- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (KHC): Losses Have Grown 12.9% Annually, Profitability Forecast Within Three Years

Reviewed by Simply Wall St

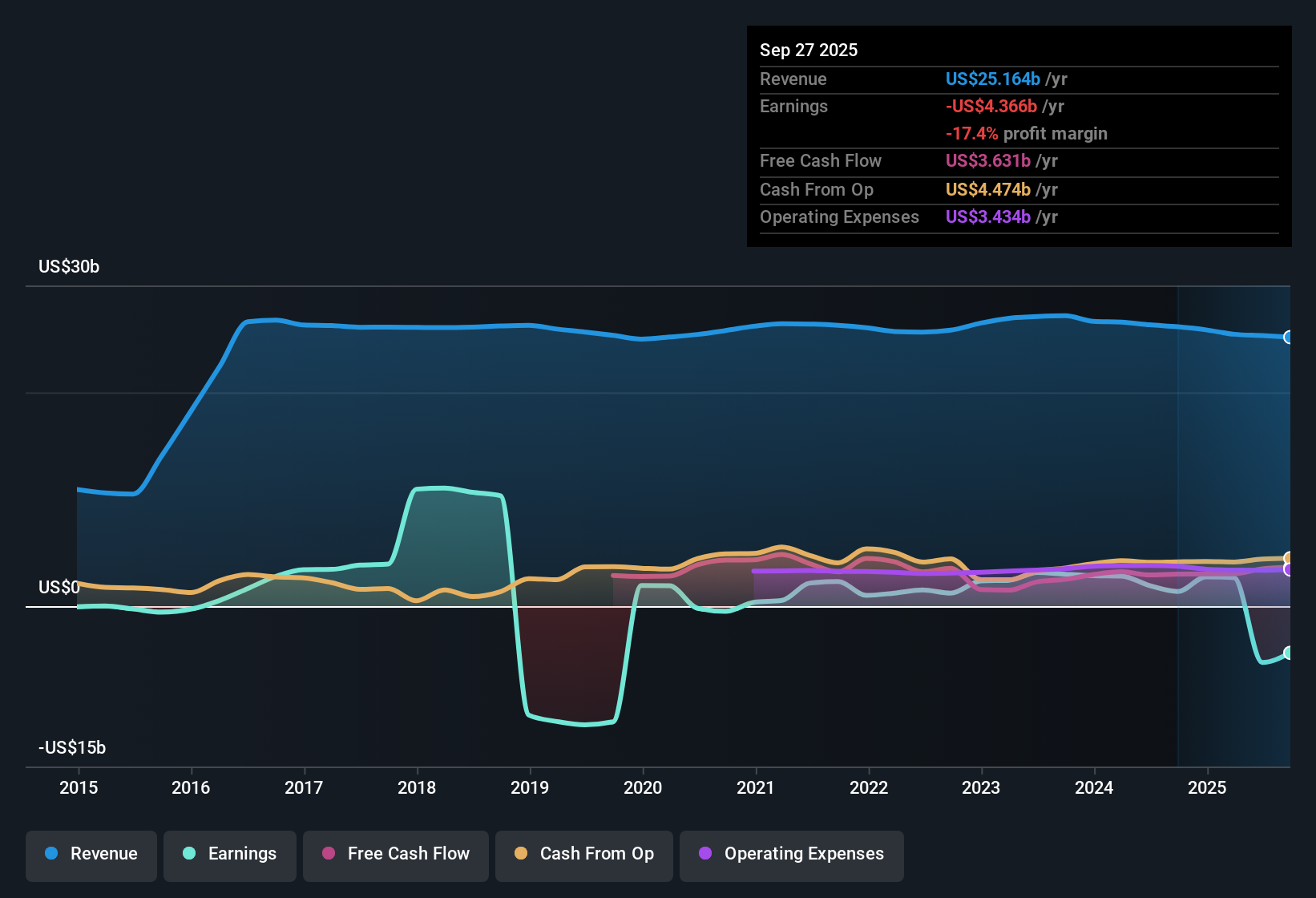

Kraft Heinz (KHC) remains unprofitable, with losses having increased at an average rate of 12.9% per year over the last five years. However, analysts project earnings to grow by 67.72% per year, with the company expected to turn profitable within the next three years. This pace outstrips the average market. Revenue is forecast to rise just 0.7% per year, trailing the US market’s 10.3%. The stock currently trades at $24.58, beneath the estimated fair value of $69.24, and its price-to-sales ratio of 1.2x sits above the industry average but below the peer group’s 1.8x. Investors will need to weigh these growth forecasts and low relative valuation against concerns about ongoing losses, financial stability, and the sustainability of Kraft Heinz’s dividend.

See our full analysis for Kraft Heinz.Next, we’ll see how these figures stack up when compared to the dominant narratives shaping investor expectations, testing whether the prevailing stories still hold up under the latest results.

See what the community is saying about Kraft Heinz

Margin Expansion Targets Raise the Stakes

- Analysts expect Kraft Heinz's profit margins to shift from -20.8% today to 12.5% within three years. This represents a dramatic turnaround that, if achieved, could reshape future profitability and the market narrative.

- According to analysts' consensus view, a key focus is on sustained investment in emerging markets and product innovation. Both factors are projected to support higher operating margins and improved earnings durability.

- Consensus notes that ongoing portfolio optimization, by moving out of low-margin categories and into high-margin brands, is seen as essential to sustaining this margin improvement. This aligns with the push toward long-term earnings stability.

- However, the risk remains that weak performance in core regions and continued cost pressures, particularly from above-inflation input costs, could undercut these margin targets and dampen the recovery.

- Curious how these ambitious forecasts match up with the big-picture outlook? See both sides in the full consensus narrative. 📊 Read the full Kraft Heinz Consensus Narrative.

Impairment Charges and Brand Value Risks

- The $9.3 billion non-cash impairment charge taken following a persistent decline in Kraft Heinz’s stock price indicates material concerns about the long-term value of its intangible assets and brand equity.

- Analysts' consensus view highlights that such a significant write-down raises red flags over stagnant or declining revenues and shareholder returns. This intensifies the debate around whether recent strategic moves can protect, or even restore, the company’s market position.

- Critics point to persistent North America retail volume declines, which management itself flagged as a gating factor for overall growth. This suggests further erosion in brand power could pressure cash flows for some time yet.

- On the flip side, consensus notes that if new innovations can drive premium pricing and win back market share, then eventual brand value recovery could outpace these recent impairments. For now, however, risks clearly dominate discussion.

Deep Discount vs. Peers and Fair Value

- Kraft Heinz’s current share price of $24.58 is well below both the analyst consensus price target of $27.13 and the DCF fair value of $69.24. Its price-to-sales ratio of 1.2x is higher than the US food industry average of 0.9x, but below the peer group at 1.8x.

- Analysts' consensus view underlines the tension. While the market is discounting Kraft Heinz’s challenges around profitability and growth execution, the lower entry price could be an opportunity if you believe forecasted earnings growth, margin expansion, and portfolio improvements will materialize in the years ahead.

- The consensus acknowledges disagreement among analysts, with price targets spreading from $27.00 to $51.00. This underscores that the long-term recovery story is far from universally accepted.

- Current valuations may attract investors hunting for turnaround stories, but the extended gap to DCF fair value signals a need for caution until financial stability is visibly restored.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kraft Heinz on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something else in the results? Take just a few minutes to build your own story and add your perspective to the conversation. Do it your way

A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Kraft Heinz faces ongoing losses, weak core market performance, and questions over its ability to sustain profitability and financial health.

If you want stocks with stronger balance sheets and less uncertainty, check out solid balance sheet and fundamentals stocks screener (1981 results) for companies built to weather the next downturn.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives