- United States

- /

- Beverage

- /

- NYSE:BF.B

Brown‑Forman (BF.B) Margin Compression Reinforces Bearish Profitability Narratives After Q2 2026 Results

Reviewed by Simply Wall St

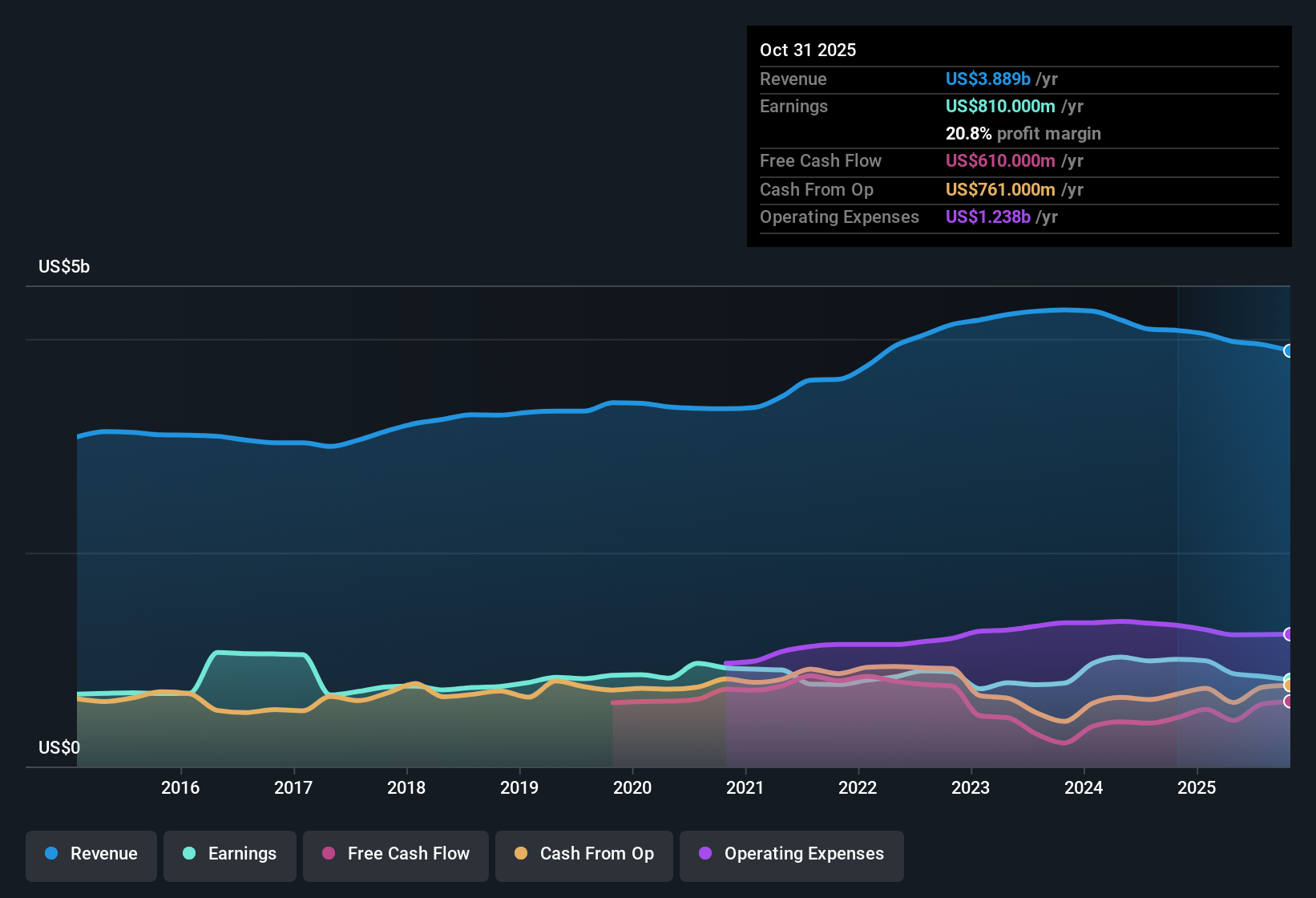

Brown Forman (BF.B) has just posted Q2 2026 results showing revenue of $1.0 billion and basic EPS of $0.47, backed by net income of $224 million as the spirits maker works through a period of softer margins. The company has seen quarterly revenue move from $1.1 billion in Q2 2025 to $1.0 billion in Q2 2026, with basic EPS shifting from $0.55 a year ago to $0.47 this quarter, while trailing twelve month net income came in at $810 million on revenue of $3.9 billion. Against a backdrop of lower net profit margins and a still solid earnings base, investors may view this print as a balance between steady cash generation and pressure on profitability that will need to stabilize.

See our full analysis for Brown-Forman.With the numbers on the table, the next step is to compare this earnings profile with the most common market narratives around Brown Forman to see which stories hold up and which ones the latest margin trends start to challenge.

See what the community is saying about Brown-Forman

Margins Under Pressure at 20.8%

- Trailing net profit margin sits at 20.8%, down from 24.6% a year ago, alongside trailing 12 month net income easing from $1.0 billion to $810 million and revenue moving from $4.1 billion to $3.9 billion.

- Critics highlight that softer profitability could signal demand or pricing pressures in mature markets, and the margin slippage lines up with those worries.

- The decline in net margin from 24.6% to 20.8% and the step down in trailing net income from $1.0 billion to $810 million both echo concerns about slower developed market performance.

- At the same time, revenue only slipped modestly from about $4.1 billion to $3.9 billion, which suggests costs and mix are doing more damage to margins than top line volume alone.

Steady but Modest Growth Outlook

- Analysts expect earnings to grow roughly 4.9% per year and revenue about 2.8% annually, with EPS projected to reach $1.91 and earnings $870 million by around 2028, compared with today’s $810 million trailing net income.

- The analysts' consensus view sees premiumization and international expansion supporting this mid single digit growth, but the recent slip in margins shows the path may not be smooth.

- Forecast earnings of $870 million versus the current $810 million are consistent with a gradual build, not a rapid rebound from the trailing net margin drop from 24.6% to 20.8%.

- Expected revenue of about $4.1 billion in a few years is broadly in line with the recent trailing 12 month range around $3.9 billion to $4.1 billion, which fits with a slow and steady rather than high growth trajectory.

Valuation and Dividend Offset Margin Strain

- At a share price of $30.40, Brown Forman trades on a 17.4 times P/E, below peers at 21.6 times and slightly under the industry at 17.5 times, with a 3.04% dividend yield and a DCF fair value of about $42.90 indicating a sizable valuation gap.

- Consensus narrative notes that premium and super premium brands plus international growth could justify this discount narrowing if margins stabilize, and today’s numbers partly support that optimistic angle.

- The combination of a 3.04% dividend yield and earnings forecast to grow around 4.9% annually gives income investors a tangible return profile while they wait for profitability to improve from the current 20.8% net margin.

- The share trading about 29.1% below the DCF fair value of $42.90 and at a P/E below peers contrasts with the still strong trailing 12 month earnings base of $810 million, which bolsters the bullish view that valuation is compensating for near term margin pressure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Brown-Forman on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light and think the story should read another way? Capture that view in a few minutes: Do it your way.

A great starting point for your Brown-Forman research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Brown Forman's slipping margins, only modest growth outlook, and need for profitability to stabilize suggest its future returns may be steadier rather than exciting.

If that leaves you wanting more reliable expansion, use our stable growth stocks screener (2088 results) to quickly focus on companies already proving they can compound revenue and earnings consistently through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown-Forman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BF.B

Brown-Forman

Manufactures, distills, bottles, imports, exports, markets, and sells a variety of alcohol beverages.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026