- United States

- /

- Food

- /

- NYSE:LOCL

Insiders of Local Bounti Getting Good Value On Their US$3.59m Investment

Insiders who bought Local Bounti Corporation (NYSE:LOCL) stock in the last 12 months were richly rewarded last week. The company's market value increased by US$9.8m as a result of the stock's 19% gain over the same period. In other words, the original US$3.59m purchase is now worth US$4.94m.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Local Bounti Insider Transactions Over The Last Year

The Independent Director Charles Schwab made the biggest insider purchase in the last 12 months. That single transaction was for US$3.4m worth of shares at a price of US$2.00 each. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of US$2.74. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

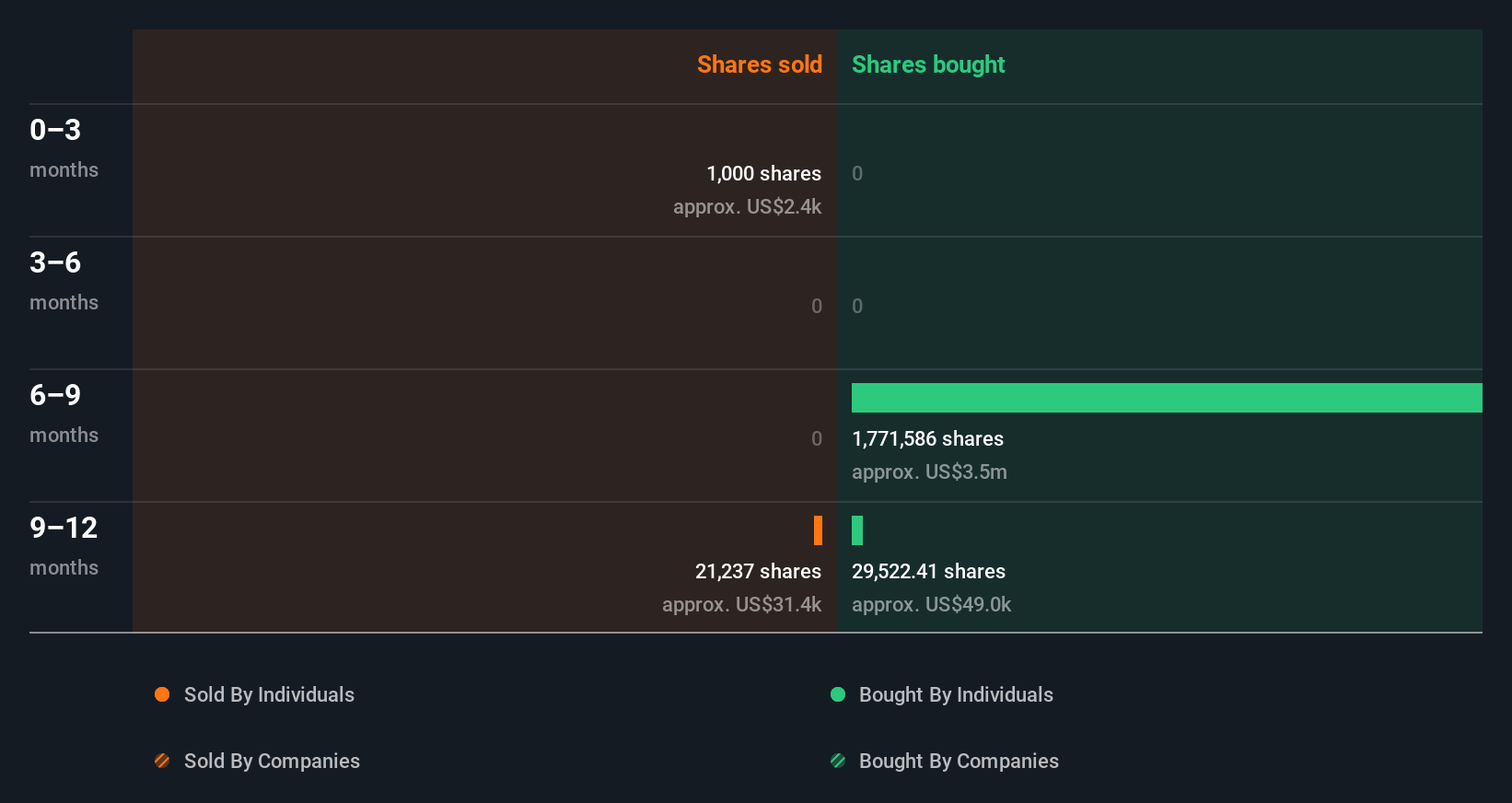

Over the last year, we can see that insiders have bought 1.80m shares worth US$3.6m. But insiders sold 22.24k shares worth US$34k. In the last twelve months there was more buying than selling by Local Bounti insiders. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for Local Bounti

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Are Local Bounti Insiders Buying Or Selling?

In the last three months company Lead Independent Director Matthew Nordby divested US$2.4k worth of stock. That is not a lot. Ultimately the overall selling isn't enough to tell us much.

Insider Ownership Of Local Bounti

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Local Bounti insiders own about US$48m worth of shares (which is 79% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Local Bounti Tell Us?

While there has not been any insider buying in the last three months, there has been selling. However, the sales are not big enough to concern us at all. On a brighter note, the transactions over the last year are encouraging. It would be great to see more insider buying, but overall it seems like Local Bounti insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. At Simply Wall St, we've found that Local Bounti has 6 warning signs (4 are a bit unpleasant!) that deserve your attention before going any further with your analysis.

But note: Local Bounti may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LOCL

Medium-low risk with weak fundamentals.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026