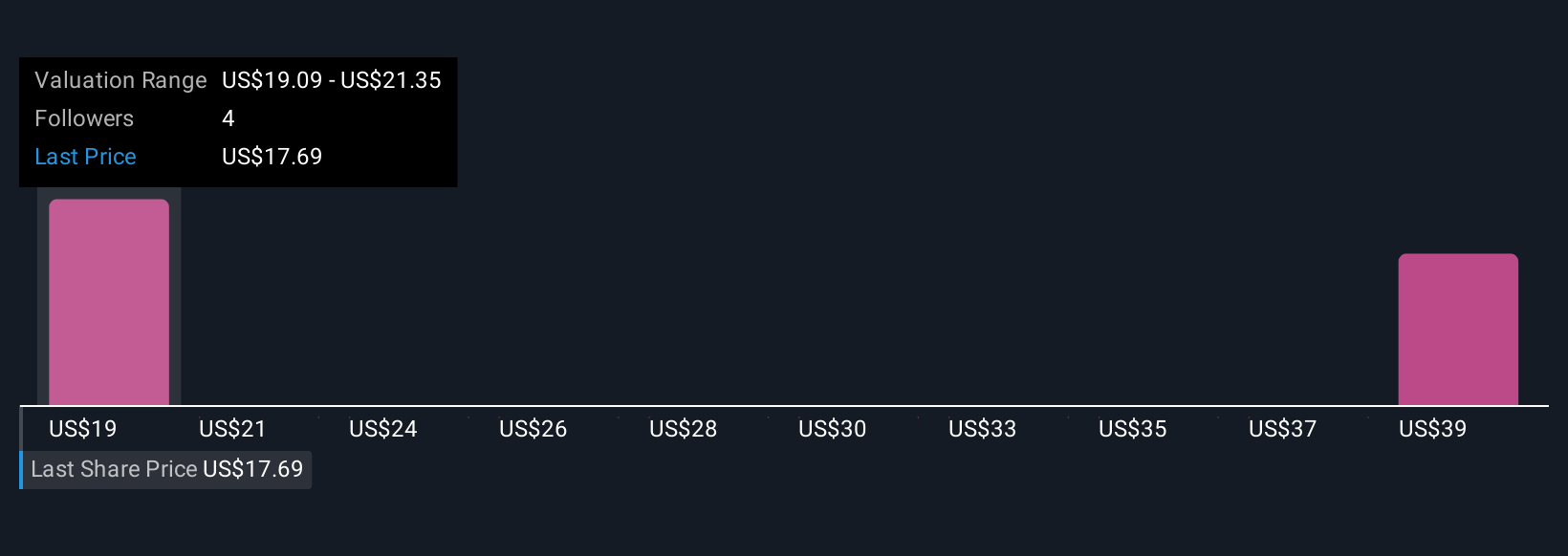

The Simply Wall St Community’s fair value estimates range from US$16.69 to US$21.04 across two analyses. Despite optimism around the company’s technology and Medicare Advantage positioning, many investors remain mindful of pending regulatory changes that could affect future profitability.

Explore 2 other fair value estimates on Alignment Healthcare - why the stock might be worth as much as 10% more than the current price!

Build Your Own Alignment Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alignment Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alignment Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alignment Healthcare's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026