- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (NYSE:TSN) Elevates Leadership With Promotions Of Devin Cole And Brady Stewart

Reviewed by Simply Wall St

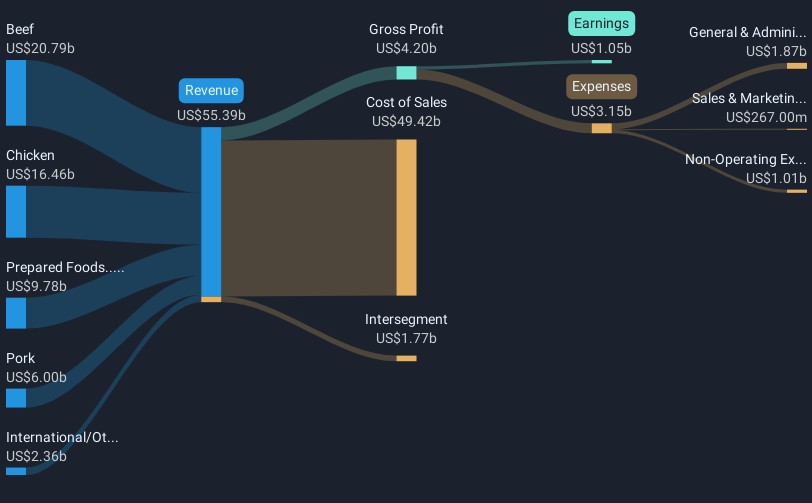

Tyson Foods (NYSE:TSN) has seen a 9% increase in its share price over the last month. Key developments during this period may have influenced this upward trend. The company announced executive promotions, with Devin Cole appointed as Group President of Poultry, and Brady Stewart expanding his role, ensuring strong leadership as Wes Morris transitions into retirement. Additionally, Tyson Foods declared a quarterly dividend and reported robust earnings for the first quarter of fiscal 2025, with net income rising significantly compared to the previous year. The broader market context, marked by a recent 3.9% decline after a year of gains and investor focus on economic and policy uncertainties, contrasts with TSN's positive performance. This indicates that the company's internal actions and financial health likely contribute to its resilience and investor confidence, setting it apart from broader market fluctuations.

Click here to discover the nuances of Tyson Foods with our detailed analytical report.

Over the past year, Tyson Foods' total shareholder return, including share price appreciation and dividends, reached 17.14%. While this performance is commendable, it slightly underperformed the broader US market, which returned 16.7% during the same period. However, when compared to the US Food industry, which saw a downturn of 2.3%, Tyson Foods significantly outperformed. A key factor contributing to this was the company's robust turnaround in profitability, transitioning from a substantial loss to a healthy net income over the financial year 2024, showcased by year-end sales hitting US$53.31 billion.

Additional elements enhancing shareholder value included a 2% increase in the quarterly dividend declared in November 2024, which reflects Tyson's commitment to returning capital to shareholders. The appointment of a new independent director in June 2024 and the suspension and replacement of the CFO at that time helped underscore a period of change aimed at leadership stability and governance within the company. Furthermore, Tyson's strategic actions took place amid industry challenges, including legal issues, which potentially shielded their overall performance from broader market pressures.

- Analyze Tyson Foods' fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for Tyson Foods in our thorough risk analysis report.

- Hold shares in Tyson Foods? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives