- United States

- /

- Beverage

- /

- NYSE:STZ

Assessing Constellation Brands Stock After Canada Boycott and Record Low U.S. Alcohol Demand

Reviewed by Bailey Pemberton

Thinking about what to do with Constellation Brands stock? You are not alone. Over the last year, investors have watched this well-known beverage giant take a turbulent ride on the market roller coaster. Shares just closed at $141.33, but that number comes after a tough stretch, including a 40.1% drop over the last twelve months and a 36.5% slide year-to-date. Even recent weeks have been lackluster, with returns of -0.6% over the last seven days and -1.1% in the last month. That is a lot of red. It begs the question: is all the negativity already baked into Constellation’s price, or is there still more risk ahead?

Some of these declines can be traced back to industry headwinds. A high-profile boycott in Canada hit U.S. alcohol sales after rising trade tensions, and consumption among U.S. adults has fallen to historic lows as health concerns make drinking less popular. These factors have clearly weighed on Constellation’s stock and shifted how investors assess its prospects for growth. Yet, with a three out of six valuation score, meaning the company is undervalued on half the key checks we look for, there are certainly some signals worth a closer look for bargain-minded investors.

Let’s dig deeper into the numbers and see which valuation tools really matter for Constellation Brands right now. And stick around, because by the end of the article, we will go beyond the usual models to reveal a smarter way to decide if this stock is truly worth your money.

Why Constellation Brands is lagging behind its peers

Approach 1: Constellation Brands Discounted Cash Flow (DCF) Analysis

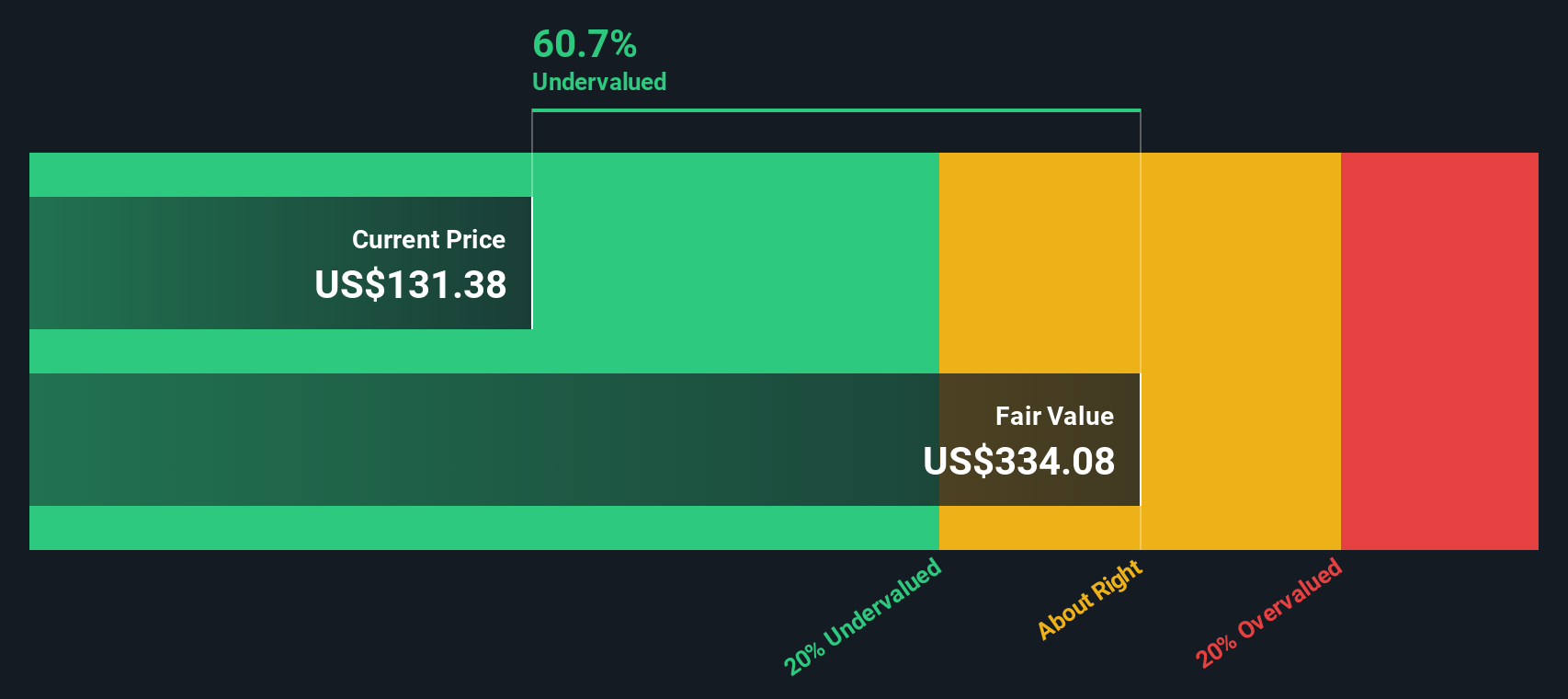

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting all its future cash flows and then discounting them back to what they're worth today. For Constellation Brands, this approach uses its Free Cash Flow (FCF) of roughly $1.63 billion as a starting point in 2024. Analysts forecast steady growth, with FCF expected to reach about $2.52 billion by 2030. The first five years of these projections are anchored in analyst estimates, and later years are calculated by extrapolation to capture long-term trends.

All figures are reported in U.S. dollars. The model used here, a Two-Stage Free Cash Flow to Equity, arrives at an intrinsic value of $334.08 per share for Constellation Brands. Compared to the current share price of $141.33, the DCF model indicates the stock trades at a steep 57.7% discount, suggesting notable undervaluation based on these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Brands is undervalued by 57.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Constellation Brands Price vs Earnings

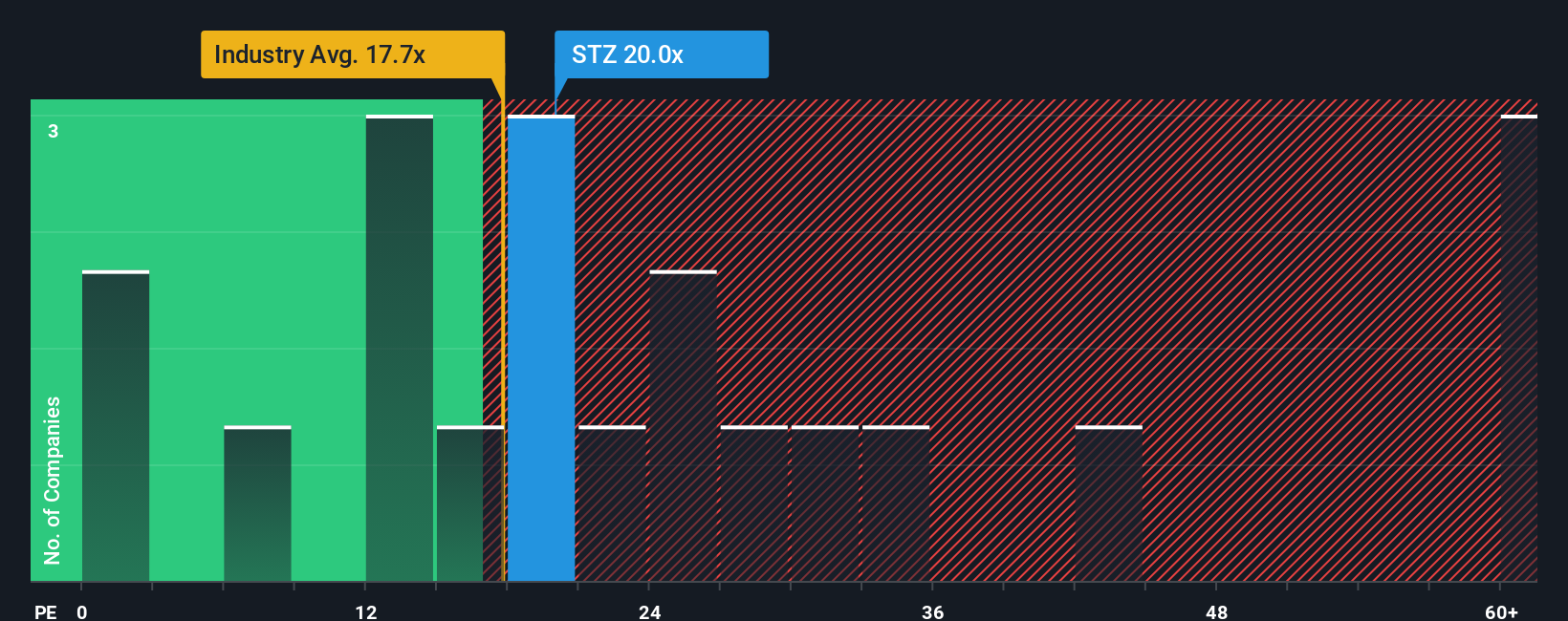

For profitable companies like Constellation Brands, the Price-to-Earnings (PE) ratio is a widely used and insightful metric. It helps investors gauge how much the market is willing to pay for a company’s earnings today, making it especially relevant when a business is generating steady profits. The “right” PE ratio depends on factors like expected future growth and the risks associated with the business. Companies with higher expected growth or lower perceived risk often command higher PE ratios, while those seen as riskier or with muted growth tend to trade at lower multiples.

Constellation Brands currently trades at a PE ratio of 20.2x. Compared to the beverage industry average of 17.6x and the peer group average of 17.5x, Constellation’s multiple is noticeably higher. Instead of stopping there, Simply Wall St’s proprietary “Fair Ratio” provides a more tailored benchmark, estimating what PE the company should reasonably command given its own combination of growth, profit margins, industry dynamics, and overall size. For Constellation Brands, the Fair Ratio stands at 22.9x.

This Fair Ratio is more comprehensive than simple peer or industry comparisons, as it weighs the company’s own risk profile and earning potential rather than relying on broad market averages. With the current PE just below the Fair Ratio, the analysis suggests Constellation Brands is undervalued on this measure and could have room to run if growth plays out as expected.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is the story behind a stock, your own perspective on a company's future, distilled into numbers like assumed fair value, expected revenue, earnings, and margins. Instead of relying only on standard models, Narratives allow you to connect Constellation Brands' business story directly to a financial forecast and then to a concrete fair value tailored to your outlook.

Narratives are fast becoming the most approachable and powerful tool for decision-making, available to millions of investors right now through the Community page on the Simply Wall St platform. This innovation helps you decide whether to buy or sell by comparing your Narrative's Fair Value with the current share price. Every Narrative is automatically updated whenever news or earnings are released, so your view is always current.

For example, when it comes to Constellation Brands, some investors believe its restructuring and brewery expansion will drive long-term growth, assigning a bullish fair value of $247 per share. Others are more cautious, focusing on declining sales or margin pressure, setting fair value as low as $123. By creating and following your own Narrative, you can decide for yourself what you think the stock is worth and invest with conviction.

Do you think there's more to the story for Constellation Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives