- United States

- /

- Food

- /

- NasdaqCM:VFF

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As U.S. markets experience a mixed performance with the S&P 500 and Nasdaq Composite recently hitting record highs but facing resistance, investors are keenly watching for opportunities that might offer substantial returns. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. For those looking to invest in smaller or newer companies, penny stocks can offer surprising value when built on solid financial foundations, potentially leading to significant returns while offering greater stability.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.807 | $6.3M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.58 | $1.89B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $153.34M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $49.83M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.879 | $79.96M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.7413 | $13.25M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.94 | $422.84M | ★★★★☆☆ |

Click here to see the full list of 707 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Village Farms International (NasdaqCM:VFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Village Farms International, Inc. and its subsidiaries focus on producing, marketing, and selling greenhouse-grown tomatoes, bell peppers, and cucumbers in North America with a market cap of $89.05 million.

Operations: The company generates revenue from its Canadian cannabis segment with $146.70 million, U.S. cannabis operations contributing $17.84 million, and its VF Fresh produce division bringing in $163.00 million.

Market Cap: $89.05M

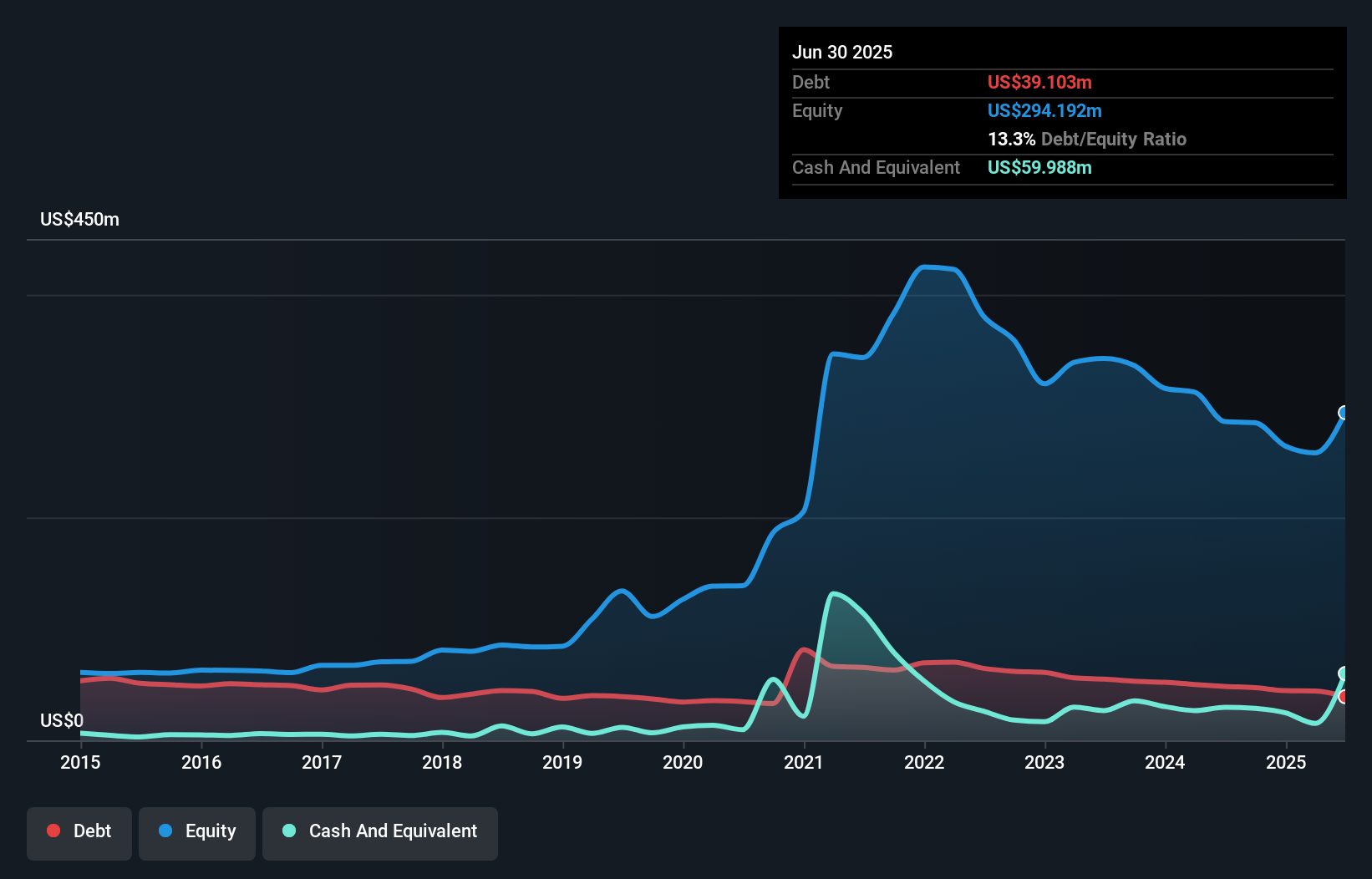

Village Farms International, Inc. faces challenges typical of penny stocks, including recent non-compliance with Nasdaq's minimum bid price requirement. Despite generating substantial revenue from its Canadian and U.S. cannabis operations and VF Fresh produce division, the company remains unprofitable with a net loss of US$27.22 million for the first nine months of 2024. Its management team is relatively new, averaging 1.3 years in tenure, but the board brings extensive experience with an average tenure of 15.8 years. The company's short-term assets exceed both its short- and long-term liabilities, providing some financial stability amidst volatility concerns.

- Click here to discover the nuances of Village Farms International with our detailed analytical financial health report.

- Understand Village Farms International's earnings outlook by examining our growth report.

Huize Holding (NasdaqGM:HUIZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huize Holding Limited operates an online insurance product and service platform in the People’s Republic of China, with a market cap of $60.11 million.

Operations: The company's revenue is derived from its insurance brokerage services, totaling CN¥1.12 billion.

Market Cap: $60.11M

Huize Holding Limited, with a market cap of US$60.11 million, operates an online insurance platform in China and recently executed a 1:5 stock split. The company reported revenues of CN¥282.95 million for Q2 2024, down from the previous year, alongside a net loss of CN¥23.35 million. Despite negative earnings growth over the past year and increased share price volatility, Huize maintains financial stability with short-term assets exceeding liabilities and more cash than total debt. Its management team is seasoned with an average tenure of 6.2 years, while its debt-to-equity ratio has improved significantly over five years.

- Jump into the full analysis health report here for a deeper understanding of Huize Holding.

- Examine Huize Holding's earnings growth report to understand how analysts expect it to perform.

2seventy bio (NasdaqGS:TSVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 2seventy bio, Inc. is a cell and gene therapy company dedicated to researching, developing, and commercializing cancer treatments in the United States, with a market cap of $202.74 million.

Operations: The company's revenue is derived entirely from its biotechnology segment, amounting to $45.62 million.

Market Cap: $202.74M

2seventy bio, Inc., with a market cap of US$202.74 million, focuses on developing cancer therapies and reported Q3 2024 revenue of US$13.53 million, up from the previous year. Despite being unprofitable, it reduced its net loss significantly to US$9.93 million from US$71.64 million a year ago and has not diluted shareholders recently. The company is debt-free with short-term assets exceeding liabilities but faces challenges covering long-term liabilities with available assets. While its board and management team are relatively new, it maintains a stable cash runway for over a year based on current free cash flow trends.

- Get an in-depth perspective on 2seventy bio's performance by reading our balance sheet health report here.

- Gain insights into 2seventy bio's future direction by reviewing our growth report.

Seize The Opportunity

- Gain an insight into the universe of 707 US Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and sells greenhouse-grown tomatoes, bell peppers, and cucumbers in North America.

Undervalued with excellent balance sheet.