- United States

- /

- Food

- /

- NYSE:POST

Is Post Holdings (POST) Trading Near-Term Interest Costs For Longer-Term Capital Flexibility?

Reviewed by Sasha Jovanovic

- Post Holdings has recently completed a private offering of US$1.30 billion 6.50% senior unsecured notes due 2036 and used the proceeds to fund the planned redemption of US$1,235.0 million 5.50% senior notes due 2029 at 101.833% of principal, plus accrued interest.

- This refinancing extends Post's debt maturity profile while increasing its interest burden, and sits alongside a new US$500 million, two-year share repurchase authorization that could reshape its capital structure.

- We’ll now examine how this higher-coupon refinancing and the new share repurchase plan interact with Post Holdings’ existing investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Post Holdings Investment Narrative Recap

To own Post Holdings, you need to believe its packaged food portfolio can offset volume pressure in cereal and pet food while margin initiatives and disciplined capital allocation support earnings. The 6.50% 2036 notes increase interest costs but materially extend maturities; in the near term, the key catalyst remains execution on cost optimization, while high leverage and weaker interest coverage stay the biggest watchpoints for shareholders.

The new US$500 million, two year share repurchase authorization now sits beside higher coupon long term debt, tightening the focus on Post’s balance sheet discipline. How actively management uses this buyback program, given elevated leverage and ongoing buybacks in recent quarters, will be important context for investors weighing the company’s acquisition driven growth and earnings stability story.

Yet investors should also be aware that higher leverage and increased interest costs could constrain Post’s flexibility if...

Read the full narrative on Post Holdings (it's free!)

Post Holdings' narrative projects $9.2 billion revenue and $537.3 million earnings by 2028. This requires 5.2% yearly revenue growth and about a $171 million earnings increase from $366.3 million today.

Uncover how Post Holdings' forecasts yield a $123.22 fair value, a 28% upside to its current price.

Exploring Other Perspectives

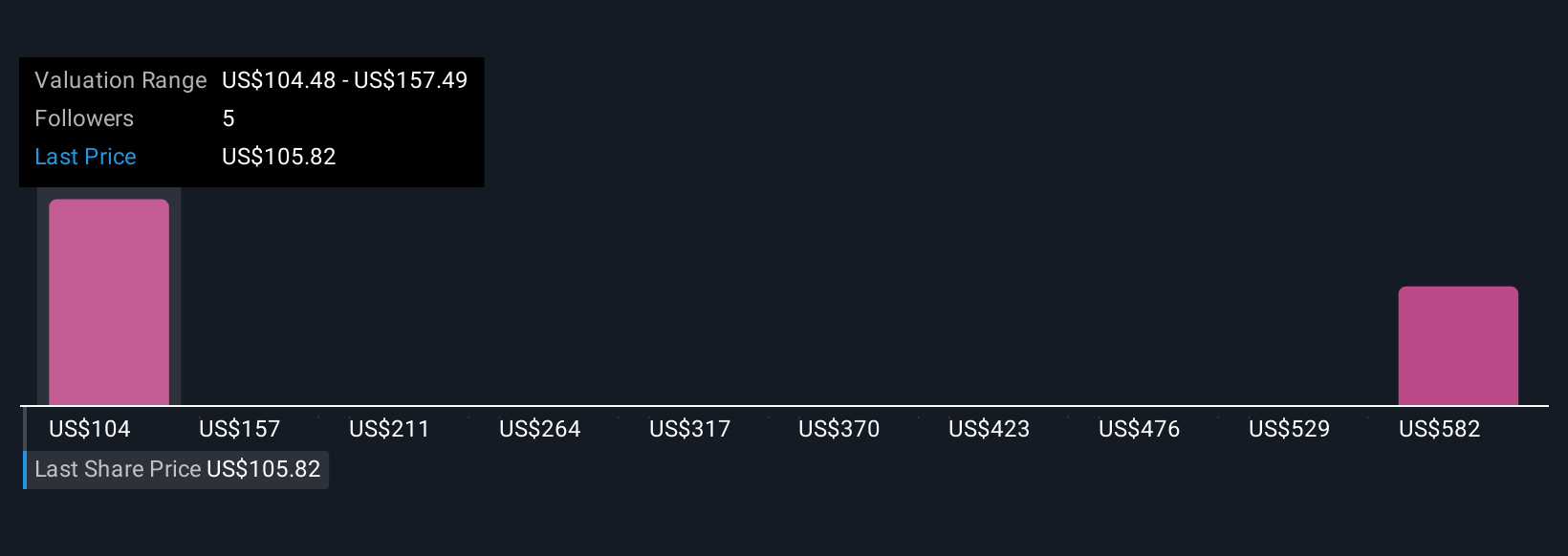

Four members of the Simply Wall St Community currently see Post’s fair value between US$104 and about US$619 per share, showing just how far views can stretch. Against that wide range, the company’s heavier interest burden and already high leverage highlight why it can help to examine several different risk focused viewpoints before deciding how Post fits in your portfolio.

Explore 4 other fair value estimates on Post Holdings - why the stock might be worth just $104.48!

Build Your Own Post Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Post Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Post Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Post Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POST

Post Holdings

Operates as a consumer packaged goods holding company in the United States and internationally.

Very undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026