- United States

- /

- Food

- /

- NYSE:SJM

A Fresh Look at J. M. Smucker (SJM) Valuation as Profit Forecasts Slide Ahead of Earnings

Reviewed by Simply Wall St

J. M. Smucker (SJM) is gearing up to announce its fiscal second-quarter 2026 results, and many investors are paying attention because expectations point to a noticeable slowdown in profit from last year. Recent quarterly misses have left some shareholders evaluating the company’s near-term prospects carefully.

See our latest analysis for J. M. Smucker.

Shares of J. M. Smucker have been grinding lower this year, with a 1-year total shareholder return of -4.1% and a notable 3-year total return loss of 22.1%. Recent dividend affirmations and broader market optimism, such as the uptick in stocks following improved U.S.-China trade sentiment, have not reversed fading momentum, as the market continues to weigh the impact of softer profits and recent earnings misses.

If you’re keeping an eye on food stocks, this could also be an ideal moment to widen the search and discover fast growing stocks with high insider ownership

With analyst forecasts hinting at further profit declines but price targets suggesting upside, the question for investors is clear: Is the current dip a compelling entry point, or is the market already anticipating any recovery ahead?

Most Popular Narrative: 9.8% Undervalued

According to the most widely followed narrative, J. M. Smucker’s fair value sits noticeably above its last close price of $104.84, fueling debate over what is driving this gap. With future earnings, margin expansion, and skeptical analyst price targets at play, here is one of the core drivers behind this valuation.

Continued investments in advertising, innovation (for example, new Milk-Bone PB Bites), and category expansion, especially in growing urban, convenience, and pet segments, are positioning the portfolio to leverage both changing consumer demographics and rising demand for convenient, branded packaged foods, supporting top-line and volume growth.

Ever wonder what’s behind this premium price target? The real engine is a forecast that sees faster earnings, margin improvements, and aggressive brand investments. Which financial levers, if pulled, could justify the whole narrative? Click to find out why the market might be watching these growth signals so closely.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff headwinds and heavy reliance on price hikes in mature categories could quickly undermine margin improvements and reshape future expectations.

Find out about the key risks to this J. M. Smucker narrative.

Another View: What Do Sales Ratios Say?

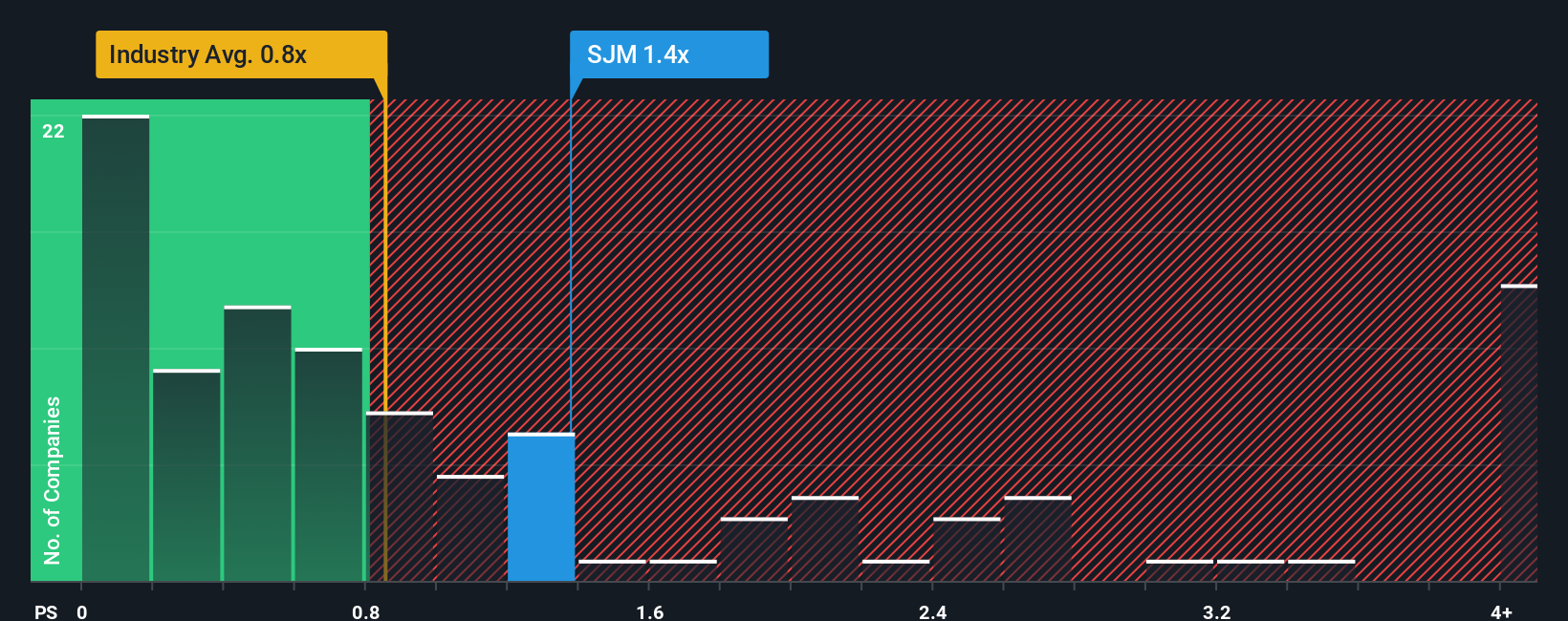

Looking at price-to-sales instead, J. M. Smucker trades on a ratio of 1.3x, which is significantly higher than both the industry average of 0.9x and the peer group average of 0.8x. Even though this matches the current fair ratio estimate, the premium suggests investors could be taking on more valuation risk if performance stalls. Is the market pricing in more upside, or could this premium narrow?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

If you have your own take or want your own analysis, you can dive into the data and build a custom narrative in just a few minutes. Do it your way

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. If you want to move ahead of the crowd, be proactive and check out these fresh stock picks now:

- Unlock the potential of untapped companies by checking out these 866 undervalued stocks based on cash flows, which are poised for returns based on solid cash flow fundamentals.

- Harness the excitement of emerging technology by spotting these 26 AI penny stocks, supported by rapid innovation and AI breakthroughs shaping tomorrow’s markets.

- Put your money to work with income in mind by evaluating these 21 dividend stocks with yields > 3%, where proven yields and stability stand out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives