- United States

- /

- Healthcare Services

- /

- NasdaqGS:ACHC

Acadia Healthcare Company (ACHC) Is Down 10.1% After Litigation Cost Surge and COO Resignation - What's Changed

Reviewed by Sasha Jovanovic

- In recent days, Acadia Healthcare cut its 2025 earnings guidance after a third‑party review identified sharply higher patient‑related litigation and insurance costs, prompting a sizable increase in professional and general liability reserves.

- The company also flagged Medicaid volume and bad debt challenges alongside the abrupt resignation of its COO, adding operational and leadership uncertainty to its legal and financial pressures.

- Next, we’ll examine how these sharply higher litigation and insurance expenses may reshape Acadia Healthcare’s previously optimistic investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Acadia Healthcare Company Investment Narrative Recap

To own Acadia Healthcare today, you have to believe that long term demand for behavioral health and payer support can ultimately outweigh near term legal, reimbursement and execution setbacks. The sharp increase in patient related litigation costs and liability reserves now looks like the key short term overhang, with Medicaid volume and bad debt issues compounding pressure on margins and testing the current investment case more than any other risk.

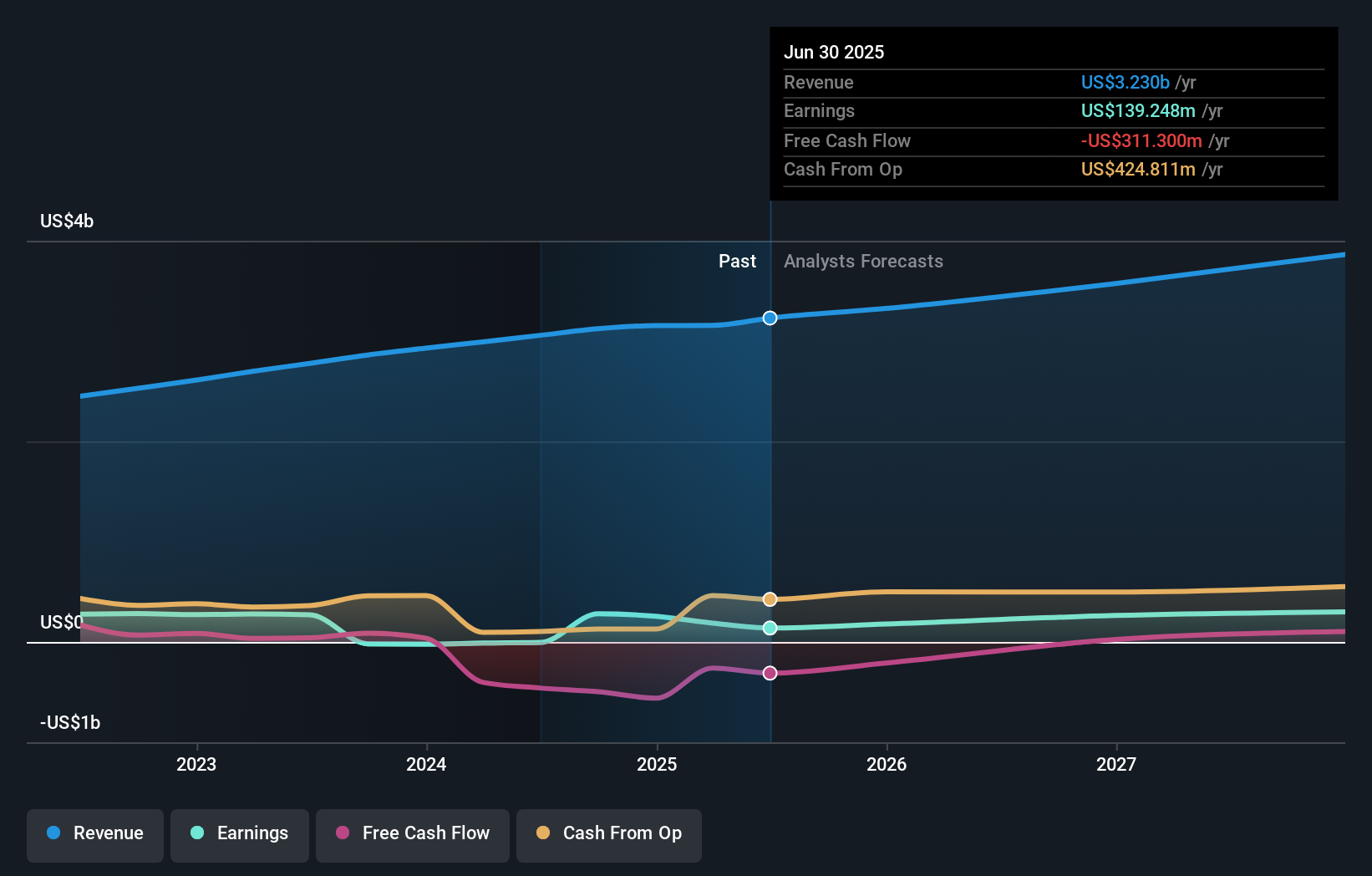

The company’s latest guidance cut, driven by an extra US$49 million of professional and general liability expense identified in a third party actuarial review, directly underpins this shift in focus toward legal risk. With analysts trimming price targets and citing higher malpractice costs and leverage concerns, what happens next around litigation outcomes and insurance terms could matter more to the story than the previously highlighted growth from new facilities or payer programs.

Yet against this long term behavioral health growth story, investors should be aware that rising patient litigation and changing insurance cover could...

Read the full narrative on Acadia Healthcare Company (it's free!)

Acadia Healthcare Company's narrative projects $4.1 billion revenue and $322.9 million earnings by 2028. This requires 8.3% yearly revenue growth and a $183.7 million earnings increase from $139.2 million today.

Uncover how Acadia Healthcare Company's forecasts yield a $25.32 fair value, a 64% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Acadia Healthcare span from US$25.32 to US$342.23 across 2 member models, showing how far apart individual views can be. Set against this optimism, the recent spike in patient related litigation costs and higher liability reserves raises important questions about future profitability that you may want to compare with several of those alternative viewpoints.

Explore 2 other fair value estimates on Acadia Healthcare Company - why the stock might be a potential multi-bagger!

Build Your Own Acadia Healthcare Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadia Healthcare Company research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Acadia Healthcare Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadia Healthcare Company's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACHC

Acadia Healthcare Company

Provides behavioral healthcare services in the United States and Puerto Rico.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026