- United States

- /

- Tobacco

- /

- NYSE:MO

Should Investors Rethink Altria After Stock Surge and Strong 2025 Outlook?

Reviewed by Bailey Pemberton

Trying to decide if Altria Group’s stock fits in your portfolio right now? You are definitely not alone. It is a name on a lot of people’s radars, and for good reason. Recently, the stock has seen a slight bump over the past week, up 0.1% since last Friday. That is not a fireworks show, but zoom out and you can spot a serious upward trend. Over the last five years, shareholders have enjoyed a massive 140.4% gain, with 41.3% of that just in the past year. The year-to-date performance stands out too, up 25.2%, suggesting investors are warming up to both the company’s prospects and its overall risk profile. Even after a slight 1.2% slip over the past month, Altria is still up handsomely over the long run, outpacing many consumer staples and signaling real momentum behind the brand.

Now, what about valuation? Are those gains justified or is the stock getting ahead of itself? According to a classic set of six valuation checks, Altria scores a solid 5 out of 6, flagging it as undervalued according to most measures. That is an impressive score, especially for a high-profile company in a mature sector where upside is not a given. So, how exactly is this valuation score built, and what does it really say about Altria’s investment case? Let’s walk through the different approaches used to value the company. Stick around, because after the classic checks, we will reveal a smarter, more holistic way to judge what Altria is really worth.

Why Altria Group is lagging behind its peers

Approach 1: Altria Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting them back to reflect what they are worth today. It is a tried and true way to get a sense of whether a stock price is justified based on a company’s ability to generate real, tangible cash over time.

For Altria Group, the latest twelve-month free cash flow sits at $8.7 billion. Analyst estimates suggest this will continue to grow, with projections reaching $9.95 billion by 2029. Since analysts typically forecast up to five years, projections beyond that are extrapolated based on recent trends and growth assumptions. For the next decade, Simply Wall St’s model expects free cash flows to keep climbing, albeit at a measured pace as Altria operates in a mature industry with steady cash generation.

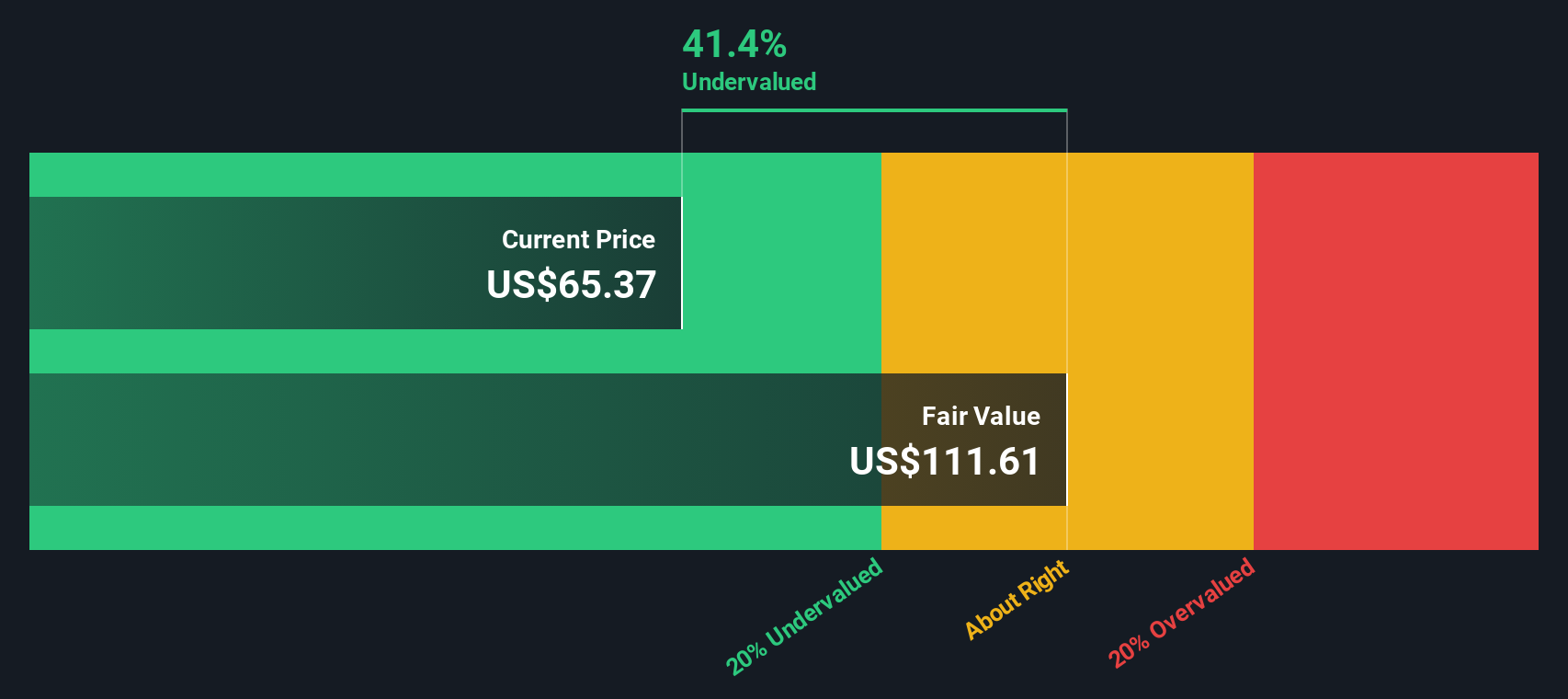

Using this DCF approach, the intrinsic value of Altria’s shares is estimated at $111.62. When compared to its current share price, this suggests the stock is trading at a steep 41.1% discount. In other words, based on cash flow fundamentals alone, the market appears to be offering Altria shares at a significant bargain right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Altria Group is undervalued by 41.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Altria Group Price vs Earnings (P/E)

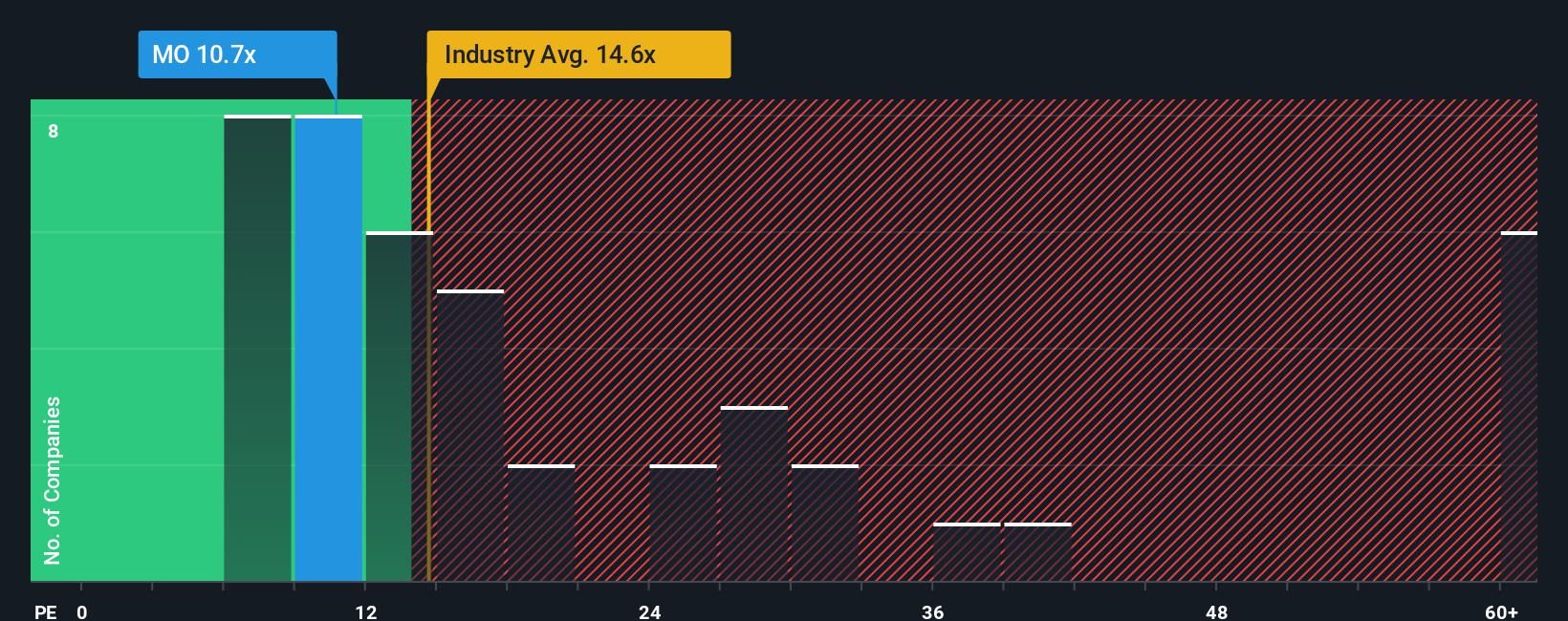

The price-to-earnings (P/E) ratio is one of the most widely used approaches for valuing established, profitable companies like Altria Group. It provides a straightforward way to gauge how much investors are willing to pay for each dollar of earnings. Generally, a higher expected growth rate and lower risk will justify a higher P/E ratio, while slower growth or higher risk could mean a lower “normal” or “fair” P/E multiple.

Currently, Altria trades at a P/E ratio of 12.6x. This is noticeably below both its peer average of 21.4x and the broader tobacco industry average of 14.9x. At first glance, this discount might suggest Altria is undervalued compared to similar companies, but context is key here.

Simply Wall St’s “Fair Ratio” helps bring that context. This proprietary metric predicts the most fitting multiple for Altria, factoring in not only earnings growth and profit margins, but also its industry, size, and risk profile. For Altria, the Fair Ratio is estimated at 20.0x, a figure that recognizes the balance of solid, steady earnings and the unique risks the tobacco sector faces. This tailored benchmark is more meaningful than a simple peer or industry comparison, as it adjusts for company-specific strengths and headwinds.

Because Altria’s actual multiple is well below this fair estimate, it suggests the stock is undervalued by this metric, not just in relative terms but even when adjusting for all the nuances that matter.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Altria Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives bring your investment decisions to life by connecting a company’s unique story, your perspective on its market, risks, and growth opportunities, to the numbers behind a fair value calculation, like estimates for future revenue, earnings, and margins.

With Narratives, you can create a clear, personalized outlook: define the business trends you believe will shape Altria’s future, feed your assumptions into the platform, and instantly generate forecasts and fair value estimates. Narratives take the numbers from static models and make them dynamic and actionable, updating automatically when new information such as company news or earnings emerges.

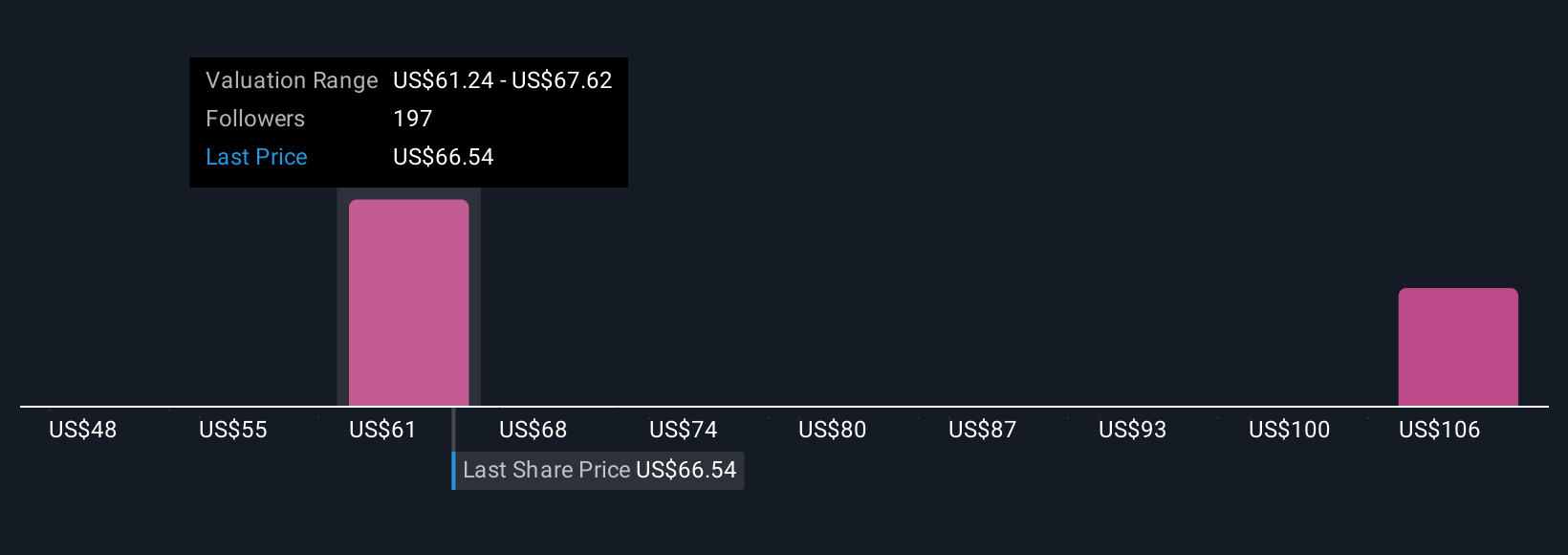

The best part is that Narratives are built into Simply Wall St’s Community page, making it easy for anyone to see, build, or challenge investment stories used by millions of investors. By comparing your fair value to Altria’s current price, you’ll know when your story suggests it is time to buy, hold, or sell. For example, some investors believe regulatory setbacks will limit Altria’s earnings and set a cautious price target of $49, while others are more optimistic, pointing to strong brand resilience and recent dividend growth as reasons for a bullish $73 target.

Do you think there's more to the story for Altria Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives