- United States

- /

- Food

- /

- NYSE:THS

A Fresh Look at TreeHouse Foods (THS) Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for TreeHouse Foods.

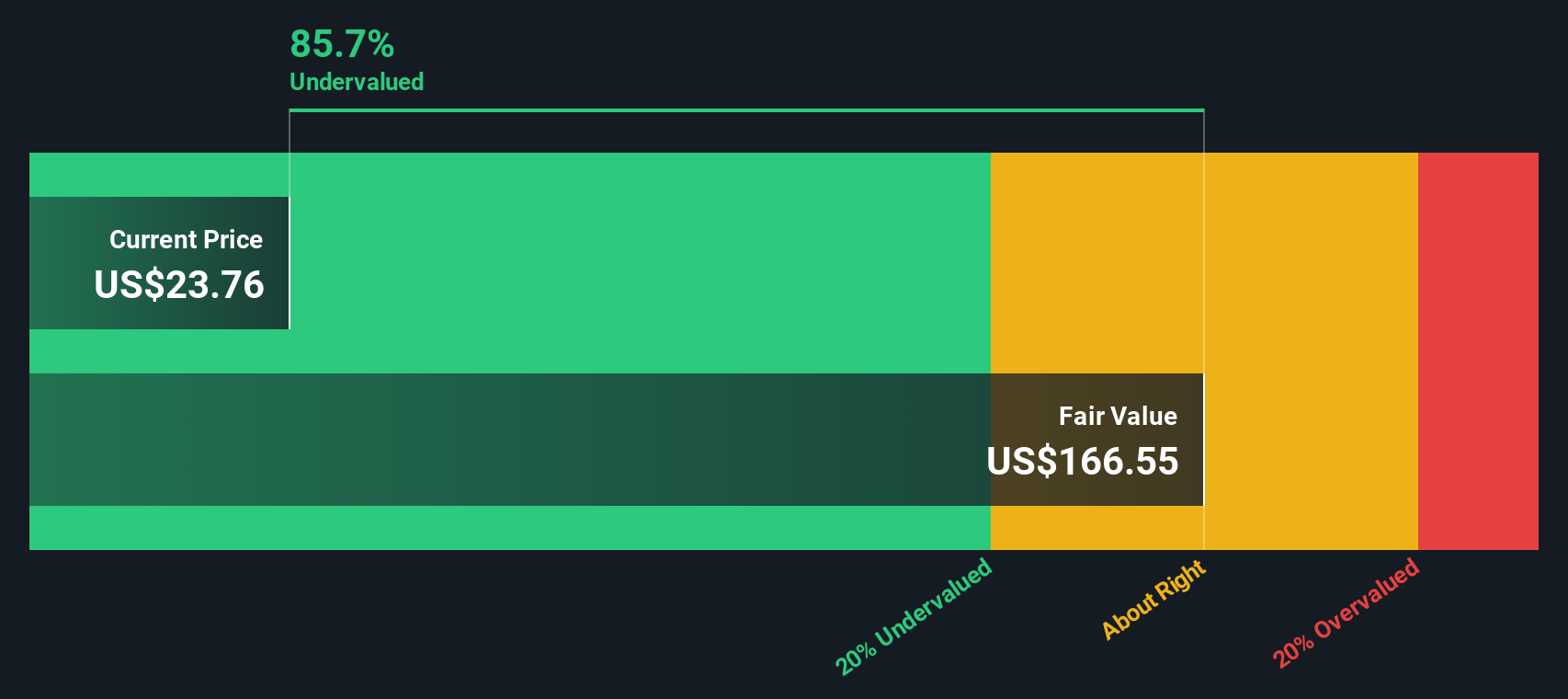

After a rough start to the year, TreeHouse Foods’ recent 1-month share price return of nearly 25% stands out, especially since its total return over the past 12 months is still down around 25%. The latest rally suggests momentum is building as investors reassess the company’s outlook. This could reflect renewed confidence in its growth prospects or a shift in risk perception.

If the market’s sudden shift towards TreeHouse Foods has you interested in what else could be gathering speed, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding sharply yet still well below last year’s levels, the question now is whether TreeHouse Foods is an undervalued opportunity or if the recent surge means the market is already factoring in future growth.

Most Popular Narrative: 10.7% Overvalued

Compared to the latest close at $23.60, the narrative places TreeHouse Foods’ fair value at $21.31. Investors are questioning if earnings momentum can keep up with these elevated expectations.

Supply chain optimization, plant closures in underperforming businesses, and margin management initiatives are structurally lowering TreeHouse's cost base and increasing operational flexibility. These efficiency gains and disciplined capital allocation are expected to strengthen EBITDA margins and translate to higher, more predictable free cash flow over the next several years.

Can operational streamlining alone support such a premium? The calculations behind this narrative hint at bold margin improvement and tightly managed financials. Curious what sort of growth trajectory justifies this target? Explore the numbers and assumptions that could change how you view TreeHouse Foods’ future.

Result: Fair Value of $21.31 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volume declines and mounting competition from branded rivals could undermine TreeHouse Foods’ margin gains, which may challenge this narrative’s optimistic earnings outlook.

Find out about the key risks to this TreeHouse Foods narrative.

Another View: How Does the SWS DCF Model Compare?

While some analysts suggest TreeHouse Foods is overvalued based on earnings expectations, our SWS DCF model offers a dramatically different perspective. The model estimates fair value at $518.91, which is far above the current share price and signals that the market could be underestimating TreeHouse's longer-term cash flow potential. Could the true value be hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TreeHouse Foods Narrative

If you have a different perspective or want to test your own assumptions, dive into the data and easily craft your own view in just minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TreeHouse Foods.

Looking for More Smart Investment Ideas?

Don’t just watch from the sidelines while others uncover tomorrow’s winners. Right now is the perfect time to get hands-on and target high-potential opportunities with the Simply Wall Street Screener.

- Unlock the potential of small but mighty stocks by checking out these 3575 penny stocks with strong financials, which have strong financial health and growth momentum.

- Capitalize on the AI boom and ride the wave of innovation by identifying standouts among these 26 AI penny stocks that are reshaping the future of technology.

- Secure your portfolio with reliable cash flow by selecting from these 862 undervalued stocks based on cash flows, which are priced well below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TreeHouse Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THS

TreeHouse Foods

Manufactures and distributes private brands snacks and beverages in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives