- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Does Williams (WMB) Securing NESE Permits Reshape the Investment Outlook for Its Natural Gas Strategy?

Reviewed by Sasha Jovanovic

- Williams Companies recently announced it has secured Clean Water Act permits from both New Jersey and New York for its Northeast Supply Enhancement project, a major regulatory milestone enabling advancement of crucial natural gas infrastructure for New York City.

- This achievement is expected to unlock over US$1 billion in investment, create thousands of construction-related jobs, and support significant emissions reductions by shifting from fuel oil to natural gas in one of the nation’s largest energy markets.

- Let’s examine how overcoming permitting hurdles for the NESE project could influence Williams Companies’ investment outlook moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Williams Companies Investment Narrative Recap

To be a shareholder in Williams Companies, you need to believe that large-scale expansion of natural gas infrastructure will remain essential despite rising policy and decarbonization pressures. The recent permitting breakthrough for the NESE project addresses a key short-term catalyst, infrastructure growth in highly regulated regions, though ongoing regulatory risks and project execution hurdles remain significant concerns for near-term outcomes.

Williams’ third-quarter earnings announcement, released just days before the permit news, highlighted strong year-to-date revenue and net income growth compared to the prior year. This performance links closely to the company’s ongoing expansion and its ability to translate new project approvals, like NESE, into tangible financial results, but regulatory setbacks and rising construction costs could still weigh on future returns.

However, the persistent risk of future permitting delays, even after recent wins, remains a factor investors should be aware of if...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' outlook anticipates $14.5 billion in revenue and $3.3 billion in earnings by 2028. This implies an annual revenue growth rate of 8.6% and a $0.9 billion increase in earnings from the current $2.4 billion.

Uncover how Williams Companies' forecasts yield a $67.46 fair value, a 11% upside to its current price.

Exploring Other Perspectives

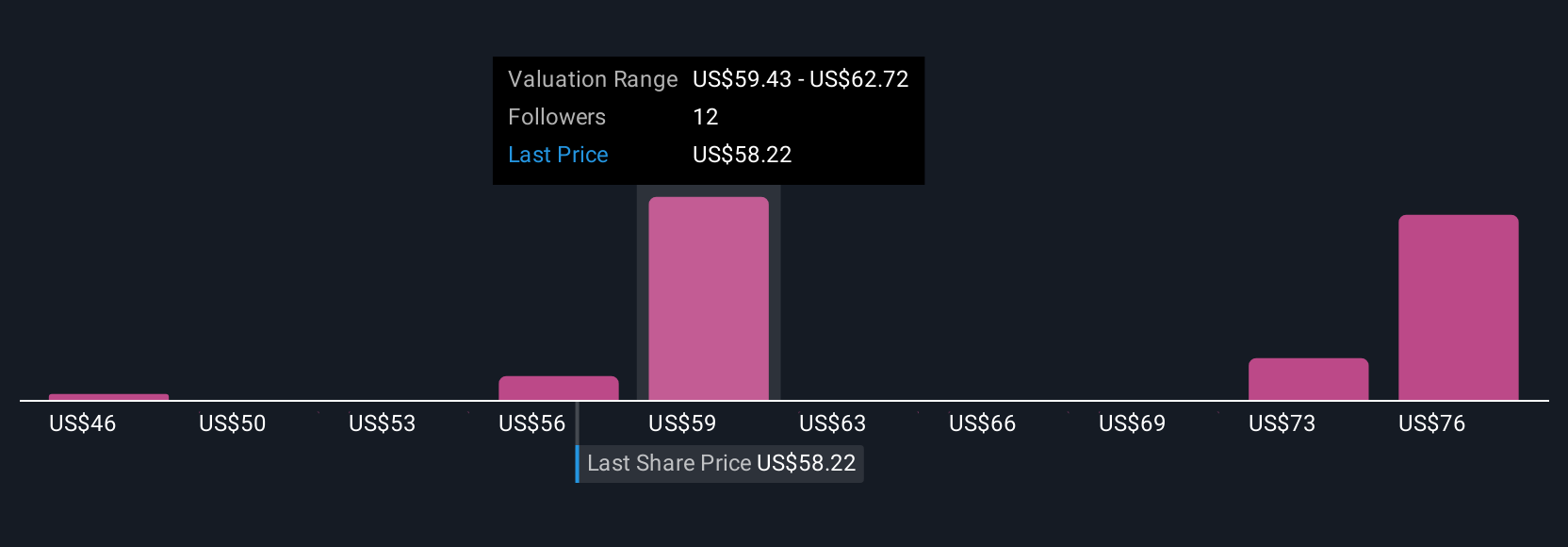

Six members of the Simply Wall St Community estimate fair value for Williams between US$49.47 and US$79.85 per share. While many expect expansion projects to boost earnings, policy and permitting volatility could affect these outcomes; you will want to compare these different viewpoints for yourself.

Explore 6 other fair value estimates on Williams Companies - why the stock might be worth 19% less than the current price!

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives