- United States

- /

- Oil and Gas

- /

- NYSE:WKC

Enhanced Credit Facility Might Change the Case for Investing in World Kinect (WKC)

Reviewed by Sasha Jovanovic

- World Kinect Corporation recently announced the amendment and extension of its US$2 billion senior unsecured credit facility, comprising both revolving and term loan components, with the maturity now extended to November 2030 and an option for further extension to 2031.

- This revised facility introduces improved pricing terms and expanded covenant flexibility, which are expected to support the company's future capital allocation and growth initiatives.

- We’ll explore how the enhanced credit facility flexibility could influence World Kinect’s financial positioning and investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

World Kinect Investment Narrative Recap

To be a shareholder in World Kinect, you'd need to believe in the company's ability to transform its portfolio toward higher-margin, growth-oriented energy solutions and improve its profitability despite recent headwinds. The news of the amended and extended US$2 billion credit facility strengthens near-term financial flexibility, but does not materially shift the most pressing short term catalyst: the need to stabilize earnings amid ongoing revenue declines, nor does it remove the greatest near-term risk, margin compression as legacy businesses are reduced.

Among recent company actions, the multi-year partnership with easyJet and ATOBA Energy for sustainable aviation fuel stands out, as it ties directly to World Kinect’s efforts to access new, higher-growth markets and lessen reliance on its mature core fuels business. Healthy liquidity from the new facility could support further moves in this direction, though building momentum in renewables remains closely tied to how quickly and profitably the company can scale these ventures.

Yet, against this more flexible credit backdrop, investors should be keenly aware of the continued threat posed by...

Read the full narrative on World Kinect (it's free!)

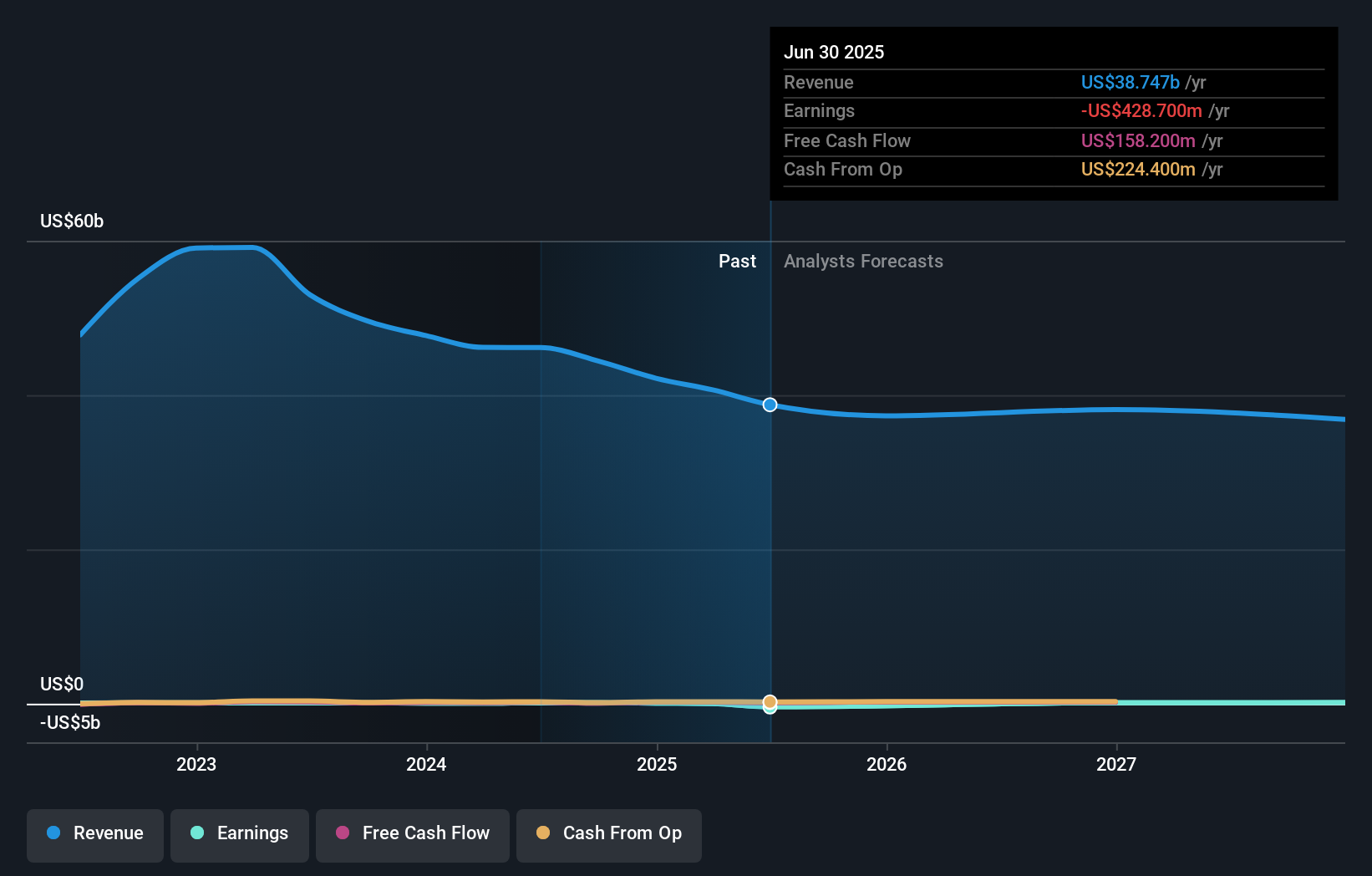

World Kinect's outlook anticipates $37.1 billion in revenue and $330.9 million in earnings by 2028. This is based on a yearly revenue decline of 1.5% and an earnings increase of $759.6 million from the current earnings of $-428.7 million.

Uncover how World Kinect's forecasts yield a $28.33 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community estimate World Kinect’s fair value between US$28.33 and US$41.10, drawing from just two sharply distinct viewpoints. While optimism around the company’s liquidity is rising, margin pressures in core segments remain a persistent concern for future performance, explore how various perspectives weigh these competing factors.

Explore 2 other fair value estimates on World Kinect - why the stock might be worth just $28.33!

Build Your Own World Kinect Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your World Kinect research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free World Kinect research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate World Kinect's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives