- United States

- /

- Food

- /

- NYSE:K

Has Kellanova’s Momentum and New Product Launches Created a Valuation Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Kellanova is a smart buy right now? Let’s dig into what the numbers and recent events are saying about its value in today’s market.

- The stock has steadily climbed, posting a 5.8% return over the past 12 months and gaining 41.7% over three years. This momentum has captured investors’ attention.

- Recently, Kellanova has made headlines with new product launches and strategic partnerships, supporting optimism around future growth. These moves have also influenced how the market perceives the risk and opportunity in the stock.

- On our value checks, Kellanova scores a 2 out of 6, highlighting that most conventional metrics do not suggest undervaluation, at least so far. Let’s break down what the main valuation methods say and reveal a smarter way to assess whether Kellanova really is worth your attention before we wrap up.

Kellanova scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kellanova Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting them back to today’s dollars. In essence, it shows what the company is really worth if you consider all the cash it’s expected to generate over time.

For Kellanova, analysts estimate the company generated $594.5 million in Free Cash Flow (FCF) last year. They project this figure to grow steadily, with analyst consensus reaching $1.27 billion by 2027. Beyond this, forecasts are extended based on conservative growth rates. By 2035, projected FCF could top $1.65 billion. All projections are calculated in United States Dollars ($).

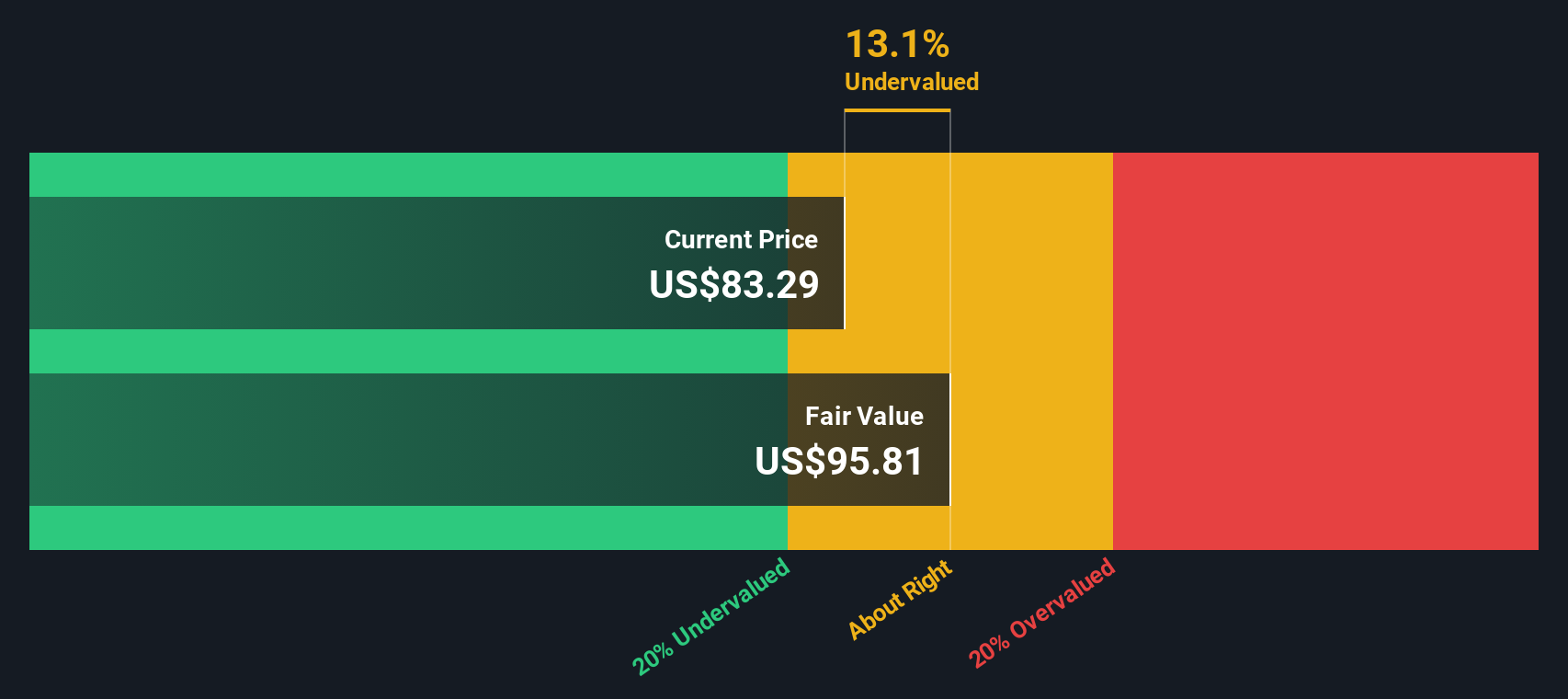

Crunching these numbers through the DCF method, we arrive at an estimated intrinsic value of $95.81 per share. With the current share price reflecting a 13.0% discount to this value, the stock appears undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kellanova is undervalued by 13.0%. Track this in your watchlist or portfolio, or discover 855 more undervalued stocks based on cash flows.

Approach 2: Kellanova Price vs Earnings

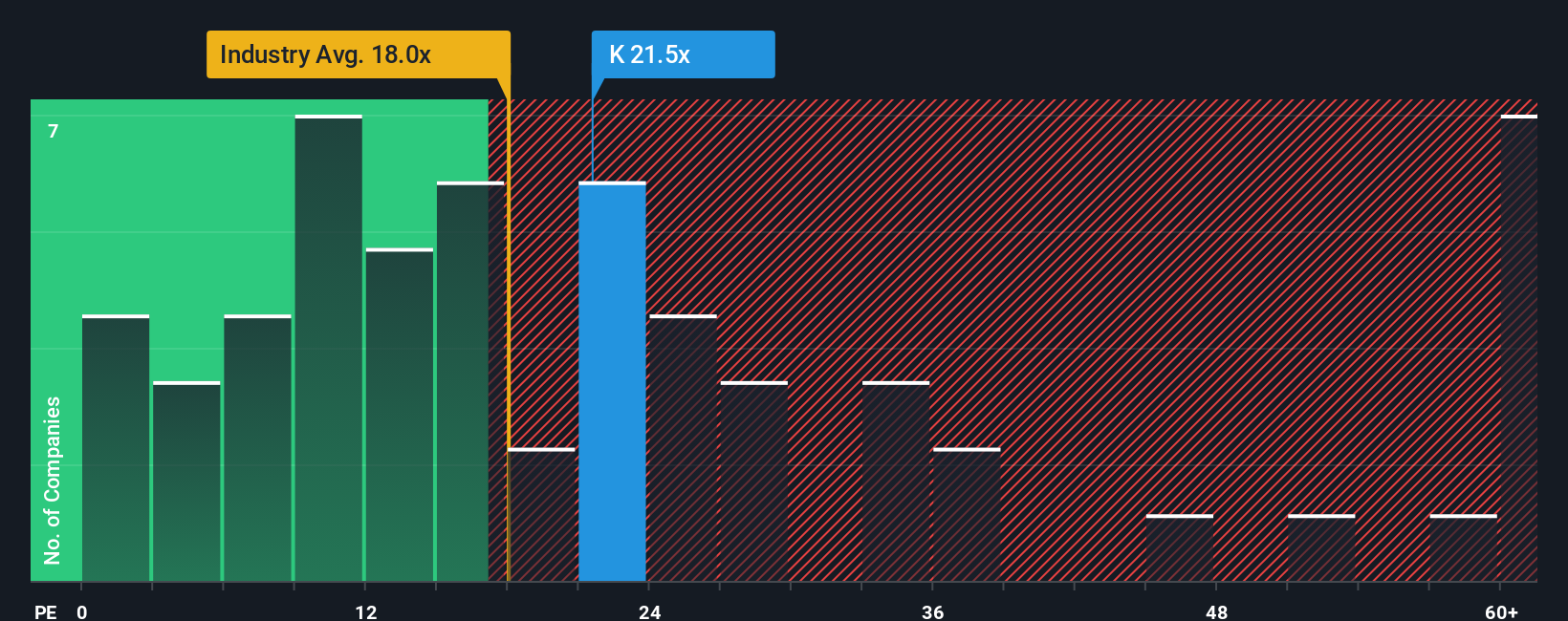

The Price-to-Earnings (PE) ratio is a trusted metric for valuing profitable companies like Kellanova because it compares a company’s current share price to its earnings per share. This ratio makes it easy to see how much investors are willing to pay for each dollar of profits. It is a quick way to gauge if a stock is reasonably priced, especially when those profits are strong and growing.

When considering a “normal” or “fair” PE ratio, it is important to remember that growth expectations and risk play a big part. Fast-growing or less risky companies usually have higher PE ratios, while slower-growing or riskier businesses tend to see lower ones.

Right now, Kellanova trades at a PE of 22.7x. This is a bit above the food industry average of 18.3x, but just below the average for its listed peers at 24.6x. Simply Wall St’s proprietary “Fair Ratio” is 16.5x. The Fair Ratio is designed to go beyond just looking at industry or peer comparisons by factoring in Kellanova’s specific strength in earnings growth, profit margins, market cap, and its unique risk profile. This makes it a more personalized and holistic benchmark for valuation, especially when companies do not fit neatly into an industry average.

Given that Kellanova’s PE is noticeably higher than its Fair Ratio, this suggests investors are paying a premium and the company may be overvalued relative to what its fundamentals justify right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1371 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kellanova Narrative

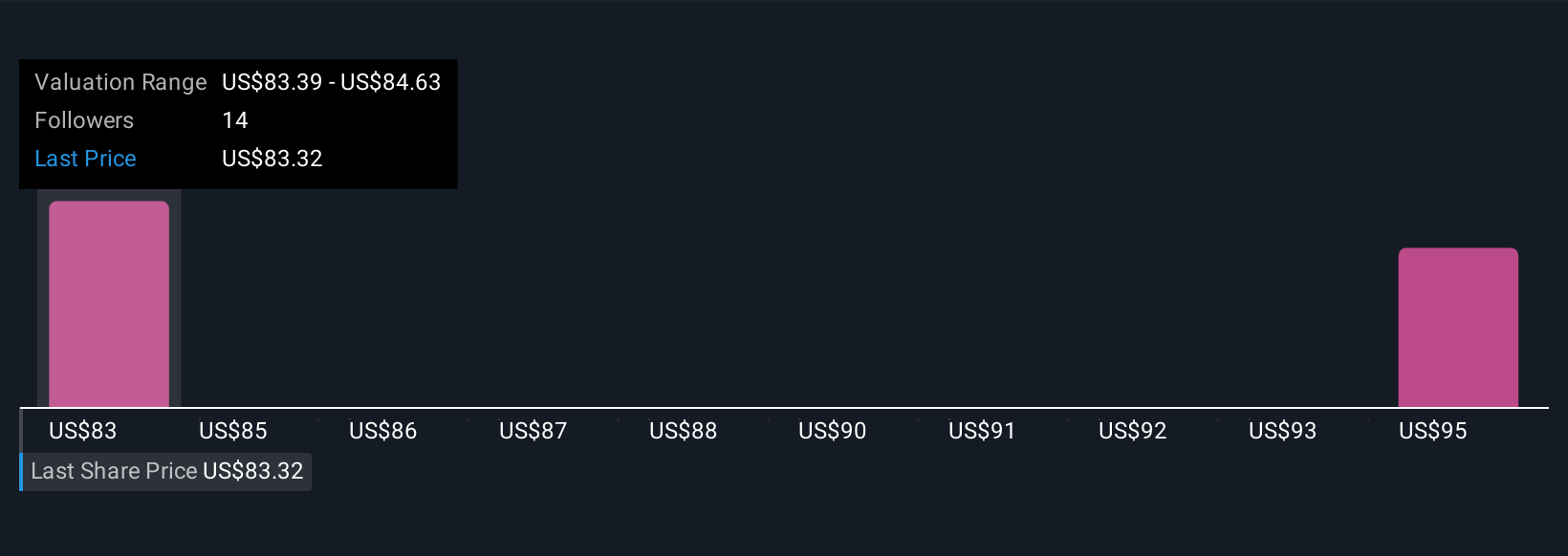

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story of the company—how you see its future, including your personal assumptions about growth, profits, margins, and what Kellanova’s business might achieve next. Narratives connect the dots between your view of Kellanova’s prospects, the numbers you believe in, and what you believe the shares should be worth today.

This approach is easy to use, available on the Simply Wall St Community page used by millions, and lets you generate a fair value for Kellanova based on your own forecasts. The best part is that Narratives update automatically as new information comes out, whether it is the latest product launch, quarterly results, or significant news, so your view always reflects the latest facts. Narratives bring a powerful advantage by showing whether you think Kellanova’s price is attractive to buy or signals it is time to sell, all by comparing the fair value your story generates with the market price.

For example, one investor could be optimistic, expecting rapid sales growth from new global snack launches and see fair value above $95, while another could see more risk and set fair value at $79, letting each Narrative help decide if and when to act.

Do you think there's more to the story for Kellanova? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives