- United States

- /

- Food

- /

- NasdaqGS:JJSF

J&J Snack Foods (JJSF): Evaluating Valuation Following Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

See our latest analysis for J&J Snack Foods.

J&J Snack Foods’ share price has lost momentum, sliding nearly 38% year-to-date and posting a one-year total shareholder return of -41%. While there has been steady operational progress in the background, the market’s recent retreat signals investors are still waiting for clearer signs of a turnaround or growth catalyst before jumping back in.

If you are keeping an eye on changing market sentiment, this could be a smart time to expand your watchlist and discover fast growing stocks with high insider ownership

With the stock trading at a sizable discount to analyst targets and recent operational gains, investors must ask whether J&J Snack Foods is undervalued or if the current price already reflects all foreseeable growth potential.

Most Popular Narrative: 29.9% Undervalued

J&J Snack Foods’ most widely followed fair value estimate is $136, setting it meaningfully above the last close of $95.36. This gap is driving a surge of interest in the company’s future potential and what may be fueling analysts’ projections.

*Operational improvements through supply chain optimization, automation, and facility consolidation (for example, shifting handhelds production to a more efficient plant and reducing distribution/freight costs) are expected to drive higher net margins and earnings over time. Ongoing product innovation and the expansion of better-for-you offerings, such as high-protein and whole-grain items, clean label novelties, and the removal of artificial colors, expands the accessible market and aligns with evolving consumer preferences, paving the way for sustained top-line growth.*

Want to know what powers such a bullish outlook? The heart of this narrative is bold operational shifts and a financial forecast that bucks industry convention. Think higher margins, game-changing revenue moves, and profit targets that would surprise most snack food investors. Curious which numbers make the narrative possible? Don’t miss the details that drive this headline valuation.

Result: Fair Value of $136 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing ingredient cost inflation and weak retail segment sales could quickly test the strength of even the most optimistic forecasts for J&J Snack Foods.

Find out about the key risks to this J&J Snack Foods narrative.

Another View: Market Multiples Tell a Different Story

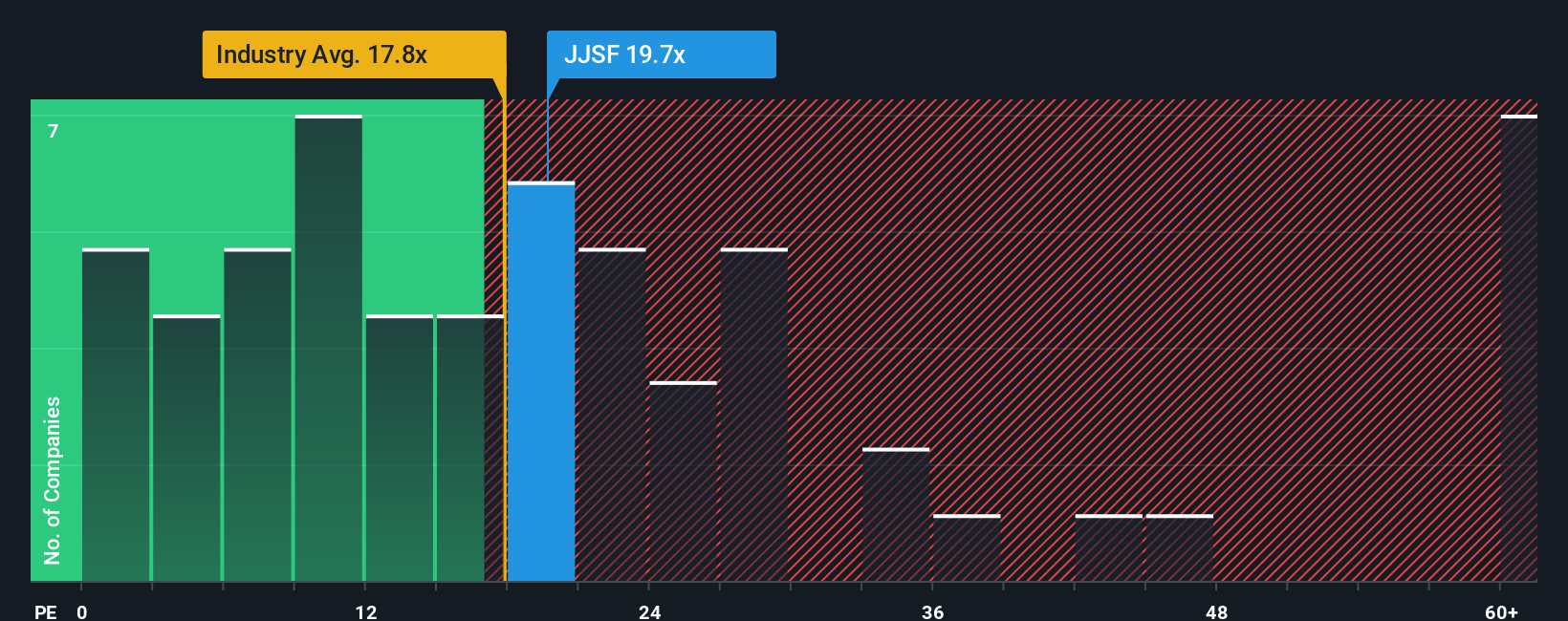

Looking through the lens of price-to-earnings ratios delivers a more cautious perspective. J&J Snack Foods trades at 22.1 times earnings, higher than the industry average of 17.8, and well above its own fair ratio estimate of 15.1. This signals the market is demanding a premium, which introduces valuation risk if performance disappoints. Could this premium persist, or is there room for a correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J&J Snack Foods Narrative

If you want a different perspective or enjoy hands-on research, you can dive into the data and craft your own story in just minutes with Do it your way.

A great starting point for your J&J Snack Foods research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

The best opportunities are often beyond the obvious. Keep your portfolio one step ahead by acting on fresh trends and themes using Simply Wall Street’s powerful tools.

- Capitalize on stable income streams and inflation protection by checking out these 19 dividend stocks with yields > 3%, which offers yields over 3% and robust financial health.

- Break into artificial intelligence with these 26 AI penny stocks, now shaping entire industries with disruptive algorithms and real-world innovations.

- Tap into breakthrough computing by targeting these 26 quantum computing stocks, where game-changing growth potential could redefine technology’s future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JJSF

J&J Snack Foods

Manufactures, markets, and distributes nutritional snack food and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives