- United States

- /

- Food

- /

- NasdaqCM:SMPL

Has Simply Good Foods Stock Fallen Too Far for Its Valuation in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Simply Good Foods is trading at a discount or premium? You're not alone. Getting the valuation right can make a significant difference in your returns.

- Despite a slight uptick of 0.2% over the past month, the stock has experienced a considerable decline year-to-date, down nearly 50%.

- Investor sentiment has been shifting recently, partly due to broader conversations about changing consumer eating habits and evolving strategies in the food and beverage sector. News of increased competition from new product launches and changing health trends has provided additional context to the recent price movements.

- Simply Good Foods currently scores a 5 out of 6 on our undervaluation checks, which is notable. Next, we'll explain how analysts approach this valuation and introduce a method that could offer even deeper insight, so stay tuned.

Find out why Simply Good Foods's -50.4% return over the last year is lagging behind its peers.

Approach 1: Simply Good Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation estimates what a company is worth today by projecting its future cash flows and then discounting those values to the present using a required rate of return. This approach is especially useful for businesses like Simply Good Foods, where cash generation is consistent and forecastable.

According to recent DCF modeling using a 2 Stage Free Cash Flow to Equity method, Simply Good Foods currently generates free cash flow (FCF) of $163.6 Million. Analyst forecasts project FCF will grow steadily in the coming years, reaching approximately $240 Million by 2030. While analysts directly estimate cash flows only for the next five years, Simply Wall St extrapolates values beyond that point to build a complete 10-year view.

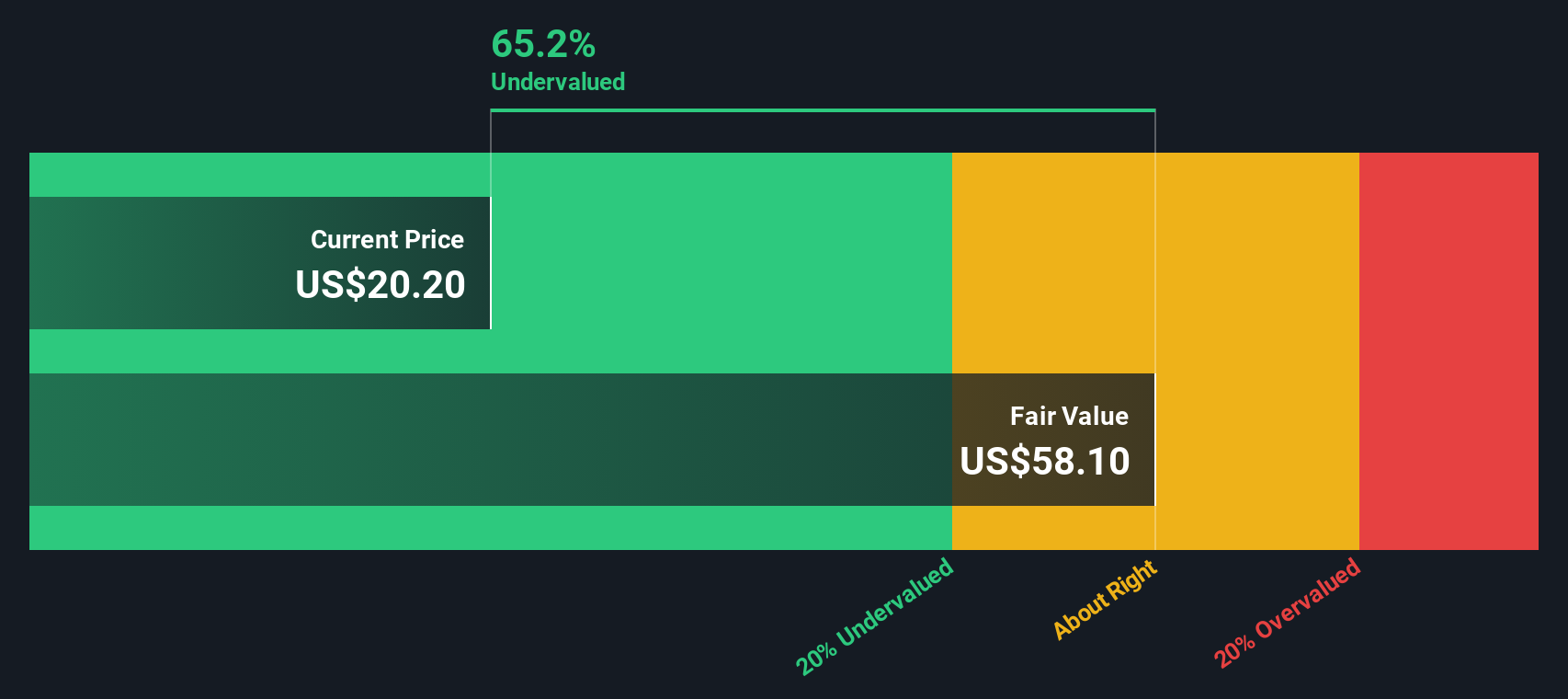

Based on these projections, the estimated intrinsic value per share for Simply Good Foods is $57.56. This value is significantly higher than the company’s current share price, which indicates the DCF model suggests the stock is trading at a 65.7% discount relative to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simply Good Foods is undervalued by 65.7%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Simply Good Foods Price vs Earnings

The Price-to-Earnings (PE) ratio is the most widely used valuation metric for profitable companies like Simply Good Foods. It helps investors judge how much they are paying for a dollar of company earnings, providing a simple reference for comparing stocks. PE ratios are especially meaningful for businesses with established earnings histories, as they reflect both current profitability and market sentiment.

It's important to remember that a "normal" or "fair" PE ratio depends on a company's growth prospects and risk profile. Companies with brighter growth outlooks or lower risks typically justify higher PE multiples, while slower-growing or riskier businesses often command lower ratios.

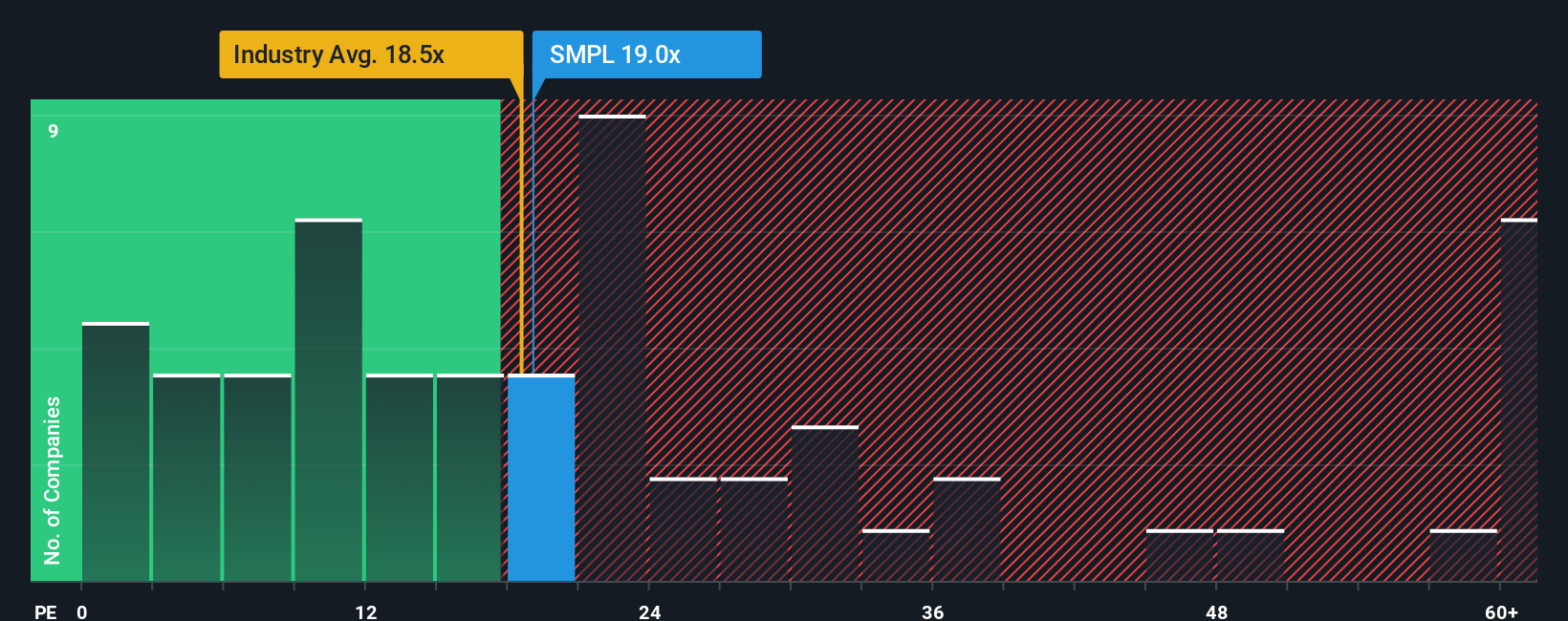

Currently, Simply Good Foods trades at a PE ratio of 19.0x. This is very close to both the peer group average of 19.3x and the food industry average of 20.9x. More notably, the proprietary Simply Wall St “Fair Ratio” for the company is calculated at 19.2x, which considers a broader spectrum of factors, including expected earnings growth, profit margins, market capitalization and risk characteristics.

The Fair Ratio stands out compared to traditional benchmarks because it blends general market expectations with company-specific realities such as earnings volatility, growth rate, margins and sector conditions, providing a more tailored valuation yardstick. By using the Fair Ratio, investors gain a better sense of whether Simply Good Foods is priced appropriately for its unique circumstances, rather than relying solely on rough comparisons.

Given that the company's current PE of 19.0x is nearly identical to the 19.2x Fair Ratio, Simply Good Foods appears to be trading in line with its fundamental value based on the preferred multiple approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Simply Good Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are an innovative, story-driven framework that lets you attach your own perspective to a company’s numbers. Essentially, you describe Simply Good Foods' future in your own words and connect that story directly to realistic financial forecasts and a personal estimate of fair value.

A Narrative links a company's journey, such as new product launches or expansion plans, to your projections for future revenue, earnings, and margins. It then automatically calculates what the business is worth based on those beliefs. This makes Narratives a uniquely accessible investing tool, available right now on Simply Wall St’s Community page, and already trusted by millions of investors.

Narratives empower you to decide when a stock might be a buy or sell. Once you've set your fair value, Simply Wall St will show you how it compares to today’s share price, making investment decisions quicker and more transparent. Since Narratives update dynamically as news, earnings, or forecasts change, you always have the most current view of your thesis reflected in the numbers.

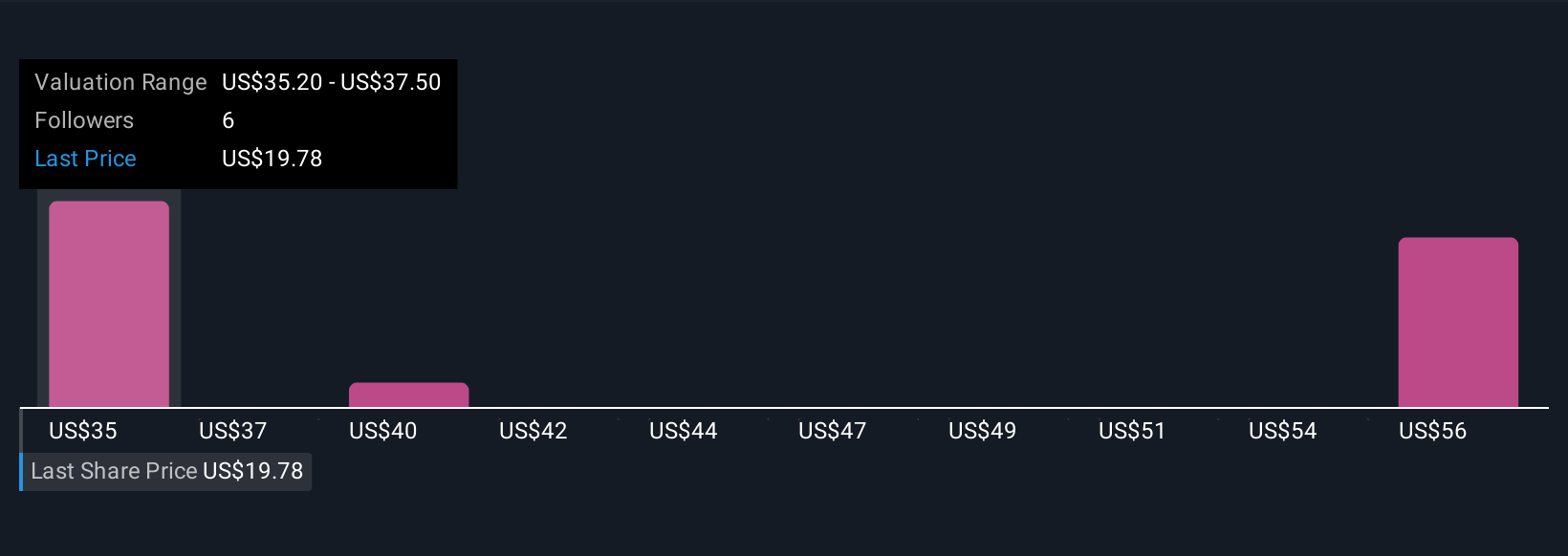

For example, some investors see bullish value in Simply Good Foods' margin expansion and product innovation, leading them to a price target near $43. Others are more cautious, aiming closer to $32 based on uncertainty around growth and integration risks. Which story fits your belief? Narratives make it easy to decide, track, and take action.

Do you think there's more to the story for Simply Good Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.