- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz’s Lowered Outlook and Innovation Push Might Change the Case for Investing in KHC

Reviewed by Sasha Jovanovic

- In the past week, Kraft Heinz lowered its full-year outlook after posting third-quarter earnings where net income rose to US$615 million, but sales declined to US$6.24 billion compared to the previous year.

- Alongside financial results, Kraft Heinz announced new product launches and creative partnerships, such as a limited-edition Apple Pie flavored Kraft Mac & Cheese and a collaboration with Herschel Supply for HEINZ-branded travel accessories, highlighting the company's push for innovation and brand engagement despite pressures on its core markets.

- We'll explore how Kraft Heinz’s reduced earnings forecast and renewed focus on product innovation might influence its investment narrative and forward outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Kraft Heinz Investment Narrative Recap

To be a shareholder in Kraft Heinz right now, you need to believe that the company’s brand strength, global reach, and ongoing product innovation will be enough to offset declining sales in North America. Although the recent earnings update confirmed lower sales and a reduced full-year outlook, the headline risk, persistent volume declines in key markets, remains the most important near-term factor for the stock. The impact of new partnerships and product launches is interesting but does not materially change this short-term risk.

One of the most engaging recent announcements is the limited-edition Apple Pie flavored Kraft Mac & Cheese, released for the holiday season. This product, and other creative collaborations, signal Kraft Heinz's commitment to reinvigorating consumer interest through unique flavor launches, potentially supporting the broader catalyst of accelerating product innovation to drive incremental sales and improve margins.

By contrast, investors should be aware that while new product creativity draws attention, it does not eliminate the risk of ongoing weakness in core North American sales...

Read the full narrative on Kraft Heinz (it's free!)

Kraft Heinz's narrative projects $26.1 billion in revenue and $3.3 billion in earnings by 2028. This requires a 1.0% yearly revenue growth and a $8.6 billion increase in earnings from the current -$5.3 billion.

Uncover how Kraft Heinz's forecasts yield a $28.82 fair value, a 18% upside to its current price.

Exploring Other Perspectives

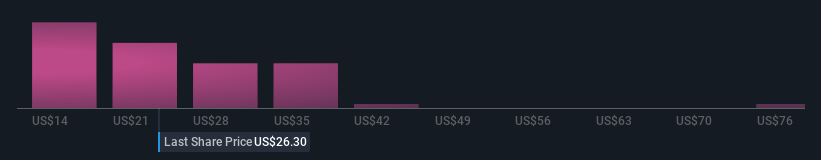

The Simply Wall St Community provided 21 fair value estimates, ranging widely from US$23.95 to nearly US$68.79 per share. With near-term profit challenges from core regions, explore these diverse individual viewpoints to understand how varying assumptions could affect Kraft Heinz’s future.

Explore 21 other fair value estimates on Kraft Heinz - why the stock might be worth just $23.95!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives