- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Mondelez International (NasdaqGS:MDLZ) Teams With Sargento For Real Cheese Cracker Line Launch

Reviewed by Simply Wall St

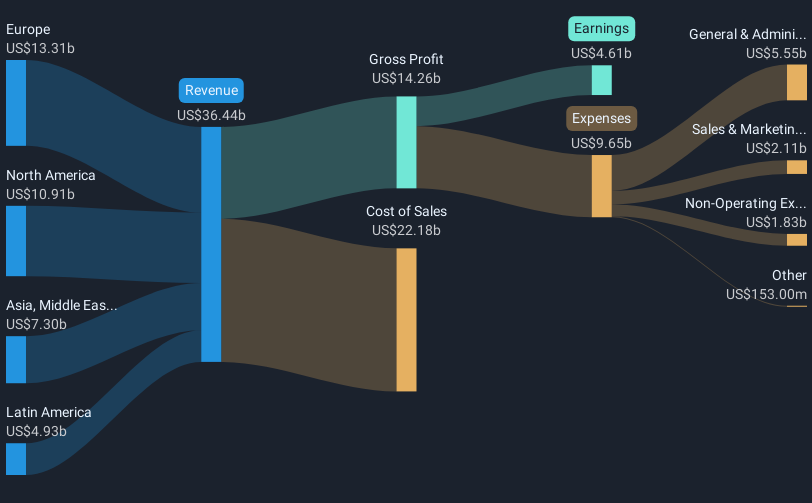

Mondelez International (NasdaqGS:MDLZ) experienced a notable price increase of 14% over the past month amidst several key developments. The company launched the Sargento® Cheese Bakes in collaboration with Sargento®, enriching its premium snack offerings, which may have attracted positive investor sentiment. Additionally, the announcement of strong Q4 2024 earnings, with sales and net income increases compared to the previous year, likely bolstered confidence in Mondelez's financial health. The company's updated guidance for 2025, indicating an organic net revenue growth expectation of 5%, also signals a solid outlook that could contribute to its share price appreciation. Meanwhile, the broader market faced a downturn, with the S&P 500 and Nasdaq declining amid tech stock slides, highlighting Mondelez's relative strength during a challenging period. The concurrent share buyback updates and dividend affirmation potentially added further support to its stock by drawing attention to shareholder value initiatives.

See the full analysis report here for a deeper understanding of Mondelez International.

Over five years, Mondelez International's shares achieved a total return of 34.14%, a testament to the company's strategic initiatives and market resilience. During this period, Mondelez introduced various innovative products, such as the Oreo Cakesters expansion into Canada and the launch of belVita Energy Snack Bites, both contributing to its appeal in the snack market. Furthermore, Mondelez's active share buyback program—repurchasing approximately 58.72 million shares for almost US$3.94 billion—highlighted its commitment to enhancing shareholder value, alongside consistently affirmed dividends.

Despite recent challenges, including a 1% decline in net profit margins, the company sustains a reliable financial strategy. Its recent partnership with Inter Miami CF, emphasizing community engagement, further strengthened its brand visibility. However, in comparison, Mondelez underperformed the broader U.S. market and food industry over the past year. The company remains focused on its earnings growth trajectory, despite current forecasts indicating a potential 1.2% per year decline in earnings over the next three years.

- Learn how Mondelez International's intrinsic value compares to its market price with our detailed valuation report.

- Gain insight into the risks facing Mondelez International and how they might influence its performance—click here to read more.

- Got skin in the game with Mondelez International? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives