- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

A Fresh Look at Uranium Energy (UEC) Valuation After Recent Price Pullback

Reviewed by Simply Wall St

Uranium Energy (UEC) stock has seen some movement recently, with shares pulling back even though the company has delivered a strong overall return over the past 3 months. Investors may be wondering how this recent performance aligns with the company’s long-term story.

See our latest analysis for Uranium Energy.

Despite a sharp pullback over the past week, Uranium Energy has shown impressive momentum this year, with a 60.1% year-to-date share price return and a stellar 1-year total shareholder return of 53.85%. After such a strong run, the recent dip appears more like a breather within a much bigger growth story. This suggests sentiment is shifting; however, the broader upward trend remains intact.

If you’re curious about what else investors are watching in today’s market, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a discount to analyst targets despite strong returns, investors are left questioning if Uranium Energy is undervalued or if the recent gains reflect future growth that has already been priced in.

Price-to-Book of 6x: Is it justified?

Uranium Energy shares are currently trading at a price-to-book (P/B) ratio of 6x, which makes the stock appear expensive relative to both industry peers and broader market norms. The last close was $12.20.

The price-to-book ratio compares a company’s market valuation to its book value and essentially measures how much investors are willing to pay for each dollar of assets. In sectors like oil and gas, where asset values can be substantial, the P/B ratio often helps investors judge value versus tangible resources.

At 6x, Uranium Energy’s P/B ratio is noticeably higher than the US Oil and Gas industry average of 1.3x as well as the peer group average of 4.7x. This premium valuation suggests investors expect significantly accelerated growth or unique company advantages. However, with the company currently unprofitable and below industry benchmarks, the justification for this premium is questionable.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6x (OVERVALUED)

However, weak profitability and a steep premium to industry averages could lead to further volatility if growth experiences any setbacks.

Find out about the key risks to this Uranium Energy narrative.

Another View: Discounted Cash Flow

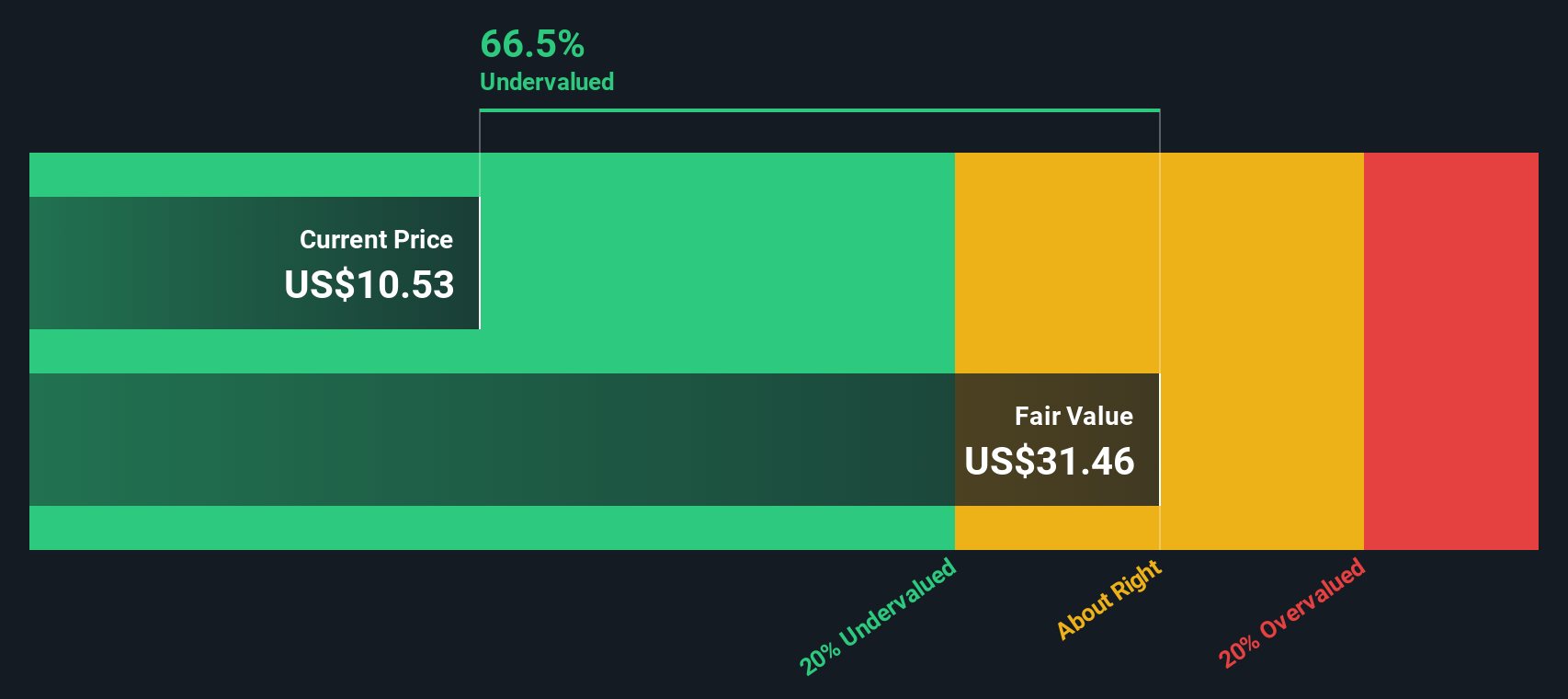

Looking beyond the price-to-book ratio, the SWS DCF model offers a different take. According to this approach, Uranium Energy is trading about 10% below its estimated fair value, which suggests potential upside. Could this signal a hidden value that the market has yet to recognize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes, Do it your way

A great starting point for your Uranium Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by tapping into opportunities beyond Uranium Energy. Don’t let today’s big ideas slip by when you could be shaping your portfolio’s future right now.

- Capitalize on technology’s breakthrough trends and uncover potential with these 25 AI penny stocks, which is at the forefront of innovation and artificial intelligence.

- Unlock attractive yields and find companies built on sustainable payouts with these 16 dividend stocks with yields > 3%, offering resilient income potential.

- Get ahead of the curve by seizing emerging shifts in quantum computing. Start your search with these 28 quantum computing stocks, which is riding the next wave of disruptive tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives