- United States

- /

- Tobacco

- /

- NYSE:PM

Will Philip Morris (PM)’s New Management Structure Accelerate Its Smoke-Free Transformation?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Philip Morris International’s Board of Directors approved a major restructuring, appointing Frederic de Wilde as CEO PMI International and outlining new executive roles as part of a new organizational model effective January 1, 2026.

- This restructuring introduces two primary business units, PMI International and PMI U.S., and aims to heighten agility as the company accelerates its transition towards a smoke-free portfolio under the leadership of Group CEO Jacek Olczak.

- We'll examine how the creation of dedicated U.S. and international smoke-free units could reshape Philip Morris International's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Philip Morris International Investment Narrative Recap

To own Philip Morris International shares today, you need confidence in the company’s ability to accelerate its shift toward a smoke-free portfolio, driven largely by the strength of its IQOS, ZYN, and related reduced-risk platforms. The recent restructuring into dedicated U.S. and international smoke-free units is strategically significant but is not expected to materially alter the most important short-term catalyst: continued high-margin growth in smoke-free products. However, regulatory and tax risks, particularly in the EU, remain the most pressing threats to the business, as they can directly impact margins and sales volume.

Among PMI's recent announcements, the US$37 million investment in its Wilson, North Carolina facility stands out, underscoring the company’s push to scale up smoke-free product operations. This expansion of IQOS ILUMA production capabilities is strongly linked to the central growth catalyst for PMI, reinforcing the company's intent to capture rapid demand and expand its U.S. smoke-free market share in tandem with its organizational changes.

In contrast, some investors might underestimate the persistent threat from illicit tobacco trade in key regions, an ongoing risk that can erode legitimate market share and is information shareholders should...

Read the full narrative on Philip Morris International (it's free!)

Philip Morris International's outlook anticipates $49.4 billion in revenue and $14.5 billion in earnings by 2028. This is based on an expected 8.2% annual revenue growth and a $6.3 billion increase in earnings from the current level of $8.2 billion.

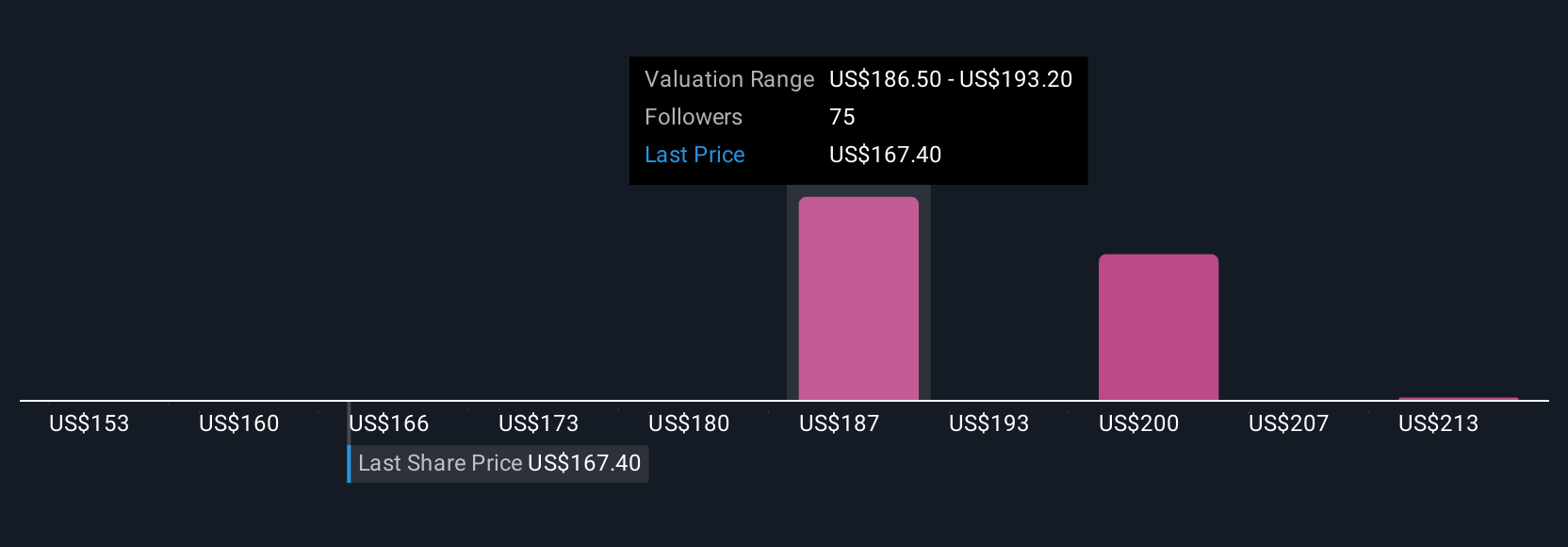

Uncover how Philip Morris International's forecasts yield a $185.44 fair value, a 18% upside to its current price.

Exploring Other Perspectives

While the consensus outlook focuses on regulatory headwinds and slower growth, the most optimistic analysts expect revenues to reach US$53,200 million and earnings US$15,700 million by 2028. Their projections hinge on even stronger smoke-free adoption and emerging market gains. As opinion varies widely, consider multiple viewpoints and how new developments could shift these forecasts.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth just $153.00!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives