- United States

- /

- Beverage

- /

- NasdaqGS:MNST

The Bull Case For Monster Beverage (MNST) Could Change Following Record International Sales Growth

Reviewed by Sasha Jovanovic

- In the past week, Monster Beverage reported record quarterly figures, posting net sales, gross profit, operating income, and net income all at new highs, with revenue rising 16.8% year-on-year and international sales making up 43% of total net sales for the first time.

- This quarter's results mark the company's largest proportion of non-U.S. sales to date, signaling a significant shift toward greater global diversification.

- We'll explore how Monster Beverage's record international sales growth could shape the company's future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Monster Beverage Investment Narrative Recap

Monster Beverage’s investment appeal centers on continued global expansion, portfolio innovation, and the ability to sustain strong revenue growth beyond its core US market. The company’s latest results reinforce international sales as a catalyst, but margin risks stemming from rising input costs and a growing mix of lower-priced brands remain material for short-term performance and should be closely watched by shareholders.

Among recent announcements, the record-setting Q3 net sales and growing international share stand out the most, highlighting the effectiveness of Monster’s partnership with the Coca-Cola system in accelerating overseas distribution. This underscores the ongoing pivot toward non-US markets as a central driver, though the full impact on profit margins will depend on management’s ability to balance growth with pricing and cost pressures.

However, while the headlines are highly encouraging, investors should be aware that increasing global exposure brings new challenges, particularly if ...

Read the full narrative on Monster Beverage (it's free!)

Monster Beverage's narrative projects $9.8 billion revenue and $2.5 billion earnings by 2028. This requires 8.5% yearly revenue growth and a $0.9 billion earnings increase from $1.6 billion.

Uncover how Monster Beverage's forecasts yield a $72.23 fair value, a 5% downside to its current price.

Exploring Other Perspectives

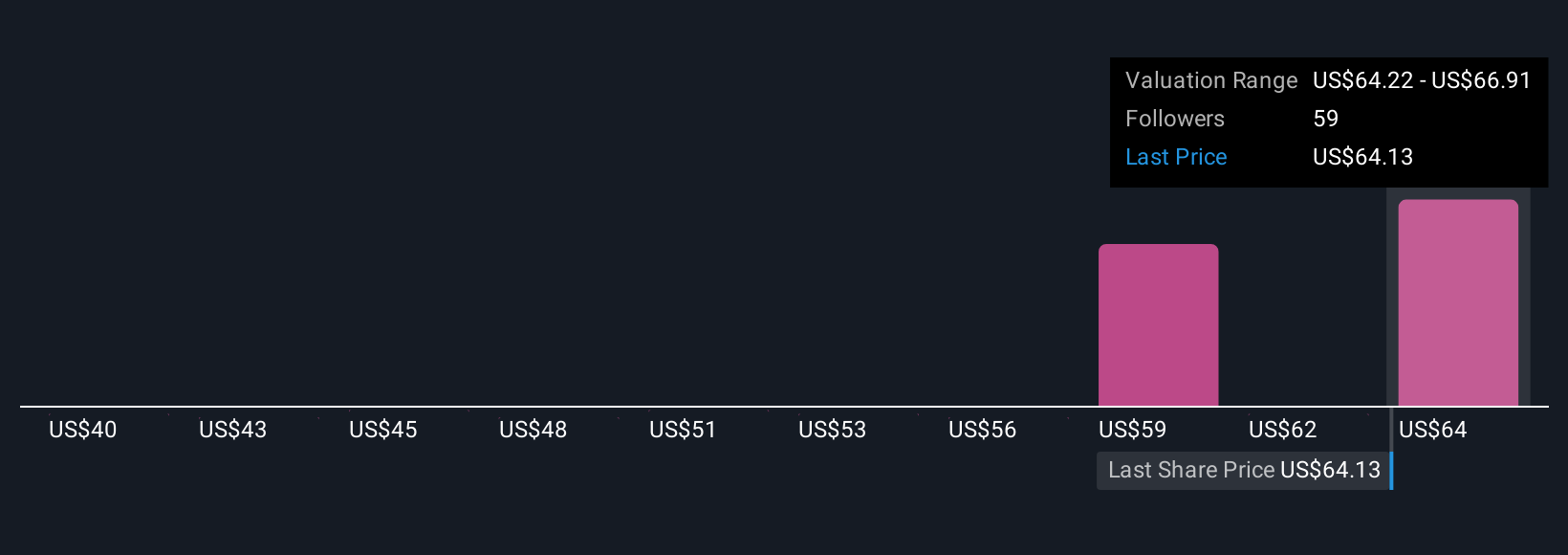

Four members of the Simply Wall St Community pegged Monster Beverage’s fair value between US$54.52 and US$72.23 per share. Despite strong international revenue growth acting as a catalyst, opinions on the company’s true worth differ widely, take a closer look at how diverse forecasts inform the debate.

Explore 4 other fair value estimates on Monster Beverage - why the stock might be worth as much as $72.23!

Build Your Own Monster Beverage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monster Beverage research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Monster Beverage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monster Beverage's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026