- United States

- /

- Food

- /

- NYSE:UTZ

Utz Brands (UTZ): Assessing Whether the 42% Share Price Slide Signals a Mispriced Snack Stock

Reviewed by Simply Wall St

Utz Brands (UTZ) has quietly slipped this year, with the stock down about 42% over the past 12 months, and that drawdown has investors asking if the snack maker is now mispriced.

See our latest analysis for Utz Brands.

The selloff has been steady rather than sudden, with a 30 day share price return of minus 8.5% and a three year total shareholder return of about minus 44.6%. This signals fading momentum as investors reassess growth and margin risks around packaged snacks.

If Utz’s slide has you rethinking where growth might come from next, it could be worth scouting fast growing stocks with high insider ownership as a shortlist of companies where management is strongly aligned with shareholders.

With shares trading at a steep discount to analyst targets, yet growth and margins under pressure, the key question now is whether Utz is genuinely undervalued or if the market is already pricing in muted future gains.

Most Popular Narrative: 39.2% Undervalued

Against a last close of $9.58, the most followed narrative pegs Utz Brands’ fair value at $15.75, implying a sizeable upside if its plan delivers.

Significant supply chain optimization, including automation, plant consolidation, and productivity initiatives, is leading to sustained gross margin expansion (~6% productivity improvement), with management guiding to further margin improvements in the latter half of the year and into 2026 positively impacting EBITDA and net earnings.

Curious how modest top line growth, rising margins, and a richer future earnings multiple can still justify such a gap to today’s price? The full narrative unpacks the specific revenue trajectory, margin lift, and discount rate assumptions that drive this seemingly ambitious fair value, and how they stack up against current profitability.

Result: Fair Value of $15.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on westward expansion paying off and on Utz successfully pivoting its traditional salty lineup toward faster growing, healthier snacking trends.

Find out about the key risks to this Utz Brands narrative.

Another Angle on Value

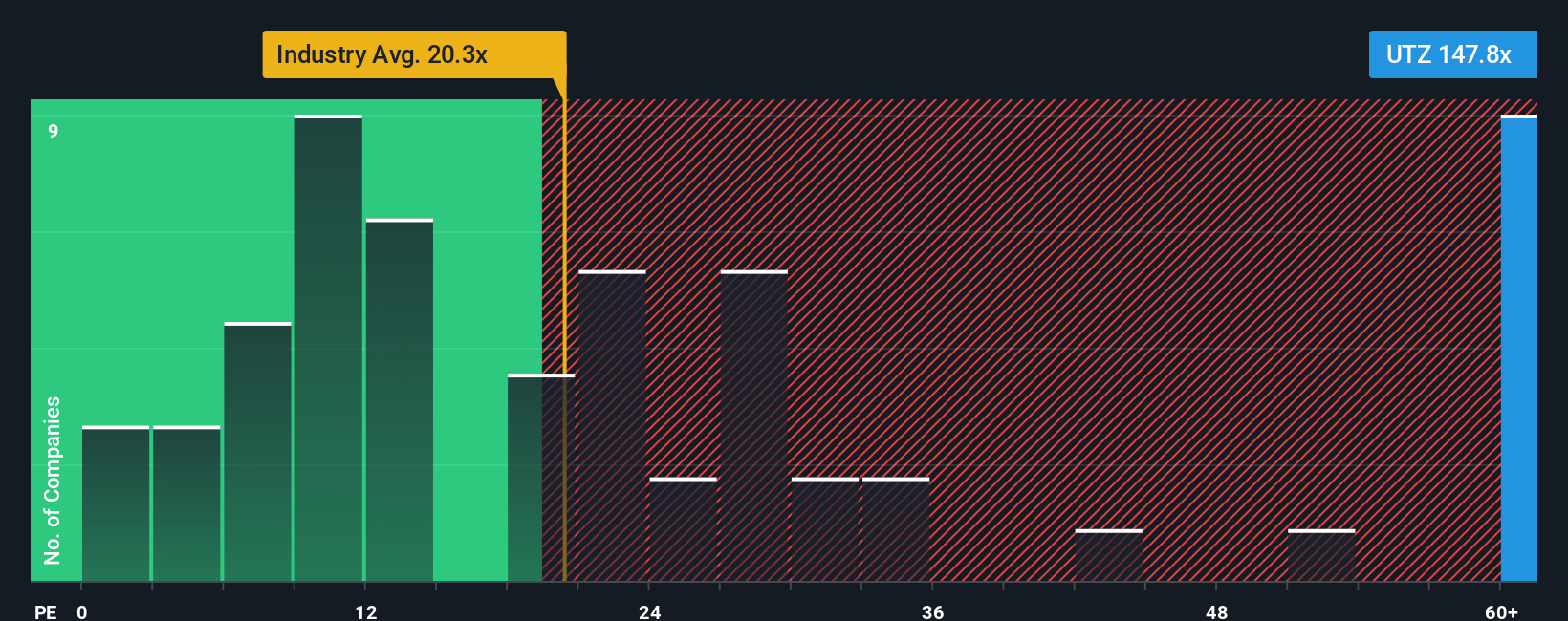

There is a catch. On a simple earnings multiple, Utz looks expensive, trading at about 147.8 times earnings versus roughly 20 times for the US Food industry and around 16 times for close peers. That lofty gap leaves less room for error if margins or growth underwhelm.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Utz Brands Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Utz Brands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one stock. Use the Simply Wall Street Screener to uncover fresh opportunities, sharpen your strategy, and avoid missing the next big move.

- Capture potential mispricings by reviewing these 906 undervalued stocks based on cash flows that strong cash flow analysis suggests the market may be overlooking.

- Ride powerful innovation trends by checking out these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Boost your income strategy by screening these 15 dividend stocks with yields > 3% that can help anchor a more resilient, yield focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTZ

Utz Brands

Engages in the manufacture, marketing, and distribution of snack food products in the United States.

Acceptable track record with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026