- United States

- /

- Energy Services

- /

- NYSE:WHD

Is Strong International Growth Offsetting Core Headwinds for Cactus (WHD)?

Reviewed by Sasha Jovanovic

- In the past week, Cactus, Inc. reported third-quarter 2025 adjusted earnings of 67 cents per share, surpassing analyst estimates despite a year-over-year decrease, supported by reduced legal expenses and rising international sales in the Spoolable Technologies segment.

- An important insight from this announcement is that Cactus managed to outperform expectations even while experiencing offsetting lower activity levels in its core business.

- We'll now explore how the strong performance in international sales may influence Cactus's investment outlook going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cactus Investment Narrative Recap

At its core, being a Cactus, Inc. shareholder means believing in the long-term demand for oilfield equipment and the company's ability to expand internationally, even as U.S. drilling activity shows signs of stagnation. The recent earnings beat, driven by lower legal costs and strong international sales, has not materially changed the short-term catalyst, which remains the integration and execution of the Surface Pressure Control acquisition. Meanwhile, the biggest risk continues to be persistent weakness in U.S. land drilling activity, which could further pressure core revenue streams. A relevant recent announcement is the formation of a joint venture with Baker Hughes, giving Cactus a controlling stake in a business focused on surface pressure control equipment. This event stands out because it directly supports the ongoing catalyst, broadening the company's footprint in international markets and positioning it to benefit from future energy infrastructure investment, even if domestic activity remains flat. On the other hand, investors should be aware that ongoing softness in U.S. drilling activity continues to cast a shadow over...

Read the full narrative on Cactus (it's free!)

Cactus' outlook projects $1.7 billion in revenue and $232.7 million in earnings by 2028. This is based on a 15.3% annual revenue growth rate and a $51.5 million increase in earnings from the current $181.2 million level.

Uncover how Cactus' forecasts yield a $48.62 fair value, a 12% upside to its current price.

Exploring Other Perspectives

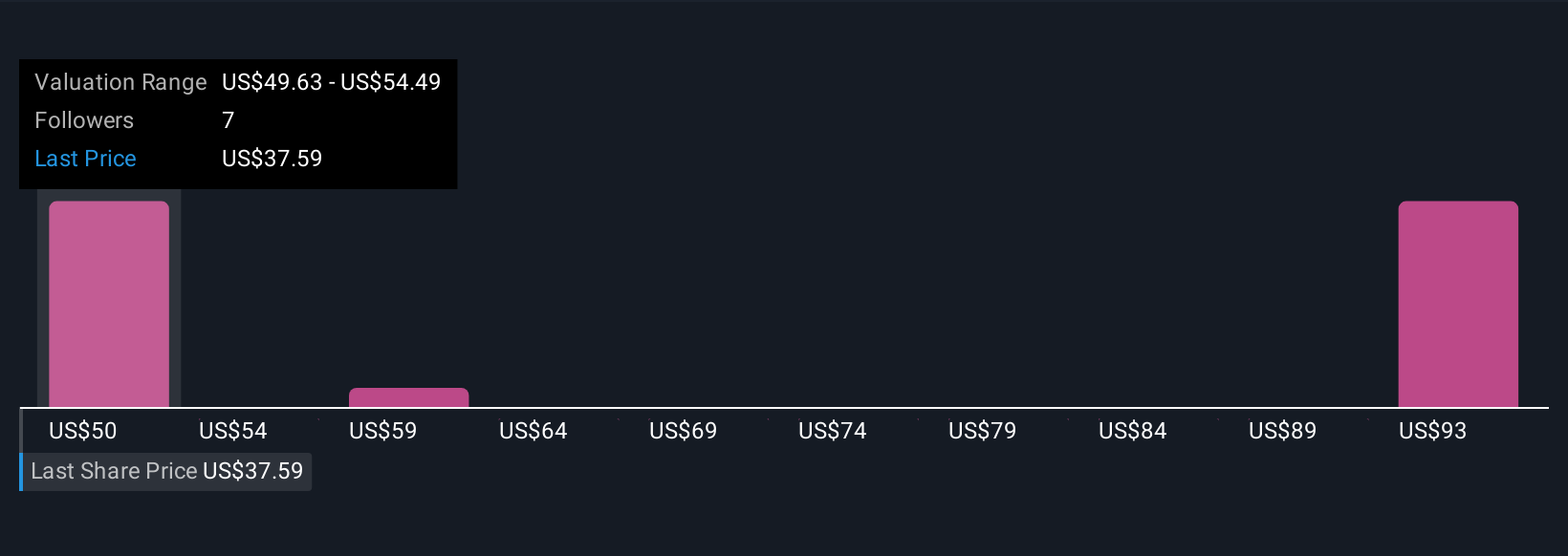

You’ll find three unique fair value estimates from the Simply Wall St Community, stretching between US$48.63 and US$80.49 per share. Looking ahead, the company's exposure to prolonged weakness in U.S. drilling presents a key challenge worthy of consideration by anyone reviewing these varied viewpoints.

Explore 3 other fair value estimates on Cactus - why the stock might be worth just $48.62!

Build Your Own Cactus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cactus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cactus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cactus' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHD

Cactus

Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026